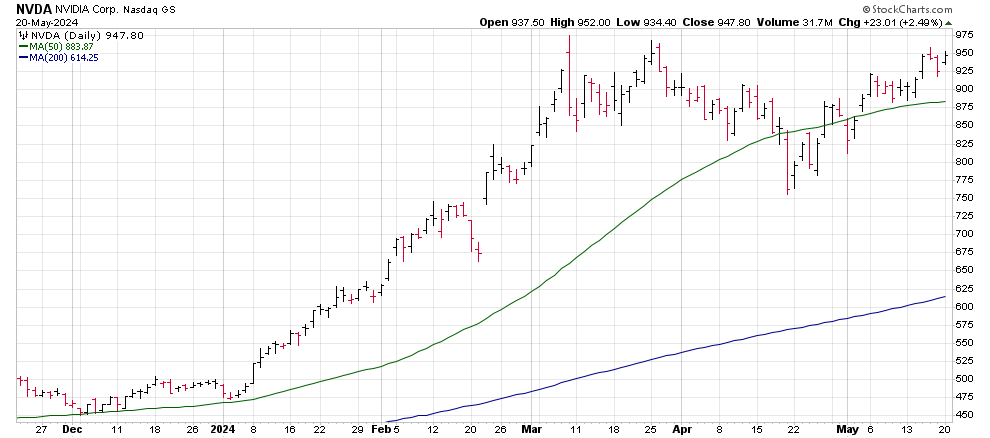

NVIDIA (NVDA)

With its earnings only a few days, NVIDIA shares made a 2.5% move today that barely missed closing the stock in new high territory.

Shares closed the day at $947.82 as four different Wall Street analysts decided that today was the day to raise their price targets on the stock.

Two of the analysts from Barclays Stifel were merely a move to catch up with the market ahead of earnings as their previous targets were below current prices at $850 and $910 respectively. The bolder of the moves were the two analysts from Susquehanna and Robert W. Baird who raised their targets from $1050 to $1,100 and $1,200 respectively.

The upgrades capture the essence of NVIDIA being one of the most dangerous stocks on Wall Street. I know it sounds odd, but NVIDIA stock is quantifiably the most loved and recommended stock on Wall Street. The fact that the stock also holds some of the highest price targets – relative to its current price – makes it susceptible to much larger selling pressure when, not if, it misses any piece of its earnings expectations.

Now the good part. NVIDIA shares just completed a short-term bullish pattern as their 20-day moving average moved above the longer-term 50-day trendline.

This pattern is called a Silver Cross and historically forecasts higher prices for the underlying stock.

An earnings beat from NVIDIA on Wednesday afternoon will result in a fast and aggressive move above analysts’ average price target of $1,035, causing a wave of price upgrades later this week.

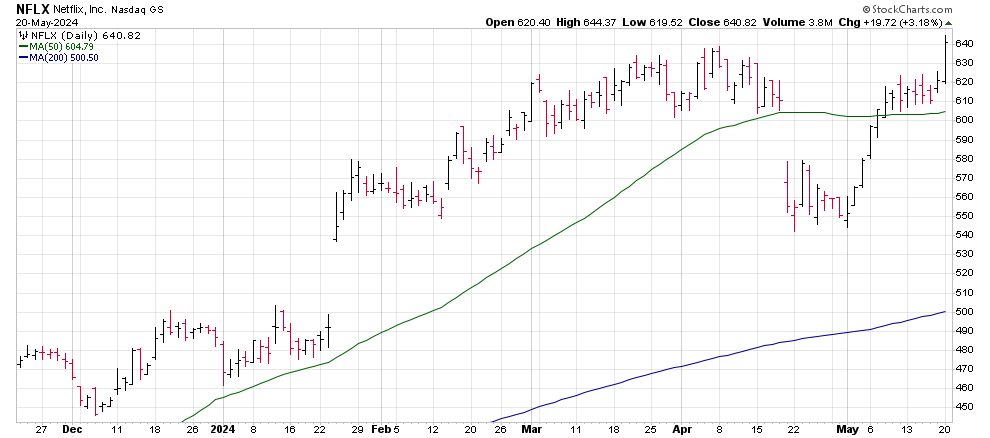

Netflix (NFLX)

Shares of Netflix moved to new highs on no new headlines.

The move, on moderate volume, bolsters investor’s attention of the streaming giant less than a month over punishing the stock 10% after a relatively disappointing management call after their last earnings report.

Keep in mind that the company’s earnings performance was better than market expectations. The disappointment came after Netflix management decided to stop reporting the net additional subscriptions data moving forward.

For many investors – like myself – the 10% correction offered an opportunity to add to existing positions as the market’s reaction was seemingly overdone given the company’s actual financial results.

Technically, the 10% correction also met the criteria for a healthy correction as shares of Netflix had already posted a 30% rally since the company’s last earnings report in late February.

Recent moves by the company to focus on live sporting events and other content has been seen to be positioning the company for what I have referred to as the great re-bundling, something that will likely mold the multitude of streaming services back into more of a “major network” type of structure.

Technically, Netflix shares have broken into a new volatility rally as the stock hits new highs. A move above $650 will add fuel to that technical rally which should lead to the next resistance level of $700, a 9% move from today’s close.

Check out my latest video on Netflix’s big move here.

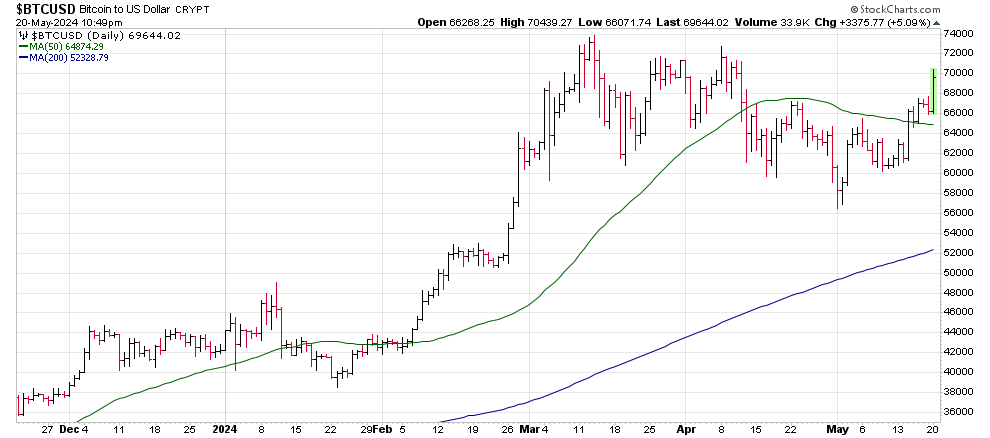

Bitcoin ($BTCUSD)

$100,000 here we come.

Bitcoin initiated the next step of its rally to $100,000 as the cryptocurrency closed today’s trading above $70,000.

It’s the first close above this round numbered resistance level since April, putting a new all-time high within a 6% reach.

The move is accompanied by a surge higher in Gold prices today, suggesting that investors are using Bitcoin as both a speculative instrument and a true store of value.

The “store of value” catalyst is attached to the scheduled release of the FOMC’s meeting minutes from its latest meeting on April 30 and May 1. Those notes are likely to detail the Fed’s thoughts on inflation and the potential trajectory of interest rates.

For now, the technical favor the bulls on Bitcoin as the next target is easily determined by the round numbers, 80,000…90,000 and then 100,000. Any sign from the Fed that they remain fearful of inflation rising again should fuel higher prices for the cryptocurrency and gold.