The price of oil has climbed sharply in the last month. As of April 17, futures of WTI oil were priced as high as $56.81. That's a gain of more than 29% from their $44.03 bottom from mid-March.

Investors trying to play rebounding prices have flooded into oil stocks in the last month. But this rush of buying has led to some highly overvalued oil stocks.

Right now, many oil stocks are trading at the same prices they were when oil was in the $80 to $90 range. Except oil is only trading north of $56 today.

Here's a look at three oil stocks that are seriously overvalued right now.

Overvalued Oil Stocks to Avoid Right Now

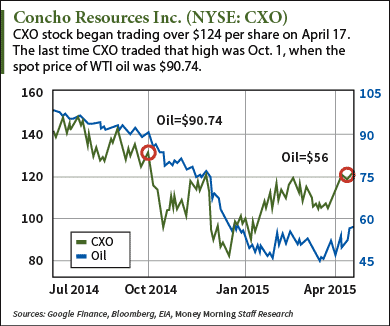

Overvalued Oil Stocks, No. 1: Concho Resources Inc. (NYSE: CXO) traded over $124 on April 17. In the last month alone, CXO stock has climbed 17.5%. But the last time CXO traded this high, oil was still over $90 per barrel.

The earnings outlook for CXO is bleak. Analysts expect CXO stock to post earnings per share (EPS) of $0.23 in Q1, compared to $1.01 last year. That's a drop of 77.2%.

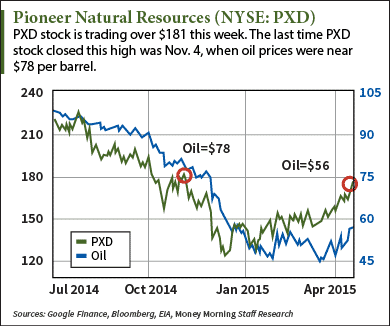

Overvalued Oil Stocks, No. 2: Pioneer Natural Resources (NYSE: PXD) traded over $181 this week. The last time it closed that high was in early November when oil was over $78 per barrel. Analysts expect PXD earnings will fall an incredible 92.9% in Q1 compared to last year.

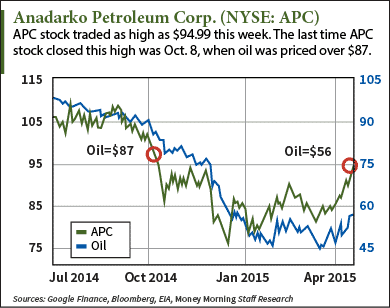

Overvalued Oil Stocks, No. 3: Anadarko Petroleum Corp. (NYSE: APC) traded at nearly $95 this week. Again, the last time it was that high oil was at $87. Last year, APC had Q1 earnings of $1.26. This quarter the company is expected to lose $0.59 per share.

What's Next for Oil Stocks

The broader oil market is still showing major signs of weakness. Production is slowing and hundreds of rigs are coming offline.

Baker Hughes Inc. (NYSE: BHI) reported in early April that the number of operation rigs in the U.S. had plummeted to 802. That was a 50% drop from the industry's high of 1,609 in October.

Last week, the U.S. Energy Information Administration (EIA) reported that production had fallen to 9.38 million barrels per day. That's down from a high of 9.42 million barrels a day from March.

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

We've also seen huge rounds of layoffs in the industry.

Today (Friday), Schlumberger Ltd. (NYSE: SLB) announced it will lay off 11,000 workers after earnings decreased 39% in Q1. The $120 billion oil services company has now cut 15% of its workforce in 2015.

That's not the only oil company with major layoffs. Apache has laid off 5,000 employees in 2015, while Baker Hughes has cut 9,000.

Even with all these warning signs in the oil sector, investors are still driving oil stocks higher as they chase the rising price of oil. But watch where you buy into the sector - many of these stock prices we're seeing are not justified.

A "Tool Shed" for This Source of Alternative Energy: There's a major energy breakthrough happening as you read this. A new device is being perfected - one that will resolve the storage problem for one particular alternative energy source. All thanks to this innovative company and the strides it's making. Now's your time to invest...