There's no sugarcoating it: The S&P 500 is down close to 7% for the month, and markets have been sinking like a stone this week – the first week of earnings season, too.

The markets have politics to contend with, prospects of drawn-out trade wars, geopolitical uncertainty, rising rates – name it.

This could be the market taking a needed breather… or the start of an overdue bear run. I’m not sure.

But then again, I don’t have to be… neither do you. Because the market, even this one, is packed with juicy moneymaking opportunities.

I’ve got a full plate of them right here…

We're Flying Blind on Direction – and That's Just Fine

Here are the top 10 worst-performing stocks in the market. They may surprise you – but they could still hand you a nice chunk of cash...

The thing is, we could very well be in the beginnings of a new bear market. We are certainly overdue for one after recently setting the record for the longest bull market in history.

That means if you own stocks, if you’re “long,” you could have a bit of a rough ride ahead. Whether that’ll be a rough week, a rough month, or a rough year and a half is anyone’s guess.

Fast Money: This powerful secret made one man a millionaire. Now he’s sharing it live on camera – find out how you could use it to become $2,918 richer in less than a minute. Click here…

But if you’re trading stocks, as opposed to owning them, you stand to make a heck of a lot of money, whether the market slides another 1,000 points and rebounds to new highs… or if it ultimately sheds 25% of its current value.

In other words, this is a great time to trade lousy stocks…

In fact, my paid-up subscribers have had the chance to rake in extra cash on stocks that are plummeting all the time… like the 100% picked up on IYR, 132.04% on GLD… and even 100.58% on NUE.

Even better, with the way I do things, turning these “flaming car wrecks” into cold, hard cash can happen in a matter of seconds.

I'll show you what I mean right here.

Detour Around All Those Falling Knives

Attempting to find the handful of stocks that will move up in correction or bear market is like catching a falling knife. Sure, you can do it… but it’s more likely you’ll just get cut.

Turns out there's a far better way with much lower risk, and a higher probability of success.

LIVE ON CAMERA: Watch America’s No. 1 Pattern Trader officially become $1,050 richer in 15 seconds! His secret to becoming a multimillionaire is so easy that anybody can do it. Click here for details…

The basic idea is to find the weakest stocks in a weak market.

We’re down around 7% and counting. Obviously, the bulk of the stocks in the market went down, and some went down a lot.

But here's the catch – the worst performers are actually the ones we're after here.

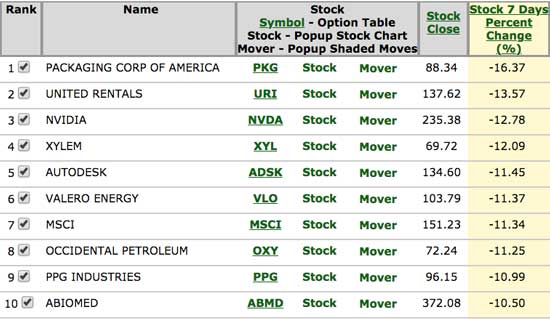

The list below shows the top 10 worst S&P 500 performers over the week ending Friday, Oct. 19. All of them dropped over 10%.

The first, Packaging Corp. of America (NYSE: PKG) dropped a whopping 16.37%. That's over 10% more than the S&P 500's drop over the same time frame.

In trader talk, it’s a “dog… with fleas.”

And truth be told, the stock is showing no sign of stopping this downward move, and this is particularly true if the S&P continues its slide…

The chart of PKG below illustrates how "bad" things are going for the stock.

PKG has crashed below both its 50-day and 200-day moving averages. It’s plunged through numerous important support levels.

Remember: Institutions control approximately 80% of the market, and this is particularly so in the “institutional playground” that is the S&P 500.

Huge volume on the slide reveals the institutional conviction on PKG and other shares on this list is… SELL!

Now, although Packaging Corp. and its fellow basement dwellers could stop their slides and recover, it's more likely, by far, that their downward movement will continue.

And this downward slide is where our opportunity lies.

One way to play this is to sell the stock short. You borrow the shares on margin, “sell” them back at a lower price and pocket the difference. Your position packs on gains as the stock drops. Of course, if the stock does pull a turnaround and shares get more expensive, you’ll be on the hook for the difference.

Your risk there is theoretically unlimited, and should your position go against you in any significant way, your broker likely will be looking to have a chat about your margin.

A better, cheaper, and much less risky way is to do what I do: Buy puts.

You’ll pay pennies on the dollar. For example, the PKG January 18 2019 $85 put (PKG|20190118|85.00P) would cost you $5.30 or so per share (minimum 100 shares). As PKG drops in price, this put option will increase in value. As a matter of fact, these puts are already up around 40% or so over the past three trading days, and I think there’s much more to come.

Should Package Corp.’s stock go up, your downside risk is strictly limited to the price you paid for the put. So it’s not the end of the world if somehow the trade goes south on you. No “worried” phone calls, texts, or emails from your broker, either.

I think traders will do well with at- or in-the-money puts on any of the stocks in my “dog pound” up above; they’ll almost certainly fare better than folks who might be long.

But I Think This Could Be Even Better. Listen up…

Tomorrow afternoon, Thursday, Oct. 25, in the 3:00 p.m. EDT hour – the very last hour of the trading day – I’ll be releasing two “fast fortune” trade recommendations for my subscribers.

These recommendations will target two of the most expensive stocks in the world, but for pennies on the dollar per share.

Both offer limited downside risk, and both will offer as much as 100% potential returns.

I expect these trades to last no more than 24 hours – seriously fast fortunes. Click right here to learn how my system works, and how you could get these and all my future “fast fortune” recommendations.

The post Trade These 10 Worst-Performers to Your Next Big Profit appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.