Editor's Note: Any investor knows that most brick-and-mortar stocks are falling faster than ever. But buying shares of their rising e-commerce competitors - AMZN, BIDU, and BKNG (formerly PCLN) - can be overwhelmingly expensive. Fortunately, Tom Gentile discovered a way you could double your money on these soaring companies in 4 days or less... starting with as little as $500. Sound impossible? Click here to see it for yourself.

Yesterday (March 15), Toys R Us confirmed plans to liquidate its U.S. business.

Last September, the beloved toy store filed for bankruptcy.

They've already closed 180 of their 800 stores, but shutting them all down was never part of their original plan (it never is). Expectations were for a re-structuring of the company that would prevent that from happening.

Fast-forward to this week's announcement of the closing of their remaining stores permanently.

Now for many, the Toys R Us shutdown news is pretty unsettling. Toys R Us has been a household name - a childhood favorite. Making that trip to pick out the perfect toy for being good or getting outstanding grades was something a lot of us looked forward to when we were kids.

And for parents, the memories of battling holiday mobs to get the last Tickle Me Elmo or a Cabbage Patch Doll still bring laughter around the family table.

So hearing that another Goliath like Toys R Us - one you'd always think would be around - is closing is enough for some traders and investors to start dumping all their retail shares.

But that's actually one of the worst things to do - especially to your portfolio.

Here's why...

It's Not Too Late to Turn a Profit on Brick-and-Mortar Stores

We've talked about the challenges in retail before.

And at times like, I favor trading strategies like going long puts or using bear put spreads to take advantage of stocks I feel are going to trade down.

But the opposite stance could be to look for bullish option trading opportunities in the ever growing e-commerce field, like Amazon.com Inc. (Nasdaq: AMZN) or Baidu Inc. (Nasdaq: BIDU).

And that's the great thing about being an options trader.

You can always position your money in a manner that can make gains based purely on your assessment of the company's future - whether they be up or down.

For example, if you own shares of Hasbro Inc. (Nasdaq: HAS) or Mattel Inc. (Nasdaq: MAT), you may be feeling nervous about the series of downs it has taken over the past few weeks...

But at times like this, there is no reason to let nerves take the lead. Just step back and assess the situation.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Your first option would be the long put route. This would mean you believe the company will continue to drop in price.

Or maybe you believe the company will weather the storm and come out mostly unscathed on the other side.

This is done by slowing down, crunching the numbers, and analyzing the charts - but mostly it's done by ignoring the headlines and sticking to your strategy.

It's easy to get caught up in the "The end of retail as we know it" headlines stating that brick-and-mortar retail is dead.

It's easy to listen to the analyst's warnings that retail is a sector that you want to stay away from.

I admit that even I've even been a bit more skeptical of the retail sector lately. But I was curious to see which retailers with a brick-and-mortar presence are holding up better than the world thinks.

So, I analyzed the holdings of the XRT: the SPDR S&P Retail ETF.

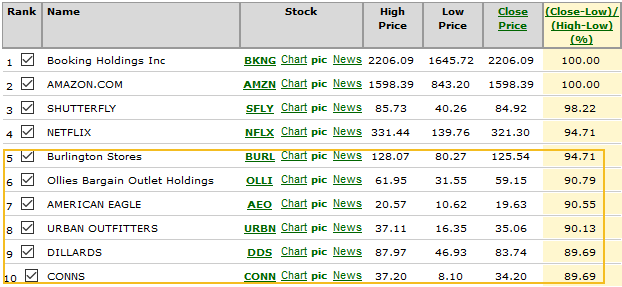

This list above shows the top 10 stocks in the retail sector that are at or closest to their 52-week high (as of March 13).

Stocks at their 52-week high are often considered momentum stocks, and though momentum and retail aren't two words we'd think go hand in hand - the proof is in the data.

Obviously, the top four stocks, Booking Holdings Inc. (Nasdaq: BKNG), Amazon.com Inc. (Nasdaq: AMZN), Shutterfly Inc. (NASDAQ: SFLY), and Netflix Inc. (Nasdaq: NFLX) are almost exclusively online companies, but the remaining six are ones that still have what is considered a brick-and-mortar, physical free-standing buildings presence.

So, the next time you hear a so-called expert say retail is dead, just show them this list.

Even better, just take a breath, shut down the anxiety, and know that you are educated and trained to look past the headlines and be able to find opportunities where others simply can't.

If you still consider yourself a Toys R Us kid through and through, hold on to your memories of those wonderful times.

But as an options trader, know that there are always new opportunities on the horizon - even on the most expensive stocks in the market...

It All Starts Again on Monday at Noon

It’s the fastest way to make money we’ve ever seen.

And for anyone who is following along with Tom Gentile, these moves are paying off big time.

Just recently, Tom recommended a fast-moving pick that returned 100.79% total profits in just four days.

Now, the fast-moving action behind Tom’s all new way to make money starts again on Monday at noon.

Don’t miss your chance to learn how to grab extra cash faster than ever.

The post Two Reasons Why the "Toys 'R' Us Shutdown" is Good for Your Portfolio appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.