The president and CEO of JPMorgan Chase & Co. (NYSE: JPM) rocked Bitcoin markets when he called it a "fraud" that he'd never touch.

That was arguably the nicest thing Jamie Dimon had to say about the cryptocurrency.

He even went so far as to say he'd fire any employees trading this cryptocurrency, calling them, bluntly, "stupid."

Now, Bitcoin can be volatile on a "normal" day, and it has seen massive swings in recent days, largely on news that China plans to clamp down on it. Nevertheless, Bitcoin plunged 10% almost immediately after Dimon's roasting.

Of course, this isn't the first time he's badmouthed Bitcoin - and I'm sure it won't be the last, either.

Here's the thing: Dimon is completely wrong about Bitcoin.

What's more, JPMorgan - his own outfit - and plenty of the other big banks are all over the digital currency and the technology behind it.

That means traders and investors who are keying in to Dimon's comments risk making a catastrophically expensive mistake.

Mega-Banks Are Quietly All Over Bitcoin

Currency transactions - buying a stock, an option, a house, a pizza - might look fast, even instantaneous, but that's only at first glance.

In reality, banks have to communicate and settle slowly - and expensively.

Payment processors, settlement banks, clearing houses - all kinds of middlemen - are required to actually conclude a transaction between two or more parties, especially if those parties are in two or more different jurisdictions like, say, the United States or Japan.

But the blockchain (I'm oversimplifying, but think of it as a virtual wallet or ledger) powering Bitcoin transactions concludes business all but instantaneously. It really is more efficient than the old-school approach. Much more.

These fund transfers are done with minimal processing fees, which in turn helps prevent the steep fees charged by most banks and financial institutions for wire transfers. Its success has also helped create a few other cryptocurrencies, like Litecoin, Namecoin, and PPCoin.

Of course nearly all of these serve to cut traditional banks out of their "piece of the action," so you can see why a banker like Dimon is less than totally in love with Bitcoin.

Governments, too, are fairly cool toward it. After all, it completely eliminates the need for central banks... and central bankers... and the politicians who appoint them.

Of course, Dimon was very careful in his remarks to separate "Bitcoin, the cryptocurrency" from "blockchain, the technology behind Bitcoin."

That's because bankers (at least the ones who don't work for settlement banks) are head-over-heels for the potential of the blockchain to rapidly boost their own bottom lines.

If that sounds counterintuitive, banks - including JPMorgan Chase - are pursuing the blockchain because they see it as a way to maintain some sort of dominant position in a world where transactions are instantaneous (and fraud-proof). They see cost savings and profit potential there.

Just look what they're doing...

Dimon's bank (along with 86 corporate firms) helped create the Enterprise Ethereum Alliance, which is an open-source blockchain initiative.

JPMorgan Chase even created its own blockchain.

There's more...

On top of its support for the technology underlying Bitcoin, JPMorgan Chase Securities reportedly bought $35,000 of XBT, an exchange-traded note (ETN) listed on the Nasdaq Nordic in Stockholm that tracks the value of cryptocurrencies like Bitcoin. It essentially serves to give investors exposure to Bitcoin.

JPMorgan has also been handling Bitcoin-related trades for its clients - despite Dimon's own declaration that it would be a "stupid," fireable offense to do so.

Other companies, like Fidelity, have also gone so far as to include Bitcoin in their charts and price quotes, as though it's a physical asset.

They're doing all this in response to demand. It's obvious: Investors and traders want it...

Financial Crises Mean Bitcoin Is Here to Stay

Now, there are a lot of techno-prophets out there who believe that Bitcoin could very well replace the U.S. dollar by 2031 - just 15 years away.

I won't go so far as to say that Bitcoin is a "safe haven" for your money right now. But I do strongly believe that blockchain technology could very well be the reason a new global currency eventually replaces the U.S. dollar.

It's come a long way in a short time.

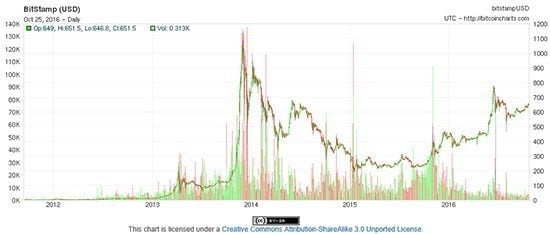

When the first Bitcoin transaction was placed in 2009, its valuation was less than pennies on the dollar - just $0.003. But a watershed moment hit 2013, after the financial crisis in Cyprus exploded... and harsh capital controls shuttered Cypriot banks and ATMs.

Many folks there turned to Bitcoin, a currency no government could screw up. In fact, the buying volume was so massive, its price skyrocketed to over $260 per bitcoin. And by November 2013, it had increased by over 377%, peaking at $1,242 per bitcoin.

You can look at Brexit as another powerful example of the growing demand for this game-changing "digital asset":

At the time of the referendum (in June 2016) - but when all bets were on the United Kingdom staying in the European Union, Bitcoin dropped from $1,242.00 to roughly $585.

Of course, we know how that went: The shocking "Leave" result came in, Bitcoin shot back up to nearly $700, with its new lows around $585. Remember, while Bitcoin was soaring, the British pound and the stock market were taking a beating (heck, the pound still is).

You can see why Bitcoin's been deemed "digital gold."

Bitcoin has every shot at becoming a trillion-dollar asset. Bitcoin's "market cap," for lack of a better phrase, is currently $65 billion.

It would need to be worth around 15 times what it is today to hit $1 trillion. But it's already surged almost 127,000% against nearly all the odds. A 15x gain isn't a big stretch in that context at all.

I wouldn't bet against it surging to $1 trillion, and I definitely want to own it on the way up.

The Only Thing That Would Get Me Out of Bitcoin

If Bitcoin is merely a fraud with no real value, it wouldn't be trading as actively as it is; that would be a nigh unprecedented mass delusion and one of the biggest cons in history.

Not likely.

But... I'm a rules-based guy. I like to have a plan, an exit plan. So I'd think about reducing exposure if signs of 17th-century-style "Tulip Mania" start to creep in around the edges.

The look of a Tulip Mania-style situation would be unmistakable. You would see everyone start to scream "Buy!" so that the market would be, essentially, all buyers, no sellers.

That would trigger the contrarian trader in me to step out and start selling.

But I really don't see that happening. I'm in Bitcoin for the long haul.

In fact, I was one of the early "miners" of this currency. I've used my old reliable mining machine to reap a nice chunk of Bitcoin as part of my overall holdings. Otherwise, my risk is quite low.

So, until we see Tulip Mania happen, my mindset is to let the mining machine do its mining thing and not worry about it - despite the recent volatility.

Now, if you want to boost your profit potential like never before in your life...

This Is the Fastest Way to Make Money I've Ever Seen

I love showing readers how they can quickly double their money. And now I want to show you a way to cash in on triple-digit winners week after week.

You see, I've uncovered a pattern even Wall Street traders can't see. This unusually lucrative pattern only appears in the top 2% of stocks. And its unprecedented moneymaking power gives you the chance to double your money in four days or less.

I've been using it to find gains like 100% on RTN in one day, 100% on BIDU in one day, 120.93% on MS in two days, and 124% on ABBV in one day.

Even better, you'll never need more than $500 to get in on these plays.

This is the fastest way to make money I've ever seen. So if you want a shot at extra cash this week (and every week), click here now to learn more...

Follow Tom on Facebook and Twitter.

[mmpazkzone name="end-story-hostage" network="9794" site="307044" id="138536" type="4"]

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.