Suffice it to say, this week's market rally has been a welcome respite from a month-long (though it feels longer) market free fall. But it's important to keep things in perspective.

While the market might continue its rally for a few more days, I wouldn't be surprised if it doesn't stick. We've entered a bear market environment, and any rallies we see from now on like we did this week will most likely be followed by severe drops. Especially as we get more news on growing infection numbers and a suffering economy.

And that's why I wanted to take a moment to talk to you folks about one of the perfect plays for a bear market. This will keep you ahead of the volatility still to come.

You see, bonds often get a bad rap.

A treasury bond is a government debt security that you can buy and sell just like a stock. But it offers lower yields, making it a much less attractive investment.

What many people don't know is that bonds are actually a vital source of revenue. They help to keep the lights on for governments, states, and corporations...

And they offer an ideal safe haven in bearish market conditions.

With all three major indexes down more than 20% from their recent highs, markets have officially entered bearish territory - making now the perfect time to get into bonds.

You don't have to worry about lower yields, either.

With bonds, you can come to the aid of your country, profit from rising prices, and dramatically increase your annual returns...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Now Is the Perfect Time to Buy Bonds

In 1693, the Bank of England issued bonds to raise money for the country's war against France, creating today's government bond.

Following the trend, the U.S. government issued bonds to support Revolutionary War efforts. In fact, one could even say that the ultimate outcome of the war was greatly influenced by the money raised through bonds.

You see, a bond is essentially a loan. Like a loan, bonds pay interest at a particular rate called the coupon rate, which produces the yield of the bond.

Yield = Coupon Rate × Bond Value

Bonds are considered safe instruments depending upon who's issuing them.

There are three broad classifications of bonds:

- Government (U.S. Treasury Bonds)

Treasury bonds are considered high-quality for most governments. In the United States, they are regarded as the highest quality available.

This makes sense when you consider they are backed by the full faith and credit of the U.S. government, making the risk of default slim to none. In addition, the interest earned is exempt from state and local taxes.

Treasury bonds are liquid and trade on the secondary market. They have maturity dates that range from 30 days to 30 years.

- Municipal Bonds

Issued by state and local governments, "munis" are used to fund construction and maintenance of infrastructure like schools, highways, sewer systems, and housing. They are typically exempt from federal income tax and, in some cases, state and local taxes.

They are, however, considered riskier than treasury bonds, as state and local governments have more bankruptcy risk. Given the added risk, municipal bonds offer higher coupon rates than treasuries.

- Corporate Bonds

Corporations may also issue bonds to fund business expansion. Corporate bonds carry more risk than treasury and municipal bonds and, therefore, typically provide higher yields.

As you can see, there is a relationship between yield and risk to consider before investing in bonds.

Higher risk of default = Higher yield

Lower risk of default = Lower yield

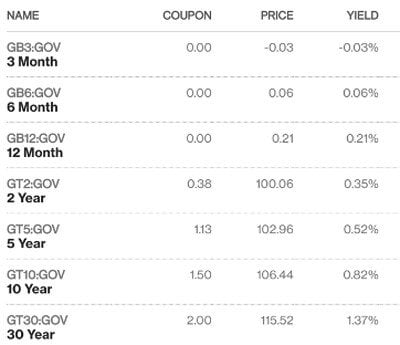

Let's take a look at the current yield of the lowest-risk bonds, the "treasuries."

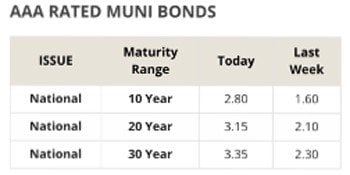

In comparison, here's a look at typical municipal bond yields:

Obviously, "muni" yields are higher than treasuries - but so is the risk of default. The same goes for corporate bonds. The higher the risk, the higher the yield.

This inverse relationship between risk and reward governs trading and investing as we know it today.

Now, in this current market, it's important to understand that bonds in general are considered safer than stocks. When the going gets tough for stock traders, money generally flows from stocks to bonds, driving their prices up. Those owning bonds in a bullish bond market profit from this flow.

Additionally, as interest rates drop, bond prices rise. Currently, interest rates are at record lows. The federal funds rate is currently at 0.25% - making the bond market significantly bullish.

If these bearish market conditions continue, you can expect bond prices to rise - meaning buying bonds right now is smart. You should consider diversifying your current portfolio with bonds.

But what if I told you that you could dramatically increase your yield and secure the safety of bonds?

Well, with exchange-traded funds (ETFs), you can.

Bond ETFs invest in bonds and are traded as stock on the stock exchange. They don't mature, meaning you can hold them indefinitely. Plus, they are liquid, even if the component bonds are not.

And the best part?

Bond ETFs pay monthly dividends. In fact, the yearly yield is much higher than typical bond yields.

Take the iShares 20+ Year Treasury Bond ETF (NYSE: TLT), for example. It's currently offering an annual dividend of $3.016, or 1.89%.

By purchasing the liquid stock, you can make $3.016 per share each year in dividends indefinitely.

Pretty good - but with options, you can supercharge those returns.

Right now, you can sell 30-day, out-of-the-money (OTM) calls against TLT stock for around $4. That's an extra $48 dollars a year in premium - 1,600% more than you would make purchasing the liquid stock.

Here are the most popular treasury bond ETFs:

| Symbol | ETF Name |

| SHY | iShares 1-3 Year Treasury Bonds |

| IEF | iShares 7-10 Year Treasury Bonds |

| TLT | iShares 20+ Year Treasury Bonds |

Now is the perfect time to invest in bonds, particularly treasury bonds. Whether you're purchasing a bond, a bond ETF, or options on either, you and the country benefit!

And in the meantime, you can watch my crisis response presentation...

You see, the markets are in a state of chaos. But I'm here to help break down what that means for your money and your financial future.

For the first time, I'm granting virtual access to my command center to give you my analysis on where the market's most critical areas stand - and to show you the right moves to make to help protect your wealth. Tune in right now...

Follow Money Morning on Facebook and Twitter.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.