We all know the Senate just passed what's been deemed the largest tax overhaul in three decades.

And provided this bill hits President Trump's desk by Christmas, most of the provisions in the tax bill will go live on Jan. 1.

But you don't need to wait until then...

You can actually take your "tax cut" early using these two lucrative plays.

Two Ways to Take Your "Tax Cut" Early

On Friday, the Dow dropped 300 points off the latest Russia investigation news. Then the Senate passed its version of the tax reform bill over the weekend, which had everyone anticipating a strong open on Monday for the U.S. equity market. But instead of reaching a parabolic state, the markets followed with a rather lackluster trading day, with the Dow gaining a mere 58 points by closing bell and the Nasdaq and S&P 500 closing lower. This led to the financial pundits screaming to take profits - especially with the great run we've had so far this year.

Free Book: The secrets in this book helped one Money Morning reader make a $185,253 profit in just eight days. Learn how to claim your copy here…

But I'm not anticipating a sell-off of any great magnitude between now and the end of the year. In fact, I believe the markets will grind incrementally higher up until at least Dec. 22 (when they could start trading sideways).

Now we can largely thank the prospect and promise of President Trump's unprecedented tax overhaul for this rampaging bull rally in U.S. equities. And I'm about to show you two lucrative strategies you can use to exploit Trump's tax plans before they likely go live in January.

But first, let's talk about the three sectors I predicted would perform the best since Trump's Election Day victory...

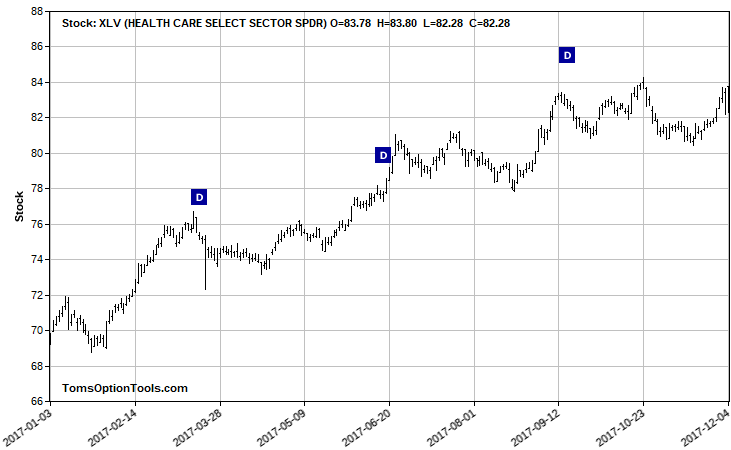

Sector No. 1: Healthcare

This is not a typo...

I wrote last November that despite the universal expectation for healthcare stocks to drop, they actually began embracing Trump's victory because of the priority in repealing and replacing the Affordable Care Act (ACA). And with the repeal of the individual healthcare mandate in this tax bill, the prospect of having state lines removed would create more competition for healthcare companies - which would drive up profits.

Take a look at one of the largest healthcare exchange-traded funds, Healthcare Select Sector SPDR ETF (NYSE: XLV):

Sector No. 2: Biotech

Fears of Clinton winning and taking strict action on the prices of pharmaceuticals had been putting a lot of pressure on the pharmaceutical and biotechnology industry. But Trump's win has eased those fears and opened up some great profit opportunities for investors and traders.

Here's how the largest biotech ETF the world, the iShares Nasdaq Biotechnology ETF (NYSE: IBB), has reacted:

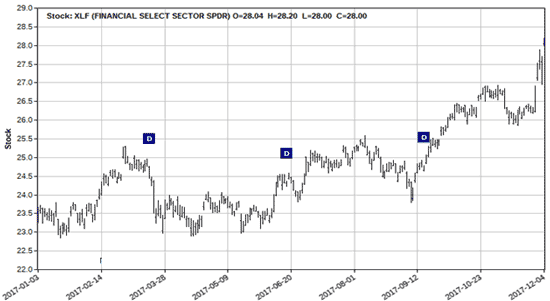

Sector No. 3: Financials

This is pretty much a gimme...

President Trump was already a huge critic of the Dodd-Frank financial reform legislation and has promised to lift regulations on banks and Wall Street. He also recently appointed White House Budget Director Mick Mulvaney as the acting director of the Consumer Financial Protection Bureau - all good things for the financial sector.

Here's how one of the largest financial ETFs, Financial Services Select Sector SPDR ETF (NYSE: XLFS), has responded:

Impressive runs by all.

And these are the best two strategies you can use to get your "tax cut" early...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Write Covered Calls

This is a strategy where you sell someone else the right to buy a stock that you already own at a specific price, within a specific time frame. This is a way to generate some regular income from shares of stock you already own.

Keep in mind that one options contract is equivalent to 100 shares, so you'd need to own 100 shares of stock for each call option you want to sell.

Create a Bull Call Spread

This is a strategy to use to take advantage of a bullish market, where you buy calls at a low strike price while simultaneously selling the same number of calls at a higher strike price. The calls all have the same expiration date.

In the case of an in-the-money bull call spread, the calls that you sold at a higher strike price would normally get exercised, and the stock would normally get assigned to your account. However, since you also bought calls to hedge against the ones you sold, these should be exercised at the same time and at the same strike price.

And the best part...

Since there's no transaction cost for this trade, your account is credited the amount of the spread (per contract) minus the cost of the calls you bought when you opened the trade (or the debit).

After all... why not book some profits?!

And If You Like Fast Cash, You Don't Want to Miss This...

I love fast money. That's why I've been working on a new invention. It's a way to get rapid-fire profits in your hands week after week.

I'm talking about trades you can make from anywhere, even right on your phone, in four days or less.

The pattern behind these quick paydays appears every single week. And I'm the only one who knows how to find it.

I've used it to show my readers top gains like 100% on RTN in one day, 100% on BIDU in one day, 120.93% on MS in two days, and 124% on ABBV in one day.

If you hope to find yourself with a pile of extra cash in your pockets, click here to learn more...

The post How to Exploit Trump's Historic Tax Cut Before It Even Goes Live appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.