The markets are flashing signs of another February-sized correction.

After setting an all-time high on Sept. 2, 2020, the S&P 500 tanked 3% on a massive volume spike the following day.

This downfall continued for the next two days, dropping the S&P 500 down 5.4% on three days of high-volume selling.

Stock portfolios may be in store for another 35% drop, and COVID-inspired economic conditions, such as fear of a resurgence and a postponed vaccine date, certainly support it.

But while most investors bite their nails in worry, I'm anticipating nothing but profits.

Should the markets go red, collecting high-probability profits will be the name of the game - and today, I'm going to show you exactly how to do just that...

Profit on the Impending Bear Market Using Credit Spreads

The question that I'm sure is on your mind is: "What is indicating a market correction?"

It's a good question, and I'm more of a "show don't tell" kind of guy, so let's take a look at the SPDR S&P 500 ETF Trust (NYSE: SPY).

SPDR S&P 500 ETF Trust (NYSE: SPY)

Simple support, resistance level, and volume analysis are what we look at for the answer.

- The volume on the recent two-day run up declined. Stated another way, the institutional conviction declined on the run up, suggesting that this run doesn't have legs and will fail.

- There is strong resistance at $342 with four bounces off this level over the past six trading sessions.

- This $342 level appears destined to hold. If it doesn't, there will likely be more upside.

- Strong support exists at the $300 level. A close below this level on above average volume will signal more downside.

Now, with any major news event or government decision, this could change. But given the amount of institutional selling over the past couple of weeks, the most likely direction is down - perhaps way down.

And I have one simple signal to look for that proves this further move to the downside...

If the SPY closes < $330 on above average volume, this will be the trigger that sends the market lower.

And this trigger is the key to these credit spreads.

Should this move happen, collecting profits will be like shooting fish in a barrel.

With this signal in place, the likelihood of the SPY closing back above $330 for the short term will be very low.

What we need is a trade that will profit as long as the SPY stays below the $330 level.

In other words, we need a trade that profits if the SPY continues to tank, goes sideways, or even goes up a little.

Sound too good to be true?

It does, but this is achievable using the right options play.

To begin, there are two sides to any option trade: a buyer and a seller. You can think of it like a long (buyer) and a short (seller) side.

For example, on the other side of a long XYZ $50 call, there must be a short XYZ $50 call.

The long call makes money when the stock rises.

The other side of the trade - the short call - makes money when the stock does not rise. In other words, the short call makes money if the stock drops or goes sideways.

If you assume that a stock has an equal probability of going up, down, or sideways, the long call has a 33.3% chance of making money. This means that the short call has a 66.7% chance of profit.

The simple act of selling a short option actually doubles your probability of profit.

Well, all trading has "tradeoffs," and shorting calls is no exception. But as long as you know the best trading strategies to use, these risks shouldn't be anything to worry about.

Here are a couple of them:

- Limited (Lower) Profit

The most you can make on a short call is the amount you take in for selling it. If you sell an XYZ $50 call for $1, the most you can make is $1. Ideally, the short call will expire worthless. You may even choose to buy it back for $0.20, netting $0.80.

- Unlimited Risk

Long calls give you the right to buy a stock. The other side, short calls, give you the obligation to sell a stock. That's fine if XYZ is at $50 or less. However, if XYZ makes a bullish run and is trading at $70, you'll be obligated to sell a $70 stock for $50 and lose $20. There is no limit to how high a stock can go, so, short calls have unlimited risk. They are called "naked calls" for this reason.

Now, these limited profits are still great profits! And when you have an impressive 67% chance at profits, the difference is worth it.

Unlimited risk can sound intimidating, but as long as you protect your trade, then you have nothing to worry about.

And you can do this by acquiring a right to cover your obligation.

Here's what I'm talking about:

Selling an XYZ $50 call gives you the obligation to sell XYZ at $50.

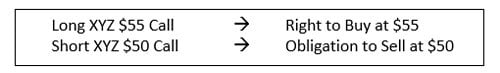

To cover the risk of the stock rising, you could buy an XYZ $55 call, giving yourself the right to buy XYZ at $55, capping your risk.

The spread now has limited risk. In the example above, if the stock went to $70, you'd be covered by the long $55 call. If you were forced to sell XYZ at $50, you could exercise your right to buy it back at $55, capping your risk to $5.

Welcome to the world of credit spreads - higher probability, limited-risk trading.

Here are some basic rules to get you started with Short Call Spreads (aka: Bear Call Credit Spreads):

- Sell ATM/OTM Call

- Buy Higher Strike Call

- 1-10 Points Between Strikes

- Use 14- to 30-day Options

Remember, short call spreads are a bearish strategy. Be sure to sell them at or above a price point you feel the stock will be beneath in two to four weeks.

I determine this "line in the sand" with the following formula:

Stock Close < Support + Above Average Volume

With all of the above established, I'll leave you with this "Shooting Fish in a Barrel" trade on the SPY.

Entry: Close < $330 + Above Average Volume

Trade: Sell Two-Week $330 Call + Buy Two-Week $335 Call

Profit Exit: Buy Back Spread for 20% of Original Credit (80% of max profit)

Loss Exit: If SPY Closes > $330.50, Buy Back Spread

Here are the legs to close or buy back this credit spread:

Should we get our entry signal, this trade will have at least a 67% probability of profit.

If the SPY continues to break below support on above average volume, keep selling these high-probability credit spreads.

And in the meantime, don't forget to check out my simple options 101 trading report...

You see, I've been teaching people how to trade for decades, and my FREE guide has everything you need to get started.

From the basics to essential do's and don'ts for profitable trading, you can click here now to access it and get on the path to making money with options...

Follow Money Morning on Facebook and Twitter.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.