I know, what about the Federal Reserve? We talked about this in Wednesday’s email, but I figured that I should take an extra minute or two of our time to give some detail.

SO, Jerome Powell and his band of merry Fed Governors will get together next Wednesday to announce their decision on interest rates.

Will the Fed lower interest rates like so many consumers want?

The answer is “NO.”

This week’s “warm” inflation reads all but locked the decision, at least in my mind. Hell, there are now some economists rolling out their takes that the Fed may increase interest rates.

They could be right over the next few months if we see a trend in the inflation data revealing that inflation is coming back.

For now, don’t expect the Fed to do anything with rates next week, but the Fed meeting is far from a risk-free event. As a matter of fact, Jerome Powell has often done more damage with his words during the press conference than the Fed’s decision on rates.

Here’s what you want to watch – or listen – for next week…

A change to the “higher for longer.”

Wall Street is caught-up on subtle changes to language. Listen for anything that is a stronger derivation of the now famous “higher for longer” to give the real story on where rates are going.

Listen for talk about the liquidity in banks.

This has turned into a warm button for the markets recently as one or two banks have disclosed waning capital. I think any mention will be to calm any fears that may remain from last March’s banking debacle.

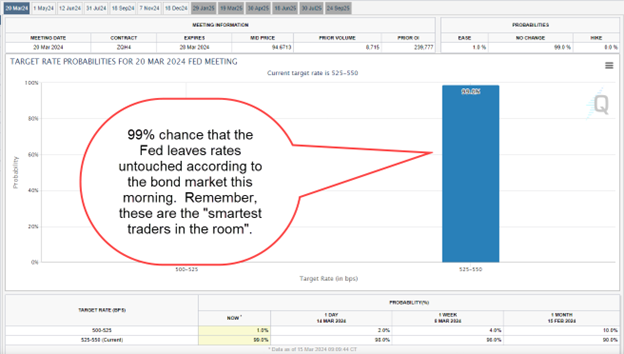

The real “data” is in the Fed Funds futures.

This tool shows that the futures market is pricing in the first rate cut on June 12, and even that is a 50/50 proposition. This means all hope – which the market was floating on just a few months ago – of a rate cut has been taken out of the market.

Bottom Line

Next Wednesday’s Fed meeting provides more risk than reward for the market.

The technical and sentimental backdrop of the market suggests that Jerome Powell and the Fed’s comments must avoid mention of any hawkish tone that may get investors thinking we won’t see lower rates until late summer.

Any hint of the Fed’s willingness to get more aggressive against inflation will trigger that healthy we just spoke about.

By submitting your email address, you will receive a free subscription to Money Morning and occasional special offers from us and our affiliates. You can unsubscribe at any time and we encourage you to read more about our Privacy Policy.

About the Author

Chris Johnson (“CJ”), a seasoned equity and options analyst with nearly 30 years of experience, is celebrated for his quantitative expertise in quantifying investors’ sentiment to navigate Wall Street with a deeply rooted technical and contrarian trading style.