Man, Boeing (BA) is starting to feel like Wells Fargo (WFC) a few years ago.

If you don’t remember, there was a time when Wells Fargo just couldn’t seem to get out of their way. The company was plagued by management missteps that resulted in a lot of explaining, fines (more than $3 billion), and a lot of work to get back in investor’s good graces.

Boeing is working on the same situation. The only thing that they have going for them is that they operate in a duopoly with Airbus (EADSY). But that’s not enough to keep the stock price above $200.

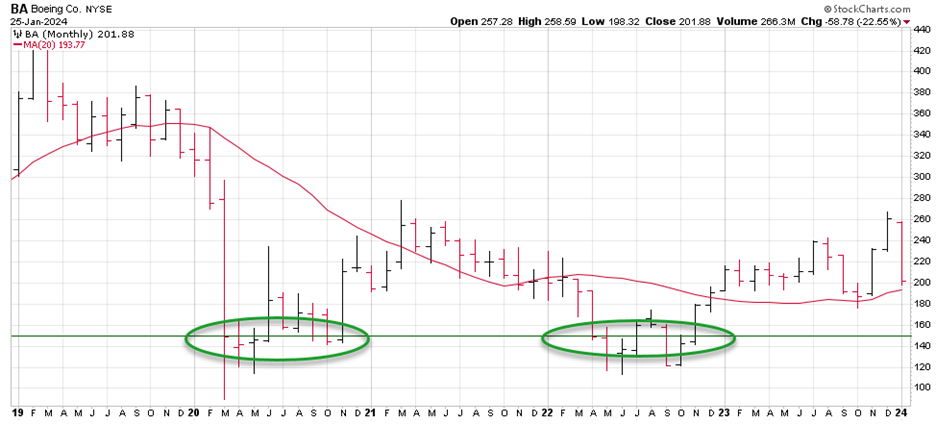

In March 2019, Boeing shares started a multi-month 25% decline after the 737-Max groundings. The stock bounced in a range for months before finally declining more than 60% in the wake of multiple investigations and charges.

This time around, shares dropped 20% in an initial reaction to the short-term 737-Max groundings after the Frontier Airlines incident. The stock found support at $200, but that is likely to its round-numbered nature - not because investors are done reacting.

I expect to see analysts begin to reassess their outlook for Boeing, as we’re already hearing about potential for orders shifting to Airbus. Currently, 89% of the analyst community considers the stock a “buy.” That classifies the stock as a crowded trade, meaning that the stock holds inherent selling risk.

Sure, the next few weeks will see fundamental developments in Boeing’s operations that will resonate through the stock as additional selling is likely, but it’s Boeing’s stock chart that will provide the short-term “guidance” for the stock.

Here are the key prices to watch…

$200: As mentioned, this round-numbered support kicked in by default this week as BA shares saw short-term technical resistance. Two closes below this price will trigger another round of algorithmic selling.

$190: This price is where Boeing stock’s 20-month moving average. This is the long-term trendline that acts as the line between a bull and bear market trend for any stock. This trendline acted as support in October. A break of this key trendline will cause more sellers to enter the market taking BA stock to my bearish price target.

$150: This is where I become interested in the stock as a long-term buy. Boeing shares have found support at $150 twice in the last three years, and we’ll see the same this time around.

Bottom Line

Boeing’s saving grace is that they operate in a duopoly, this would be a crushing blow if they had more than one competitor. That said, the stock is going to have a tough three to four months and next week’s earnings report is likely to pressure shares as the company prepares investors for a rough 2024.

For now, the “trade” takes Boeing stock to $150 where the long-term “investment” kicks in as a buy.

By submitting your email address, you will receive a free subscription to Money Morning and occasional special offers from us and our affiliates. You can unsubscribe at any time and we encourage you to read more about our Privacy Policy.

About the Author

Chris Johnson (“CJ”), a seasoned equity and options analyst with nearly 30 years of experience, is celebrated for his quantitative expertise in quantifying investors’ sentiment to navigate Wall Street with a deeply rooted technical and contrarian trading style.