Important: Prepare yourself for the market's next downturn right here.

The S&P 500 is considered to be one of the best gauges of market movement. And from its all-time high of 3,393 on February 19, the index crashed 35% in a matter of weeks.

Since then, however, things have turned around. From its March 23rd lows, the S&P has mounted a 25% rise at the time of writing.

Investors are clinging to the bullish bounce, question after question floating through their minds...

Will the jump continue? Is the market bottom in? Is it time to load up on stocks?

For the answer, we look to the technicals - and they're shaking their heads from left to right. The recent run up has no staying power. Another down-leg is likely.

But you don't have to fear another bearish drop. This time, we know it's coming - and with the strategy I'm going to show you today, you could profit even more than if the bullishness were to continue.

In fact, this trade could hand you a 327% gain in two-months' time...

Use Inverse ETFs to Profit in a Down-Turned Market

The truth is nobody knows for sure where the market will go next. But you can gain an edge over other traders by looking at historical patterns. One of those patterns compares price moves to volume.

See, institutional traders account for the bulk of trading volume. Most estimate that they make up around 75-80% of day-to-day trades. And by looking at this volume, we can get a feel for institutional traders' level of conviction as markets move. Think of it like this:

Volume = "Institutional Conviction"

That means when volume on a move is high, so is the institutional conviction. It could be compared to a crystal ball, telling you where the market is headed next. And the best part? We can trade those volume spikes - even in today's volatile market. Click here to learn how.

With this distinction, a volume chart comes to life, increasing our ability to predict direction.

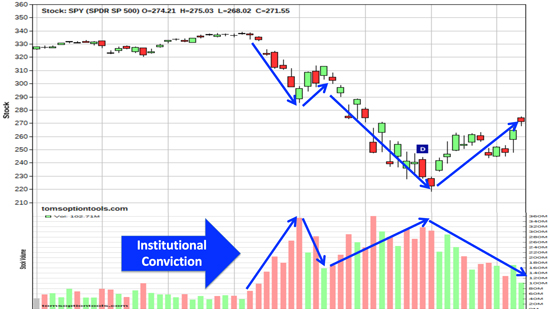

Here is a chart of the SPDR S&P 500 ETF (NYSE: SPY):

As you can see in the SPY chart, the pattern to date shows increasing institutional conviction on downward moves - and decreasing conviction on upward moves.This tells us one very important thing: the recent rally has no legs. It may be running out of steam. History says that this rally has a high probability of failing, and a new down leg will follow - meaning it's time to short the market.Think of shorting as flipping the battery in backwards, selling stocks first and then buying them back later. For example, if you were to short XYZ at $50, and XYZ dropped to $40, you could then buy it back for $40 and net a $10 profit.

As you can see in the SPY chart, the pattern to date shows increasing institutional conviction on downward moves - and decreasing conviction on upward moves.This tells us one very important thing: the recent rally has no legs. It may be running out of steam. History says that this rally has a high probability of failing, and a new down leg will follow - meaning it's time to short the market.Think of shorting as flipping the battery in backwards, selling stocks first and then buying them back later. For example, if you were to short XYZ at $50, and XYZ dropped to $40, you could then buy it back for $40 and net a $10 profit. There are numerous inverse ETFs on various indices. The most liquid are on the top three: the S&P 500, Dow Jones Industrial Average, and Nasdaq markets. Here is a list of the most liquid market ETFs:

There are numerous inverse ETFs on various indices. The most liquid are on the top three: the S&P 500, Dow Jones Industrial Average, and Nasdaq markets. Here is a list of the most liquid market ETFs:

You'll notice that some inverse ETFs are called "UltraShorts." This means that they're leveraged two or three times the normal inverse movement. In other words, an UltraShort ETF leveraged at 2x will rise twice as much as the underlying index drops.

These are great for doubling or tripling returns, but remember - it works the other way around too. If the market rises, you will lose 2-3x what you would have lost on a short ETF leveraged at 1x.

Options 101: Tom Gentile has been teaching people how to trade for decades, and his FREE guide has everything you need to get started, from the basics to essential do’s and don’ts for profitable trading. Click here now.

With a leg-less bullish rally and an expected dire earnings season approaching, consider simply buying the SH. Should the S&P indeed correct, this inverse ETF will rise.

If you want some more juice, you can consider buying one of the UltraShort ETFs, like the Proshares UltraShort S&P 500 ETF (NYSE: SDS). This stock will provide twice the returns as the SH should the S&P 500 fall. Just remember that this carries twice the risk should the S&P 500 rise.

To supercharge your returns even further, you can buy call options on these inverse ETFs instead of buying the stock.

In fact, here's a specific trade recommendation you could use...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Buy-to-Open the SDS June 19, 2020 $28 Call (SDS200619C00028000) for no more than $3.75.

If the SDS reaches $44, then this trade will be worth around $16 - making for a 327% return!

The market is rising on weak conviction, and another down-turn is quite likely. But this group of readers is employing an incredible strategy that uses a volume-trading technique. And since February 10, they had the chance to achieve a 75%-win rate.

In this short video, I'll show you how they did it - and give you all the information you need to trade this way on your own. Click here to watch.

The post Score a 300%-Plus Profit on the S&P 500's "Mirror-Opposite" by June appeared first on Power Profit Trades.

Follow Money Morning on Facebook and Twitter.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.