The price of gold continued its lateral movement last week, but veteran gold traders are used to a plateau after a rally.

But we're seeing a barrage of bullish indicators for gold right now, including a billionaire investing mogul jumping into the space.

After all, the big rally that took gold prices back into bull mode did so convincingly.

After all, the big rally that took gold prices back into bull mode did so convincingly.

Gold is well above its 200-day moving average, which should provide support if current weakness becomes a bit more near-term correction.

But none of the fundamental drivers have seen much change. Trade tariffs are still a major issue, the U.S. government shutdown is still in place, global growth is slowing, and the Fed's become more dovish.

With yet another billionaire throwing his hat into the gold ring, the arguments for owning the ultimate hedge have gotten even stronger.

Add in a mega-merger to form the world's largest gold miner, and you have the makings for more strength in gold.

Let's take a closer look at what's going on, including where I see gold prices heading next...

Why the Price of Gold Won't Stay Flat for Long

The price of gold got to within less than $4 of $1,300 a full seven times in the last few weeks. But each time, traders seized those highs as an opportunity to sell and take profits.

Once gold prices can close convincingly above $1,300, that could well become a new "floor," with gold then working its way higher.

Most People Don't Know This About Bitcoin: A systems upgrade expected any day now could send Bitcoin to $100,000. Go here to see why Bitcoin's not dead... and how it could make you millions.

Still, over the past week, gold has mostly meandered sideways. Between Monday (Jan. 14) and Thursday (Jan. 17), gold reached $1,288 on the low and $1,295 on the high.

But by Friday (Jan. 18), optimism continued to grow over prospects that the U.S.-China trade spat was nearing an end.

Stocks rose on more relief rallying during the week too. The combination of these two variables lifted the dollar even further on Friday.

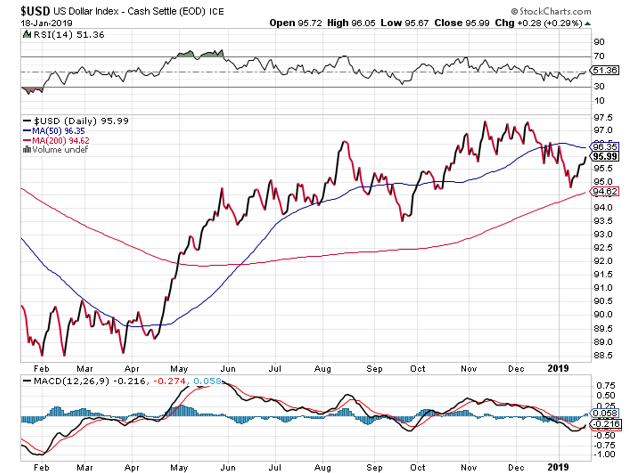

We can see that in the U.S. Dollar Index (DXY) below...

That Friday-morning surge in the DXY took it from just above 96 to almost 96.4 in short order. That was enough to beat gold back, and the price of gold fell from $1,286 to $1,281 by late in the trading day.

Then on Monday (Jan. 21), a shortened trading day for gold and a holiday for stock markets, gold dipped a bit further even as the DXY held steady around 96.34.

But as I said earlier, we're still in bull mode, and I expect a break above gold's resistance level will send gold prices higher.

And from what I'm seeing in my gold charts, one indicator shows we're poised for a new breakout.

It's no wonder a legendary real estate billionaire is moving into gold...

My Latest Gold Price Prediction for February

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Looking at price action in the dollar index over the past week shows a bit of renewed strength.

Given how long momentum had been trending downwards (since early November), it's not a complete surprise for the dollar to be putting on what may only be a relief rally.

I think the DXY is likely to find overhead resistance near current levels, its 50-day moving average.

Huge ongoing deficits and a Fed that's promised to be more "data-dependent" should keep pressure on the dollar and help push the DXY gradually lower.

As for gold, we can see that the rest I said we should expect has materialized.

I still see $1,260 as a likely "floor" if more weakness should come. At this point, we could see a bit more consolidation or even softness as this correction finishes playing out.

Now let's look at my recent suggested trades.

The DB Gold Double Long ETN (NYSEArca: DGP) has given back about 15% as it leveraged gold's recent dip. DGP is a buy.

The VanEck Vectors Junior Gold Miners ETF (NYSEArca: GDXJ) also dipped, but that was limited to about 4%. GDXJ is also a buy.

Interestingly, gold's 50-day moving average (blue sloping line) is about to complete a "golden cross" once it rises above the 200-day moving average (red sloping line).

That's a bullish technical breakout pattern, which will give more weight to the renewed gold bull market.

There's also been news lately that yet another billionaire has decided that he needs to own gold now.

Sam Zell, founder of Equity Group Investments and real estate mogul extraordinaire, told Bloomberg TV, "For the first time in my life, I bought gold because it is a good hedge. Supply is shrinking, and that is going to have a positive impact on the price."

The outspoken investor has joined other billionaires like Ray Dalio, David Einhorn, and Jeffrey Gundlach, as some of the most seasoned investors have touted the metal's benefits in today's investment atmosphere.

As well, Newmont Mining Corp. (NYSE: NEM) recently announced its plan to take over Goldcorp Inc. (NYSE:GG). That will help it leapfrog the "new Barrick," which itself was a result of Barrick Gold acquiring Randgold Resources.

If approved, Newmont Goldcorp will then become the largest gold miner, potentially sparking further M&A activity and renewed excitement in the sector.

The Crypto Party Is Far from Over: Bitcoin is expected to undergo a massive upgrade - and it could kick off a price surge all the way to $100,000. Cryptocurrency expert Michael Robinson has put together a special report on a unique strategy that could help you pocket one windfall after another not just on Bitcoin, but on all the cryptos he's following now. To get step-by-step instructions on how you could become the next crypto millionaire, click here now...