Can you identify this line off the top of your head?

I'll give you a hint: It hasn't been this high since the 2008 crisis.

And it spells disaster.

Here's why.

When This Line Hits 1%, the Credit Markets Are in Deep Trouble

Commodity markets remain a problem for the global economy as confirmed by Standard & Poor's tally of what it calls the "weakest links" in corporate credit. According to S&P, global "weakest links" hit their highest level in August since the height of the financial crisis in October 2009. "Weakest links" are companies rated B- or lower with either negative rating outlooks or ratings on CreditWatch with negative implications. This number reached 251 in August, representing $359 billion in corporate debt compared with a high of 264 in October 2009. The oil and gas sector accounted for 62 of these companies, followed by 34 financial institutions as the second-largest sector.

Commodity markets remain a problem for the global economy as confirmed by Standard & Poor's tally of what it calls the "weakest links" in corporate credit. According to S&P, global "weakest links" hit their highest level in August since the height of the financial crisis in October 2009. "Weakest links" are companies rated B- or lower with either negative rating outlooks or ratings on CreditWatch with negative implications. This number reached 251 in August, representing $359 billion in corporate debt compared with a high of 264 in October 2009. The oil and gas sector accounted for 62 of these companies, followed by 34 financial institutions as the second-largest sector.

While some point to the dominant role played by energy and other commodity issuers in these statistics to downplay global economic struggles, overall corporate credit quality remains weak but disguised by low interest rates. The corporate bond market will not react well when/if the Fed raises interest rates by another 25 basis points. Investors chasing yield in all the wrong places (i.e., the high-yield bond market) are going to regret their refusal to acknowledge the lessons of history and economics (which teach us that reaching for yield is a fool's game).

Get Our Best Wealth-Building Ideas: Money Morning's top 5 investment reports to grow your money like never before are right here - and they're absolutely free. Read more...

Unlike equity markets, which are overvalued but not dangerously so, credit markets are in an epic bubble that threatens to inflict major pain on investors. While it is entirely possible that U.S. yields will follow those in the rest of the world into the gates of negative interest rate Hell, they will sooner or later rise as the Biblical flood of money unleashed by global central banks looks for places to nest.

Risk/reward in the credit markets is as poor as I've ever seen it in three decades, and that extends beyond the fixed income market to Business Development Companies (BDCs), publicly traded private-equity firms (APO, KKR, BX, etc.), and anything else dependent on cheap credit. The edifice of leveraged finance constructed on the back of the massive Ponzi game perpetrated by governments and central banks is built on a foundation of sand. Defaults are rising but still suppressed by low interest rates, which allow companies incapable of generating free cash flow to stay alive longer than they deserve. (If you're interested in profiting off some of these disasters, I recommend buying puts on large high-yield ETFs like the iShares iBoxx High-Yield Corp Bond ETF (NYSE Arca: HYG) and the SPDR Barclays Capital High-Yield Bond ETF (NYSE Arca: JNK).

Corporate credit quality is deteriorating not only among junk borrowers, but also among investment-grade companies that borrowed tens of billions of dollars to pay dividends and buy back overvalued shares. While the inability to earn a decent return on capital in fixed-income markets poses enormous challenges for investors, outright losses are far more dangerous. And that is what they are facing if rates rise even modestly.

And rates are definitely headed up... as this often-overlooked indicator tells us.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

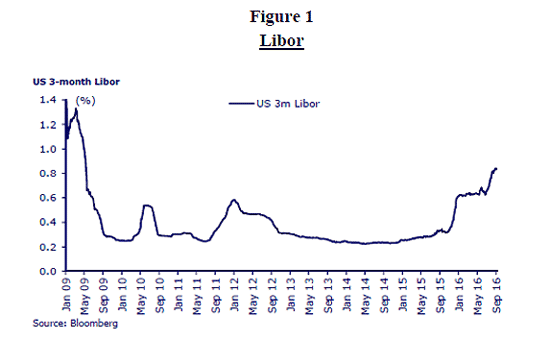

U.S. three-month LIBOR (London Interbank Offered Rate, the most commonly used benchmark for calculating short-term interest rates) has recently risen to roughly 80 basis points after remaining at one side or the other of 30 basis points since the financial crisis. This move is being chalked up to technical factors (new money market regulations), but that's not the case at all.

LIBOR is an uncannily accurate thermometer that measures the banking industry's health: In a nutshell, low rates mean banks are doing well, while higher rates indicate reduced public confidence and a struggling industry. LIBOR remains an incredibly important global benchmark and its rise will meaningfully increase borrowing costs across the global economy. The move isn't large enough yet to affect the leveraged loan market, but is getting close (LIBOR needs to hit 1% to start having an impact).

This move goes largely unnoticed by investors while they freak out at the mere whisper of a possible 25-basis-point hike in the federal funds rate. This is another example of everyone looking in one direction and getting blindsided by something coming from the other direction.

Rising LIBOR is a sign of things to come. The only way rates can remain where they are is if the global economy keeps struggling, but that scenario is inconsistent with buoyant equity markets.

This Is the Best "Retirement Stock" of 2016... And the good news is, it's trading for "pennies." But it won't be for long... its revenue is set to surge 4,709%. Learn the details of this $5 stock today while it's still "on sale." Read more...

Follow Money Morning on Facebook and Twitter.

About the Author

Prominent money manager. Has built top-ranked credit and hedge funds, managed billions for institutional and high-net-worth clients. 29-year career.