There's one eensy number that every pro trader checks out when they're doing their "homework" before picking a trade.

They clean up on those trades, and now, so will you...

You see, we know that the options on the stocks that have a $0.05 or less bid/ask spread, like you find on the CBOE Penny Pilot list, give you the best chance at making the most money on the smallest price moves.

And we know that picking an option with the lowest "percent to double" gives you an easy shot at doubling your money when you want that to happen.

But now I want to show you how to use one number to pick the options that will move in your favor when the stock you're trading moves in price before you enter the trade.

This number is always between -1.00 and 1.00. Oddly enough, plenty of casual traders never consider using it, so they miss out on some big profits. Maybe that's because it has a funny-sounding Greek name...

This Algebra Is Scary (but You'll Never Have to Use It)

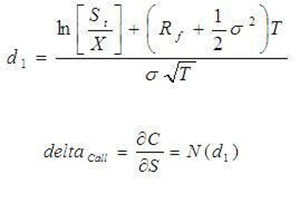

There's a rather complicated equation to solve to figure out how much your option will move in relation to the underlying share price.

It goes like this...

Looks horrible, right?

Well, the good news is you don't have to worry about it (unless you really like algebra), because your brokerage and even a few free websites - like the Chicago Board Options Exchange (CBOE) - will solve that equation for you and present you with a nice, neat, small, manageable number - a number we call "delta" (δ)

Delta (δ) is one of the options "Greeks" that determine an option's risk, and therefore its premium or value. It is considered by many, including myself, to be the most important component of an option.

Delta (δ) can be used in a couple of different ways when you're trading options. I'll show you the single most useful way to use it - and why it's really helpful in determining just which option to buy.

Here's Everything Delta (δ) Can Tell You

In simple terms, delta (δ) is a numerical value given to each option that shows how much that option's premium will move with the next $1 move in the stock.

Delta is either a positive number (for calls) or a negative number (for puts). Call options will have a value of anywhere from 0 to 1.00, while put options have a value anywhere from -1.00 up to 0.

Now, every once in a while, you'll see delta (δ) expressed as a percentage, in which case it will range from -100.00% to 100.00%, but that's no biggie. It means the same thing.

Here's a quick example: take a stock trading at $50 with a call option that has a delta of .60.

That means when the stock goes $1.00 higher, that call option should go up $0.60 in price on the delta component alone. On one contract, that means an increase of $60, since one contract grants control of 100 shares.

With a put, take that same stock at $50. If you look at a put option that has a -0.60 delta, that means when the stock drops in price by $1.00, the put option price, on the delta component alone, should go up $0.60, or $60 per contract.

Mind you, the delta will work against you by that same amount should the stock move against you. For example, if you have a call option with a 0.60 delta and the stock drops $1.00, that call option should drop that 0.60, or $60 on the contract.

The delta value of an option plays an outsized role in determining that option's profitability. An option's "moneyness" (that is, whether it's in the money, at the money, or out of the money) directly impacts the delta value.

More specifically, the delta tells you the probability of the option ending up in the money at expiration.

Here's what I mean...

The highest delta you can get on an option is 1.00. An option with a delta of 1.00 is pretty much the closest thing you have to a 100% chance of the option ending up in the money.

At the money options typically have a delta of .50, meaning it has a 50% chance of being in the money at expiration... Of course, that means there is a 50% chance it ends up out of the money as well.

I feel if I start out in the money, I should end up there, and the intent is to have it end up even further in the money. If I start out on an option with a delta (δ) of .70 and it increases, moving closer to 1.00, my option should be increasing in price at an accelerated rate.

Delta (δ) Has Even More Uses for Traders

But you can also use delta (δ) to establish a reasonable expectation of the option's price movement in relation to a $1.00 move up or down in the stock.

Here's a quick example using Microsoft Corp. (Nasdaq: MSFT) at a closing stock price of $57.46 on Aug. 31, 2016.

These MSFT options have a delta of 84.80%, or .848. The option premium is $8.10, so how many .848 moves will it take to make another $8.10 and double your money? Roughly 10. So just off the delta alone, you can guestimate a 10-point move higher should get a double on the option, right?

![]()

![]()

There are two potential spoilers: The option's time decay, or theta (θ), and/or its implied volatility, or vega (ν). Incidentally, that's the Greek letter nu, but it kind of looks like a Latin "v," so in finance we call it "vega."

Many things affect these factors and the pricing of options. Each day that goes by and each change in the price of the underlying changes the dynamics of how an option is priced.

Another thing to keep in mind is the rate of change in the delta, which is represented by the gamma (γ). It shows how much the delta (δ) number changes with each dollar move in the stock. If the gamma (γ) is 0.05, that means the delta (δ) should increase by $0.05 for every dollar move.

A positive gamma (γ), and a higher one at that, means the option could double faster than a six-point upwards price move in the stock.

The delta will increase as the stock moves in your desired direction. The higher the delta, the closer the option will track the stock.

You Can Use This to Protect Your Capital, Too

This is important because if you start out with the purchase of an out of the money option with a delta of .25, that means there is only a 25% chance this ends up in the money. When the option's "moneyness" moves from out of the money to in the money, the option should be increasing in value.

On my straight directional options trades, I like to look for an in-the-money option with a higher delta in the sweet spot of .70 to .75.

I want the underlying stock to move within 30 days. Because I need the stock to move quickly, and I want to make a higher amount of money on each dollar move in my direction, the in-the-money options with the higher delta pay out better than those that are out of the money when things work.

They also allow me to protect my capital because I am able to recoup more of my option premium in the event the stock trades flat.

Check Out Tom's Brand-New Way to Make (Fast) Money

Ever since we introduced Tom's new method, readers have been clamoring to get in on these fast-moving trades. When the best recommendations turn into total profits like 277% in four trading days, 269% in four trading days, and 297% in 24 hours, that's no surprise. Now Tom's agreed to take a few more people under his wing before summer ends. To see his special commitment to your success, start right here.

Follow Tom on Facebook and Twitter.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.