Postcards from the florida republic

An independent and profitable state of mind.

The Wall Street Journal warns that China could soon face its “Lehman Brothers moment.”

It’s a call back to the defining moment of the 2008 Financial Crisis. That “moment” was the long-expected collapse of one of Wall Street’s oldest and most-connected banks.

The finale was a decision by the U.S. government (and a Treasury Department run by the former CEO of rival bank Goldman Sachs) to go bankrupt with no financial support (or last-minute bailout) on September 15, 2008.

The result was a paralyzed global credit market, a massive bailout of corporate America, and the eventual zombification of the financial markets over the last 15 years after years of central bank intervention.

Are we going to do big bailouts and lots of money printing again?

Of course, we are! We’ve already done it five more times since then! Do we really think that BlackRock, central bankers, and politicians want to lose their jobs for what’s little more than financial alchemy?

At this point, I’ll say it. Just bring it on…

We know how these markets work. We play the shell game often.

Today, I’ll also show you how to play it and win. A broad market decline may take markets on a rollercoaster… followed by more printing, inflation, and bailouts…

But don’t worry about it. Enjoy the sunshine.

Today, I’ll show the only tool you need to call a deep market bottom and come out wealthier on the other side of this crisis.

Total Crash or Just Another Bailout Pattern?

China is in trouble.

The country’s doing all it can to defend its currency. That may require selling up to $875 billion in U.S. Treasuries in the future. That’s not de-dollarization.

That’s trying to survive. China is a massive user of U.S. dollars. It would need to wean off the dollar (a huge challenge for them) before a BRICS currency, or Yuan ruled the world.

But who will buy US bonds if China sells U.S. Treasuries to protect the Yuan? It won’t be China or cash-strapped Americans.

I’m a student of financial crises, especially over the last 20 years. I damn well know the answer is the Federal Reserve.

The U.S. will take a hit. But China will be way worse off.

The only way China gets out of this situation is by doing what central banks do —-- pumping money.

Otherwise, they’re eyeing a deflationary crisis that brings global liquidity down – perhaps to levels we haven’t seen since Lehman’s collapse. Here’s the thing: That sort of crash could take the entire Chinese Communist Party with it.

[Note: Did people really think China practiced “capitalism” when they decided to go big over 30 years in “centralized banking?”]

So, if China pumps more money into the system – it will create another massive round of money papering over deflation and debt.

As that happens, many people will tie up a lot of their money into gold coins, the Japanese Yen, or duration bonds because they believe them to be safe-haven assets.

But the real inflation protection and upside opportunity at the onset of printing and QE madness is the U.S. stock market.

You’ll want to be in the equity market – ride the next momentum rally higher – and then buy all the safe assets you want… later.

What a Crash and Reinflation Looks Like

As Michael Howell notes, “Money moves the markets.” The combination of central bank, private, and cross-border liquidity is directly linked to risk asset (stock market) performance.

This relationship with the market will stay the same for a while.

If they pump a lot of capital, the equity markets will get another boost. For fun, we’ll again watch worthless companies benefit from the onslaught of liquidity pumped into the system – eager to paper over their own existing debt with new debt.

Assuming they aren’t bankrupt yet (and the music still plays), unprofitable stocks like Beyond Meat (BYND) will likely surge.

When it’s all said and done – sometime in the future, the Federal Reserve’s balance sheet will be north of $12 trillion.

And it will likely keep climbing as America creates more debt.

Central banks – leaving their nations awash in debt – will make us repeat this entire process a few years later.

Do we really think that they’ll allow asset prices to crash?

That would cost them their jobs… and they’d have to explain – once and for all – how this whole shell game came crashing down.

Finding the Bottom of This Crisis

My definition of Equity Momentum (and how to measure it) is your best bet of knowing when it’s time to buy back in the market.

But there’s an even earlier clue than the daily MAC-Divergence (MACD) reading that I also explained on Thursday.

If you want to maximize your conviction on calling the bottom after any financial crisis occurring next week… month… or year…

We have you covered at Republic Research. It’s RIGHT HERE.

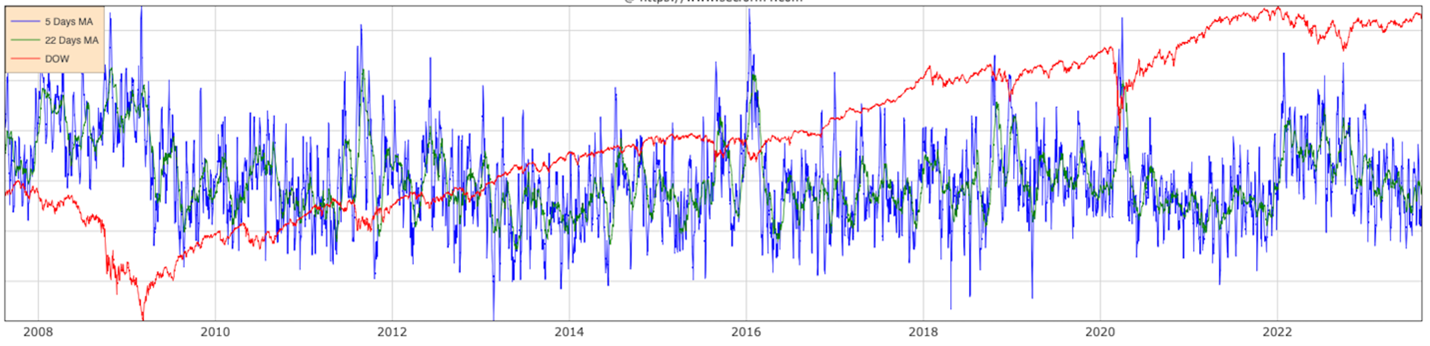

We call the Blue Line below the Executive Quotient (EQ).

The EQ measures insider buying-to-selling in real dollars of executives at public companies on a one-to-one level.

This means that executives across many companies collectively buy their own stocks with their own money… compared to selling stocks in their companies and pocketing the cash.

Look at the periods of extreme buying pressure on the EQ since 2008 (the blue line at the top of the chart). In that case, it ALWAYS coincides with major policy shifts to accommodate the economy – but ends up turbo-charging risk assets like equities.

The strongest monthly EQ readings include the following:

- October 2008 (Lehman’s collapse and government stimulus),

- March 2009 (After the first massive EQ program),

- August 2011 (After the first debt ceiling crisis),

- January 2016 (After China’s Yuan crisis,

- December 2018 (After the bond-equity crash and Fed’s pivot),

- April 2020 (After the Fed pumped $5 trillion); and,

- October 2022 (After the British Gilt/global liquidity crisis).

In the event of a deepening crisis and policy change by central bank coordination that expands their balance sheets and pumps more liquidity, a spike in the EQ pattern will happen again…

And then… it will be time to buy with confidence.

Just follow this letter to know when the EQ reading is rising.

I talk about it… every day across multiple publications…

Stay positive,

Garrett Baldwin

Secretary of Finance

Drink of the Weekend

Consider Long Drink again this weekend. It’s sturdy, Gluten-free, and great for the knees.

I will say that I was thrown off by the can, which reads that the drink is canned in Kannapolis, North Carolina, a city outside of Charlotte.

We must provide tax incentives for Long Drink’s canning company to relocate to the Florida Republic.

You can download a copy of this postcard by clicking here.

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.