After the Senate scored the votes on Tuesday to review a plan for repealing or repealing and replacing what's come to be known as Obamacare, we saw a mixed-bag reaction from healthcare stocks. Even some of the bulletproof ones, like Amgen Inc. (Nasdaq: AMGN), closed lower from their opening highs.

Now, whether or not this was simply a knee-jerk reaction remains to be seen. Only time will tell if the bill will pass - and it's got a ways to go from here.

But no matter what happens next, you've got a great opportunity to make some real money right now.

And here's the easiest way to do it...

Despite Uncertainty, the Healthcare Sector Is at an All-Time High

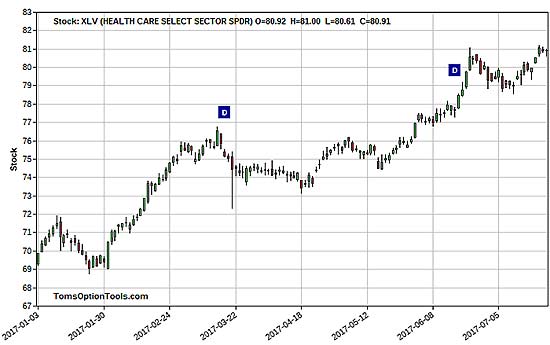

Regardless of the mixed response from healthcare stocks on Tuesday, the drama that's been playing out in Washington has actually had no ill effect on the overall healthcare sector. Just take a look at the Healthcare Select Sector SPDR ETF (NYSE Arca: XLV)...

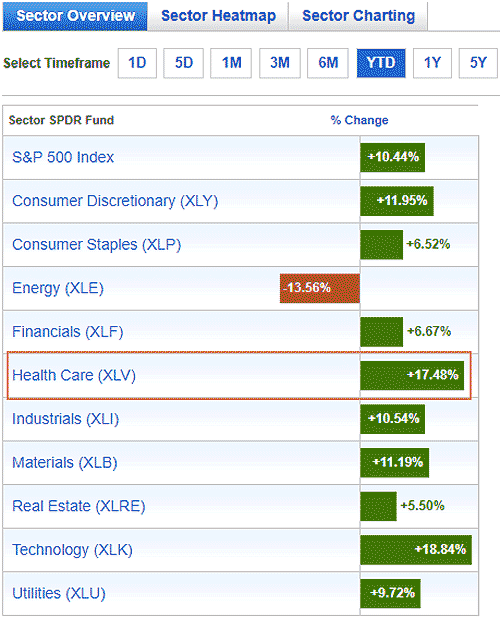

As you can see, it's just barely off its all-time highs and is in a solid uptrend so far this year. And when you analyze its year-to-date performance, XLV only trails the technology sector.

Both XLV and the Technology Select Sector SPDR ETF (NYSE Arca: XLK) are the two top-performing sectors so far this year, and both have performed better than the next-best ETF by at least a full 5% or more.

And even though we're going to have to wait to see how this healthcare bill plays out in Washington, there's no denying one thing: The healthcare sector as a whole and the stocks in this space are climbing.

So as long as you and your financial professionals deem it worthy to employ money to this sector, the easiest strategy to consider is buying calls. I wouldn't say long-term anticipation securities (LEAPS) are the way to go since a vote could some sooner rather than later... so I'd consider options with 30- to 60-day expirations.

And the first thing you can consider going long options on is the ETF itself. XLV is an optionable security, so you could look to trade options on the whole sector...

Or you can look at stocks that make up the holdings in XLV and find out which ones are the heaviest weighted in the index, as the more these stocks go higher (or lower), so likely goes the ETF.

Here's the list of XLV's holdings, ranked by largest to lowest weighting:

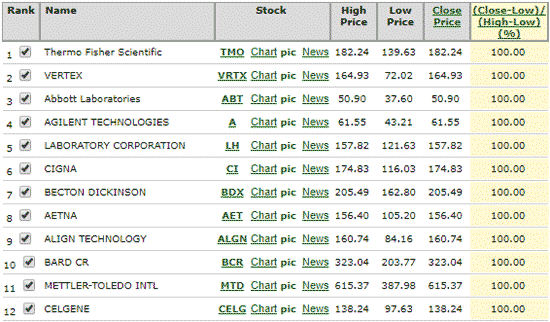

What I'd consider doing is finding the stocks in that ETF that are at their 52-week highs and look to employ the long call option strategy on one (or a few of those), with the idea that stocks at their highs should maintain their momentum higher.

But to make it even easier for you, I created a list using my proprietary tools of the top 12 stocks that are at or near their 52-week highs...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

And remember...

We've still got much more to come from Washington. But don't let the headlines decide your trading decisions for you. Plan your trade, and trade your plan. My hope is that this strategy serves as a nice, easy, and lucrative starting point for you.

The Fastest Gains We've Ever Seen

All it takes is one simple move on Monday, and you are guaranteed, by law, to collect any profits before the market closes on Friday.

Each fast move is specially designed to put you in position to double your money in four days. Of course, the gains on our best plays come even faster. Like the chance to close out two plays for a total of 221.3% profits over two days. Or when three trades added up to 297% gains in less than 24 hours.

To see just how fast this works, go here now…

The post How to Profit from the Senate's Healthcare Vote appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.