We begin September with a typical conversation between Tim Melvin and me.

Normally, we’d be at his house for Labor Day weekend, watching my daughter swim and discussing seasonality. But Tim had a fever, so we layed low this Sunday.

I have a different kind of fever – the type that comes when Equity Momentum (EQM) turns positive – and there’s an opportunity to make money. One of the key conversations Tim and I have shared over the years has centered on stocks with strong F scores, Z scores, and attractive valuations.

By layering these stocks on top of strong momentum and ample trading liquidity – we can identify attractive long-term targets using short-term trading tools.

But let’s back up…

Tim has shared on our live broadcasts that the Piotrotski F-score is a NINE-POINT system that rewards each company for meeting a certain criterion on its balance sheet.

The F score does measure management’s performance but also measures the company’s ability to grow in a meaningful way.

How are companies improving their balance sheets year over year?

And how are shareholders enhancing shareholder value?

Are companies buying back stock or lowering their debt?

If the company meets all nine criteria, it has an F-score of 9.

That means it has a perfect score.

The Altman Z-score is a weighted average of five metrics to determine whether a company might go out of business.

If a company falls below 2.6, it has a risky balance sheet.

That risk is tied to a balance sheet that likely has lots of debt or weak cash flow.

We are looking for stocks with a Z-score of 3 or higher. Let’s be very cautious in this environment. As I’ll explain this week, the Treasury Department is piling on risk to the markets.

High F and Z scores is a quick hack into basic forensic analysis.

Then, there’s the last part… We don’t want stocks trading at insane valuations. We don’t want unprofitable companies. So, we use one or various valuation metrics that can tell us a very simple story about how this company trades compared to its peers and its price history.

But for good measure… there’s ONE MORE screen we must run.

We don’t want to have a list of stocks trading over the counter. We want established companies that trade on the NYSE, NASDAQ, or even the AMEX.

We want stocks with plenty of volume – so we won’t settle for anything less than 125,000 shares traded on average.

And finally – we want to generate gains off these stocks – whether the market goes up… goes down… or sideways. We can use put spreads [a feature of our favorite way to trade and invest in Occidental Petroleum (OXY).

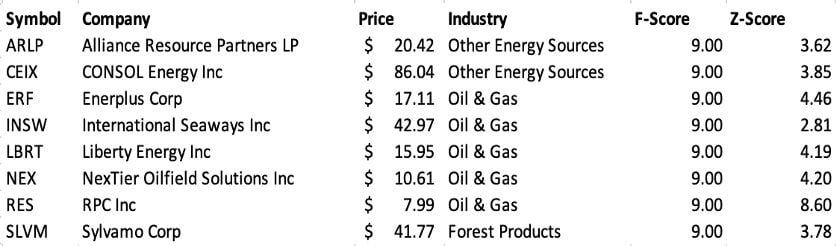

That delivers some interesting names.

Qualify Everything

The screen leaves us with eight names. There are two coal producers, five oil-and-gas players (an interesting shipping company), and one forest product manufacturer.

Now – we must qualify EVERYTHING (that’s one of the rules of the republic).

I’ll be honest. Despite rising natural gas prices in Europe, I’m not a massive fan of investing in U.S. coal now.

This sector feels like there is a sword hanging over it at any given moment – and looking into 2024 – it will become even more political than ever.

We are always one sternly worded edict from a shutdown of U.S. coal production. It’s insane.

I’m intrigued by the Forest Product space. But Sylvamo Corp. (SLVM) took a nasty downgrade from RBC Capital three weeks ago.

Shares have bounced back nicely from a recent low of $37.65 in August – but given the current state of materials stocks – I think there will be better options in the sector that I know best – oil and gas.

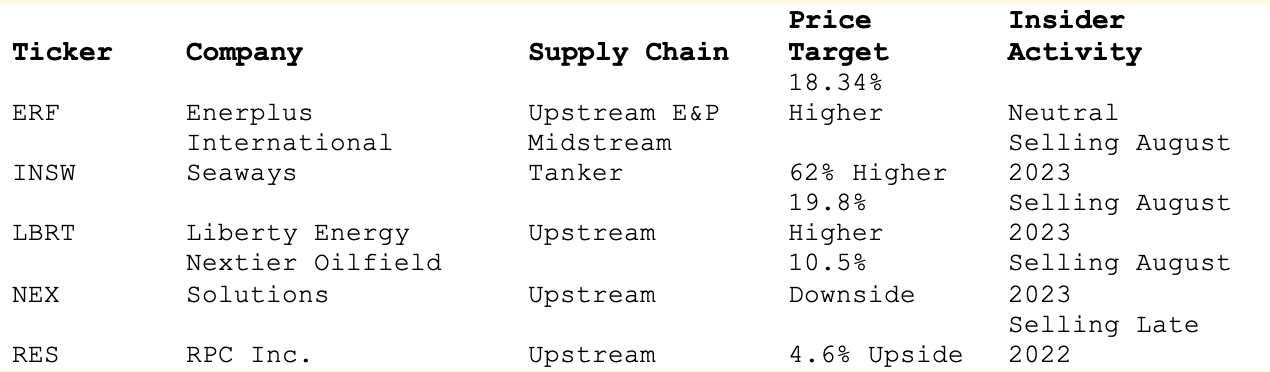

Let’s take a quick look at the average price target of the five remaining stocks… and some other key indicators that should warrant your consideration.

Have insiders been purchasing the stock or selling the stock?

Given the positive momentum in energy right now, all five of these names intrigue me. But Enerplus – with a nice price outlook and neutral insider activity has attracted my attention.

Without even digging into the stock itself, I can set myself up with an interesting trade (or backdoor to invest in the stock at a lower price). As you likely know, I’m very bullish on oil and gas over the long term.

But the short-term markets (seasonal volatility and questions about the Treasury Department’s latest antics in duration bonds) do give me a little anxiety.

So, I can trade a bullish put spread that has a high probability of success… and can generate capital on a stock that I’d want to own at a lower price.

This week, I’ll go over selling put spreads on a few of these names with the members of Flashpoint. If you'd like to join us, Call Gabe Oropollo with client services at 877-711-2560 and ask for the best price to get started today.

Stay positive,

Garrett Baldwin

Secretary of Finance

You can download a copy of this postcard by clicking here.

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.