Today I'm going to give you access to a recommendation I released just hours ago to paid-up members of my specialized trading service, The Geiger Index.

I've never done this before, and frankly, I won't do it often, because it's not fair to subscribers who are paying thousands of dollars for my profit recommendations.

But this is too big not to share.

In fact, I don't think you're going to see another entry point like the one I'm about to share with you for years.

So let's cut to the chase with today's opportunity. It's hooked directly into one of the "Unstoppable Trends" we haven't talked about yet in my Total Wealth publication, and it involves a tactic that's ideal for market conditions right now. So I want to make sure you know how to use it.

Stock of the Day: How to Play Halliburton (NYSE: HAL)

Oil prices got smashed to three-year lows Tuesday following a Saudi price cut that traders believe paves the way for even lower prices in the months ahead. Not surprisingly, many great companies related to energy have gotten slammed in a classic "guilt by association" move.

For millions of investors, this is a watershed moment. They pay huge amounts of lip service to wanting a correction, yet now that it's happening, they are completely panicked. Many can't take their fingers off the sell button.

I say you use that to our advantage and make a move to pick up one of the energy industry's strongest players - Halliburton Co. (NYSE: HAL), which was off a whopping -5.99% Tuesday alone.

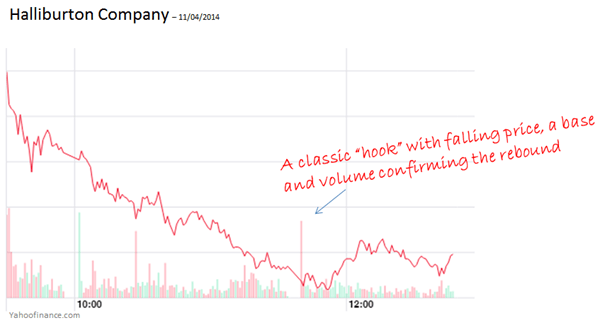

Right now there's a classic "hook pattern" forming, which you can see quite clearly in this chart from YahooFinance.com highlighting Tuesday's trading action. All three elements - falling price, a horizontal base, and a large volume bar - are there, confirming that this is an ideal entry point.

If you're not familiar with the term, a "hook" is a pattern formed when institutional traders squeeze the weak money out of a trade and proceed to take it in the opposite direction after doing so; in this case that's up.

Hooks are time-insensitive so they can play out in minutes, hours, or even days. You'll know a hook when you see an extended price movement in one direction that is accompanied by a dramatically higher bar at or near the bottom that signals capitulation. That, in turn, is followed by a period of digestion or accumulation before prices reverse.

So here's what to do...

Action to Take: Enter a lowball order to buy Halliburton Co. (NYSE: HAL) at $44.50 or less. [Note: If that's a new tactic for you, please read the sidebar to the right for a play-by-play.]

If you are able to scoop up shares of HAL at $44.50 or less, I'd recommend a protective stop at $33.75, which represents a 32.9% margin of safety (based on the current price) - and a price HAL hasn't traded down to since Dec. 31, 2012.

And, now, the bigger picture on this trade.

Despite a lot of talk to the contrary, oil is not going anywhere soon. There are still trillions of dollars being spent in an effort to keep the planet moving. That's why energy is one of our six unstoppable global trends.

Worldwide demand will increase by 31% to 119.4 million barrels a day by 2040, according to the EIA's International Energy Outlook 2014, with the lion's share of that coming from Asia, which is largely price-insensitive given government subsidies there. So the short-term price war the Saudis are kicking off is really only to their detriment (and our benefit because of the opportunities it's creating).

Halliburton has met or exceeded analyst estimates for the past nine straight quarters, so we're hardly going with a fly-by-night operation here. I think the company is exceptionally well positioned to move sharply higher a year from now, even if oil remains cheap.

Speaking of which, Goldman Sachs just issued a report that every drop in price per barrel of $1 below the company's "$84 baseline" may translate into a rise in 2015 EPS increases of about $1 a share for the average S&P 500 company. By 2016, Goldman sees that EPS increase jump all the way to $4!

So there are plenty of broader implications to be had, not the least of which is that still further declines will be great for your other investments, too.

And, finally, despite all the teeth-gnashing, lower crude oil prices are going to quickly self-correct any supply imbalances the Saudis think they've got cornered. When that happens, Halliburton will be off to the races, because it is the industry's largest fracking services supplier - and it's fracking that will be more responsive to price movements when they happen.

Investors: Lowball orders are just one investing tactic you can use to help maximize profits, especially in times of market volatility - but there are even more tactics available to help grow your wealth. Keith's new and completely free-of-charge Total Wealth newsletter will teach you the simplest and most sure-fire investing strategies, plus the best risk-management steps you should take to protect your gains. And he'll introduce you to profit potential others don't yet see - or even understand. To get all of Keith's Total Wealth research and recommendations delivered twice weekly to your inbox - completely free - click here.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.