Late in the summer of 2016, I predicted that crude oil prices would be in the mid-$50s by the end of 2016, and the low $60s by the first quarter of 2017.

And at the start of the week of Dec. 12, 2016, West Texas Intermediate sits at just under $54. Frankly, I'm not seeing anything in the market that would force me to revise my forecast right now.

But make no mistake: There is a change underway right now that will only accelerate in 2017. The "rising tide" of crude prices will not "lift all boats" equally. I'm predicting that investors will see some big shifts in the oil markets and where their profits come from.

You see, the source of global oil demand itself is refocusing, and that's where we'll see the biggest changes.

Some players will lose out: The traditional high-dividend "supermajors" - BP, Chevron, ExxonMobil, Royal Dutch Shell, Total SA, Eni, and ConocoPhillips - will see their long-term viability and short-term profitability severely challenged.

But nimble, globally oriented oil investors could see some of their biggest profits yet in 2017 from the places I'm about to show you...

Big Oil Serves Up Dividends Now, Disappointment Later

The case for investing in oil supermajors has always been their high dividends and the low chance that they would be lowered any time soon.

"After all," the thinking went, "demand for oil isn't going anywhere, so these companies will keep making money forever, right?"

That's the theory.

But in practice, the oil supermajors have for years been interested only in extremely expensive megaprojects that take years to finish and often only make sense when oil is close to $100 per barrel.

Just look at Canada's oil sands, deepwater offshore oil in Latin America, Shell's repeated attempts to drill for oil in the Arctic, or Exxon's attempt to get in on Russian oil fields.

To make matters worse, Big Oil has a horrible track record of actually finishing these projects.

As Chevron itself admitted in May, between 2007 and 2014, only 8% of the supermajors' projects ran on time, stayed on budget, and achieved the production target.

Just 8%.

And then, of course, came the 2014 oil crash, when prices ultimately plunged from close to $140 per barrel all the way down to the $20s, at their early 2016 lows.

Prices have rebounded, but all too late to do the supermajors much good.

They're all losing money, and to preserve their dividends to shareholders, they're selling assets and taking out loans. Take a look at the sidebar at right and see for yourself.

Now, this may give them the money they need to pay out their dividends in the short run. But in the long term, each one reduces how much money they make in the future.

Once oil prices recover, these supermajors will find themselves making less oil and natural gas than during the price slump, after having sold assets at the bottom, which is of course the exact opposite of what you want.

And in 2017, things will get even worse for Big Oil... but, as I said, much, much better for nimble, globally oriented investors and traders.

Let me show you what I mean.

Here's Where 2017's Biggest Profits Will Be Had

As I noted in my September 2016 forecast, we'll see crude prices rise in the coming year, to the point where we'll see West Texas Intermediate in the low-$60s by the first quarter of 2017.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

That slow, steady increase will really let much (but not all) of the oil industry recover; with fewer productive assets and more debt to pay off, the supermajors will keep suffering.

You see, most of Big Oil's assets are concentrated in the West, so it will miss out in a big way.

That's because I'm predicting the center of oil demand will move to Asia in earnest in 2017.

My Energy Advantage readers have had, since late July, a head start with a Chinese oil and gas direct play to benefit from this exact trend, but energy companies large and small are already moving in.

It's simple demographics and economics that necessitates this re-focusing of global oil demand.

Asia has a booming population and a booming middle class - especially the world's first- and second-most populous countries, China and India.

Asia has a booming population and a booming middle class - especially the world's first- and second-most populous countries, China and India.

This makes Asia the energy growth market for the next 20 or 30 years. India in particular will be key, with the International Energy Agency (IEA) estimating that this country alone will account for almost half of new global oil demand over the next 25 years.

Oil exporters are already "fighting dirty" to get a foothold in India. During this autumn's negotiations for an international deal to cap oil production, for instance, the Saudis made a shock announcement that they were cutting the price of their exports to East Asia in a bid to take market share from Russia and other producers - the very countries they needed to get onboard with a production cap!

Russia's largest, state-controlled oil company, Rosneft, responded by offering some $32 billion to purchase India's second-biggest oil refinery.

This tit-for-tat bridge-burning is just one example of the fierce international competition for the rich Asian energy market. When oil companies compete like this, it's the investors who win.

Now, Asia is by no means the only place energy investors will make money in 2017. Here in the West, as I mentioned, energy demand will remain high. And it will increasingly be filled by natural gas.

That makes U.S. shale companies the smart bet in the segment. CONSOL Energy Inc. (NYSE: CNX), for instance, has returned more than 88% - and counting - since March 2016, and I expect it to outperform for a long time to come.

Plenty of these shale companies pay dividends - CONSOL does - but they don't pay unsustainable dividends that the supermajors do. And they're in a much better position in the long haul. Shortsighted Chevron, for instance, is actually selling natural gas fields in Asia to fund its Western operations.

Now, some supermajors, including BP and Royal Dutch Shell, have seen the writing on the wall and are trying to move their operations from oil to natural gas.

The former has signed $18.5 billion worth of natural gas deals in China, while the latter bought natural gas company BG for $53 billion in February 2016. These are undoubtedly smart moves.

Still, as we move into 2017, the supermajors' shareholders will face the ugly prospect of shrinking dividends or shrinking future revenue if the fire-sale of their valuable corporate assets at rock-bottom prices continues. Either way, those shareholders lose.

But investors like us, who are looking at booming, lucrative oil opportunities in Asia and shale and natgas plays here in the United States, should have a very, very good year indeed.

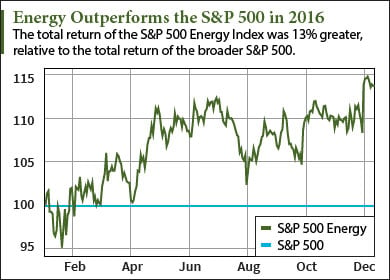

Kent's Energy Advantage subscribers get full access to his energy investing model portfolio recommendations, along with his full 2017 energy investors' forecast, including: crude oil, renewables, alternatives, and even solar. The forecast also get Kent's bulls versus bears energy outlook. Remember, energy investments did 13% better than the S&P 500 in 2016. 2017 could be even better... Click here to learn more about Energy Advantage.

Follow Kent on Facebook and Twitter.

About the Author

Dr. Kent Moors is an internationally recognized expert in oil and natural gas policy, risk assessment, and emerging market economic development. He serves as an advisor to many U.S. governors and foreign governments. Kent details his latest global travels in his free Oil & Energy Investor e-letter. He makes specific investment recommendations in his newsletter, the Energy Advantage. For more active investors, he issues shorter-term trades in his Energy Inner Circle.