The market's "fasten your seat belt" light just turned on.

If you've been on a plane, then you know what I'm talking about...

Everything's going smoothly. You're enjoying the in-flight entertainment - which in my case is reading or people watching - and then bing - the light goes on, followed by the captain's announcement that we may experience a little turbulence.

That's what the CBOE Volatility Index (VIX) just did. The market's ride looks like it's about to get bumpy as we head into year-end trading, and the VIX lit the "fasten your seat belt" light in response.

For what it's worth, you shouldn't be scared of this volatility. Contrary to popular belief, it isn't a bad thing. It's a lot more pleasant than plane turbulence, actually. Volatility gets things moving. It shakes out the weak hands in the market and allows the strong hands to come in and get into new positions.

In fact, volatility is the basis of one of my own Ten Commandments of Trading that I've built my fortune on:

Volatility is a trader's best friend.

Today, I'm breaking down what this means. It could hand you a 52% profit opportunity, after all...

Why Volatility Is a Trader's Best Friend

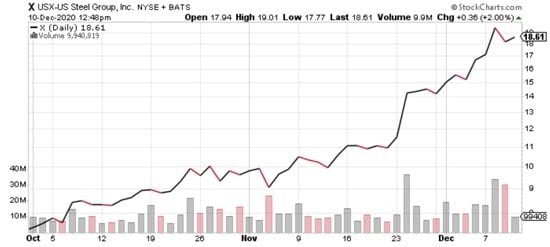

There's another common misconception that volatility only means prices are going down. That's simply not the case. Just look at the United States Steel Corp. (NYSE: X), for example:

The past few weeks, as you can tell, have been incredible for the stock. It has returned more than 80%! And those returns aren't from a lack of volatility. Quite the opposite, in fact. This 80% jump came as the stock's volatility more than tripled.

That's what we refer to as "upside volatility," and it's truly a trader's friend.

Now, let's go back to that seat-belt sign - and how it's going to help you get through the last two weeks of the year.

The VIX has been skipping across the 20-level like a stone thrown across a smooth pond. This is a bit of a problem, as it suggests that we're getting ready for a short-term increase in the VIX, which means a bit of a pullback in the market.

This is not the upside volatility that I was just talking about. It's the kind of volatility most people associate with the VIX: downside volatility.

The silver lining here is that the market actually needs a pullback. The post-election rush into stocks has created a mini "bubble" that needs to release a little of its pressure. If you want to see how that works, just look at one of my favorite industries: alternative energy.

Stocks like solar energy company SunPower Corp. (NASDAQ: SPWR), electric services provider Blink Charging Co. (NASDAQ: BLNK), and electric auto manufacturer Nio Inc. (NYSE: NIO) rallied 50%, 240%, and 57%, respectively, in a matter of weeks as traders rushed in to embrace these "new tech" names.

That rally led to a frothy market for these stocks... followed by a "healthy correction."

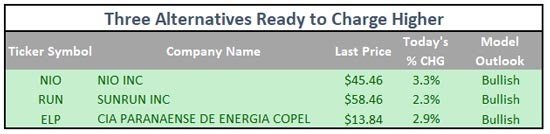

But that doesn't mean they were heading down for good. Today, those same stocks have retraced and are ready for their next rally. There's your target-rich area of the market right now!

Here are just a few of the companies that I'm eyeing for a strong year-end rally in the "alternatives." Since I put the following chart together last week, their stock prices have moved a little since then, but I'm still expecting to see double-digit returns from each of these names over the next few weeks:

As for the rest of the market, it's time for the same healthy correction to put prices back at the levels where traders will start to pounce on them. And once that happens, we'll see the Santa Claus rally we're all expecting. I'll be among those traders on the pounce, and you should be, too. I'm waiting to buy the dip on a number of stocks - but one in particular is my "Great White Whale."

Remember that thriving chart of U.S. steel? Well, Cleveland-Cliffs Inc. (NYSE: CLF) is a steel manufacturer, and shares have rallied 75% since the election.

The stock is extremely overbought. In fact, it just underwent what I call "crescendo volume," which typically signals that a stock is ready for a short-term pullback. That volume spike, highlighted in the chart below, combines with the overbought relative strength index (RSI) to forecast a short-term pullback in the stock.

I missed the opportunity to buy into the new bull market trend in CLF, but I'm loaded up and ready to take advantage of the pending dip in price.

If you want to follow me to the money, here's what I recommend...

Consider purchasing CLF shares as they dip to $12 with a Good-Til-Canceled (GTC) limit order. That allows you to buy the stock at an 8% discount compared to where it sits today.

In addition, I would consider another GTC limit order at $11 in case the selling continues. You must remember that there are a lot of traders that may move to lock in some of those 75% profits.

If both of those orders are triggered, you'll have an average cost of $11.50 per share on a stock that my analysis says will jump to $17.50 on its next bull run - making for a 52% return.

And that, my friends, is why volatility is a trader's best friend.

So, fasten your seat belt, and we'll navigate any turbulence that the market may throw our way together.

And in the meantime, don't forget to check out the complete list of the best (and worst) stocks for 2021...

You see, my colleague and Wall Street insider Shah Gilani says 2021 could be a gold mine for Americans. He's showing his subscribers exactly which stocks to buy and which to sell.

But you're getting it all for free - no sign-up or credit card required. Prices, tickers, and company names will be coming your way fast. It's all right here...

Follow Money Morning on Facebook and Twitter.

About the Author

Chris Johnson (“CJ”), a seasoned equity and options analyst with nearly 30 years of experience, is celebrated for his quantitative expertise in quantifying investors’ sentiment to navigate Wall Street with a deeply rooted technical and contrarian trading style.