We've all been there at some point in our trading careers - frustrated, banging your fist on the desk as yet another option expires worthless.

Don't let it get you down. It's all part of the journey to becoming a better investor.

With that said… you can't keep executing the same strategy and expect a different result. I think it was Einstein himself who called that the "definition of insanity."

It's easier than you think to break the cycle and learn how to stop chasing after unrealistic moonshots time and time again.

Let me show you how to put on trades with a high probability of profit. It's the first step to start turning things around…

The Market Makers Love to Sell You Calls

Success in trading and investing rests on three critical pillars: a sharp understanding of market mechanics, an appreciation of the role of probabilities, and, not least, a strong handle on risk management. That last one can be… challenging, to put it politely.

Consider what happens when you're buying a call option…

Here, you're essentially signing an agreement with a counterparty, who often holds the underlying stock. They decide to sell the call option at a strike price where they’d make a profit by letting go of their shares. If the stock indeed exceeds that strike price, they stand to gain from both the appreciation of the stock's value and the premium they received from the contract they sold you.

However, there's a widespread and, let's face it, tragic misconception that simply buying calls will inevitably lead to huge gains.

Tragic because, the truth is, more often than not, call options expire completely worthless. So, instead of speculating and hoping for the best, it's better (and wiser) to trade based on a well-thought-out strategy that amplifies your chances of success.

Tragic because, the truth is, more often than not, call options expire completely worthless. So, instead of speculating and hoping for the best, it's better (and wiser) to trade based on a well-thought-out strategy that amplifies your chances of success.

At Flashpoint, that's precisely what I focus on; it's our bread and butter.

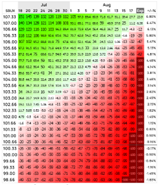

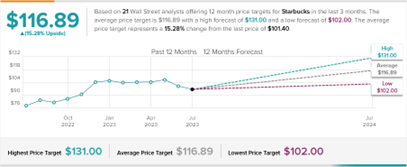

Let's consider Starbucks (SBUX), a consistent performer who remains popular regardless of the economic climate - we'll always need coffee. It's currently trading at around $101, but analysts estimate its stock value is between $102 and $131. That discontinuity between reality ($101) and expectation (as high as $131) is important.

Now, you could pursue a couple of different strategies here.

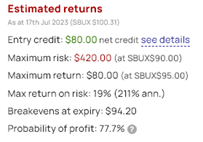

The first approach involves selling puts which would require a large amount of margin to cover 100 shares of SBUX at say $95. If you’d rather avoid using $9,500 in margin, consider buying the SBUX Aug 18, 2023 $90 put. Why? It's downside protection, essentially. Do that and you negate the need for margin. Then you're free to sell, or "write" the SBUX Aug 18, 2023 $95 put.

With this strategy, you're risking just $420 for a potential return of $80. This trade has a probability of profit of 77.7%, far superior to the typical 'lottery ticket' options trades that offer high returns but also come with high risk.

With this strategy, you're risking just $420 for a potential return of $80. This trade has a probability of profit of 77.7%, far superior to the typical 'lottery ticket' options trades that offer high returns but also come with high risk.

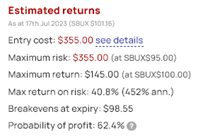

There's another approach: If you're more aggressive, and willing to throttle back on your probability of success for the chance to make more money, you can set up a call spread.

With this strategy, you can buy the SBUX Aug 18, 2023 $95 call and sell the SBUX Aug 18, 2023 $100 call. This trade requires just $355 for a potential return of $145. Providing a possible 40% return and a probability of success of 62%.

With this strategy, you can buy the SBUX Aug 18, 2023 $95 call and sell the SBUX Aug 18, 2023 $100 call. This trade requires just $355 for a potential return of $145. Providing a possible 40% return and a probability of success of 62%.

Bear in mind that both of these strategies are designed for consistent returns, not unrealistic 100%, 300%, or 500% "windfall" gains. And remember, even if the stock remains stable around $101 over the next six weeks, you'll turn a profit. If it falls, your losses are capped due to your downside protection.

Through disciplined trading, setting appropriate stop-loss levels, and letting go of the pipe dream of massive gains on every single trade, you can turn your investing fortunes around. The value of these strategies is in their ability to deliver consistent returns and manage risk effectively, helping you become a more profitable and sustainable investor.

It's the best way I know to break the cycle of frustration and focus on a strategy that prioritizes high probability of profit and sound risk management.

You can see exactly how these strategies work in this video, too.

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.