It has been a crazy week for Spirit Airlines (SAVE).

This morning’s news wires are buzzing with bullish news on the company, and from the look of the options activity from yesterday, I’m guessing that someone got this news early.

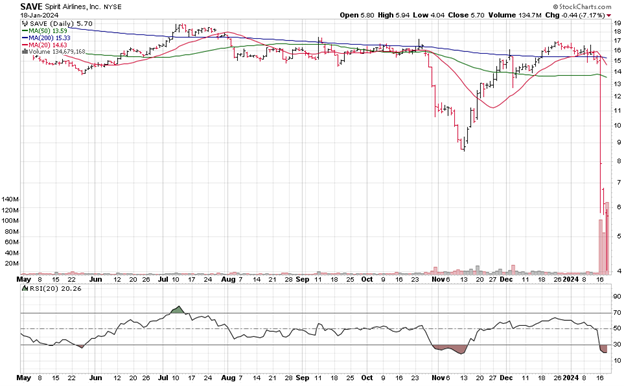

Shares of Spirit spiraled lower this week after a judge agreed with the Department of Justice (DoJ)’s antitrust challenge to block JetBlue (JBLU)’s acquisition of the company. SAVE dropped from $16 to $4, a crushing blow to anyone holding the stock.

Yesterday, the company blew out a flurry of headlines about trying to push forward with the JetBlue acquisition and a possible restructuring of the company.

Most investors hear the word “restructuring” and think of a worst-case scenario, especially when a company is as debt laden as any airline out there. It’s the type of news that makes investors run to the hills until things settle down for the company and its stock.

Not Dave Portnoy, though.

Dave Portnoy is the outspoken founder of Barstool Sports. Google him for more information if you like, there’s a lot to be said about Dave. I’m a fan.

Portnoy took to his “X” account to post about buying "a ton" of SAVE stock right before it dipped on WSJ restructuring story.

Given the week’s events, I’ve been watching the options activity on SAVE daily, just to see what the options market is forecasting for movement on SAVE stock - and last night’s trading summary got interesting.

A ton of call option activity was traded during yesterday’s session. Call buyers were unusually active on strike prices that stretched from $4 to $10. Looking back to Wednesday’s trading, similar activity, including hundreds of thousands of call options all expiring this afternoon, were traded.

The kicker: this morning at 6:56 a.m. ET, Spirit Airlines provided an update to investors that they see Q4 revs at high end of initial guidance and that the merger agreement with JetBlue "remains in full force and effect."

Bottom Line

I always say that “luck prefers the prepared trader,” but it appears that some traders may have had a little more than luck on their sides in the options trading pits this week.

Steer clear of SAVE shares for now.

By submitting your email address, you will receive a free subscription to Money Morning and occasional special offers from us and our affiliates. You can unsubscribe at any time and we encourage you to read more about our Privacy Policy.

About the Author

Chris Johnson (“CJ”), a seasoned equity and options analyst with nearly 30 years of experience, is celebrated for his quantitative expertise in quantifying investors’ sentiment to navigate Wall Street with a deeply rooted technical and contrarian trading style.