It starts tomorrow.

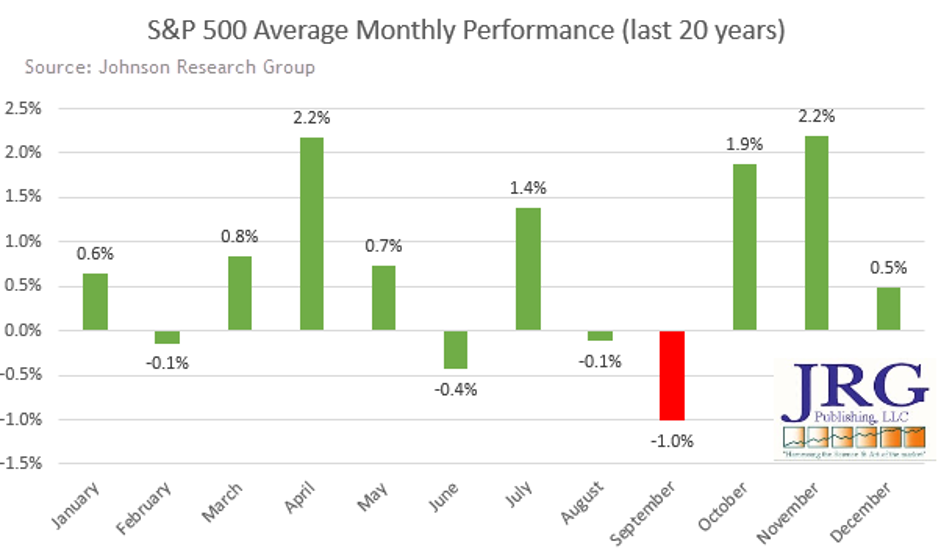

The worst month of the year in terms of performance on the major indices.

I've been setting up for the worst month of the year for quite some time

It's presenting as a phenomenal opportunity, one that won't come around again until February...

With the market dropping, so will a lot of the companies that have become a bit too expensive to build any meaningful position in, and sure, you could go buy shares at that point but that still wouldn't be the best use of your money.

A synthetic stock position will be the best bang for your buck.

If you don't know what that means I can help - I gave quite a bit of detail last week, If you missed it you can check it out right here.

I promise it'll be worth the time because this could be the last chance you have to build your long-term A.I. portfolio for several months, and by then things could get crazy.

Oh yeah, and if you're not a fan of volatility you may want to brace yourself too. Because September is also the most volatile of the twelve months of the year.

Investors do everything they can to avoid the toxic combination of negative return and high volatility, but I'm here to tell you that you need not be afraid of the next 30 days.

I'm going to walk you through September - the good and the bad - so we can both come out of the month prepared for two of the best months of the year, October and November.

WHY?

The first step to thriving in a month like October is to simply understand why it's the worst month of the year for the market.

September is one of the lighter months of the year for volume. How light? Some years we see as much as a 32% drop in average volume on the S&P 500.

You can hear the crickets chirping on Wall Street when things slowdown that much.

Volume drops because earnings season is over and there are fewer headlines and events to drive the market.

At the same time, traders and investors are wrapping up their summers. Spending time getting things back to normal. Getting in their last travels for the summer.

Put simply, it's a quiet month.

But that lack of volume is a key "trigger" for the market's volatility. Lighter volume means increased volatility as pricing becomes less efficient.

Volatility in September historically increased by around 28% in September. Volatility like that almost always spooks investors. Especially when they're expecting the market to scare them a bit.

That combination turns into a self-fulfilling situation for the market year after year.

Which is why September is consistently the worst month of the year.

If you need a visual, think about a movie theater full of people watching Texas Chainsaw Massacre.

90% of the patrons know when the scary parts are coming.

The theater gets eerily quiet just ahead of one of those scenes.

And then everyone screams and jumps when the chainsaw flies, even though they knew it was coming.

That's September seasonality.

Now that you understand how and why this anomaly happens, let's talk about how to prepare for profits.

My approach for turning the month of September's trends in my favor is simple. Protect and prepare purchases.

Protect

No other month presents itself with the consistently poor returns that September holds. For that reason, the "protect" is simple.

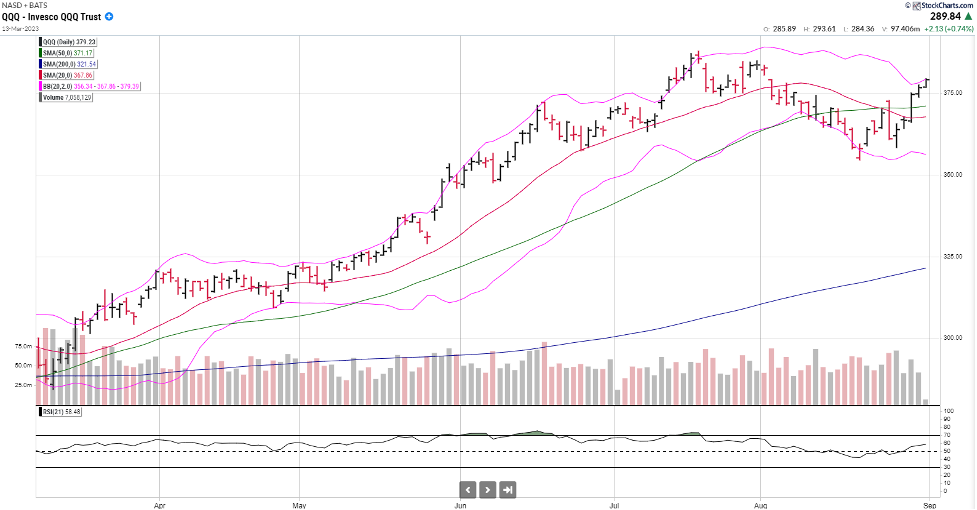

Near the end of August (today, August 31, 2023) I simply buy a put on the S&P 500 (SPY) or the Nasdaq 100 (QQQ).

Think of it like a safety blanket position. My "thunder buddy" position.

It's there to do one thing, hedge my portfolio against the high probability that the market will take a deep dive over the next 30 days.

It's not there to make a 1,000% return. Maybe 50%-60%.

A hedge.

I'll share that trade with you in a moment.

Next, I Prepare Purchases

Investors are more lucid in a volatile market when they've laid out their plan to purchase stocks at certain prices.

This approach cuts through the noise and confusion that most traders face when the markets are whipping prices lower.

It removes the questions that cause us to misstep.

"Will prices go lower?"

"What stocks should I buy?"

"Is this the bottom?"

These questions have already been answered because we've named our stocks and the target prices we're purchasing them at.

It really is as simple as that. Let the market make all the noise it wants, we'll just calmly execute our plan.

Now, as you know, I'm in the midst of building my Two-Year AI Portfolio. I expect to be busy buying several AI-leading stocks during any weakness in September.

Follow my outlook, stock picks, and recommendations by clicking here.

In addition, I'll spend the next week giving you a few of my September Watchlist stocks, complete with target buying prices and options that I will be using to leverage the October comeback.

We'll get into October's seasonality in a few weeks. You're going to like it.

Until then, here's the "protective put" that I am adding to my personal portfolio to hedge the September

This in-the-money October put option on the Nasdaq 100 will provide time and space for any volatility to play out as an intermediate-term profit generator.

My current downside target for the Nasdaq 100 sits at $350, roughly 8% lower than current prices.

I'll update this position and any changes over the next few weeks as we work my Targeted Buy Watchlist.

*Thank you for being a subscriber! Every week you are subscribed to our Text Alerts, you will receive a FREE bonus trade to act on... so be sure to keep an eye out for more weekly trades!

Generally, closing instructions will not necessarily be provided for every trade. It will be up to you to keep up with the trade after it is recommended and exit when you see fit. However, there may be instances when we do send out closing instructions, so be sure to keep an eye out.

The post Things are Getting Bad - This is Your Protective Insurance for What's to Come appeared first on Penny Hawk.

About the Author

Chris Johnson (“CJ”), a seasoned equity and options analyst with nearly 30 years of experience, is celebrated for his quantitative expertise in quantifying investors’ sentiment to navigate Wall Street with a deeply rooted technical and contrarian trading style.