At least 60 million people tuned in to the second presidential debate yesterday.

But what I really want to see is what they do after.

That's because I've been watching a pattern that forms during election years, and it's driven one industry in particular to all-time highs 17 months in a row.

This pattern doesn't care about who's running or what their chances of winning are, either...

It only cares about the election itself - and how people are responding.

And with just 28 days left until Election Day, it's only getting stronger.

So now's your best time to profit.

Here's how...

It's Time to Buy Gun Stocks... and This Is Where You Start

It may come as no surprise to you that in most election years, gun sales soar. Take the 2008 election, for instance, where more guns were sold shortly following Obama's re-election than were sold over nearly the seven years prior.

And that momentum has only picked up...

In fact, gun sales have crushed every single monthly record this year, with September becoming the 17th consecutive month of record gun sales, which increased by 27%.

Don't Miss: This is your ticket to bigger and better returns... and it won't cost you a penny. What are you waiting for? Read more...

And this increase in sales of firearms and accessories helps ammunition and gun manufacturers, like Smith & Wesson Holding Corp. (Nasdaq: SWHC).

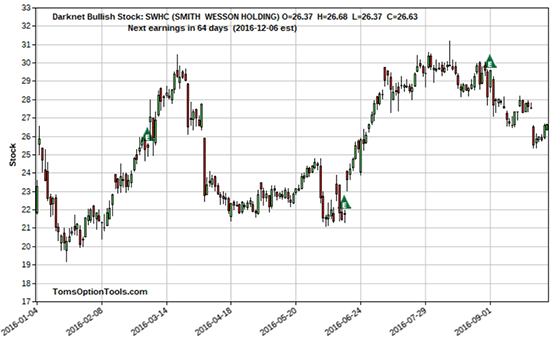

SWHC stock is up by about three points from its closing price from the first day of trading for the year. It's bounced higher by 10 points from its yearly lows in January before bouncing nine points from its secondary low between May and June.

Both times SWHC ran out of steam in the price area of $30.

SWHC reported earnings on Sept. 1, 2016, beating both earnings-per-share (EPS) and revenue expectations. It reported a $0.62 EPS (nearly 17% higher than consensus estimates), and its revenue grew 40.1% on year-over-year basis.

Now, the company's increased its 2017 EPS projections, from $2.38 to $2.48, and its revenue projections, from $900 million to $920 million.

And as you can see below, it looks like SWHC has been in a post-earnings retracement where traders are "selling the news."

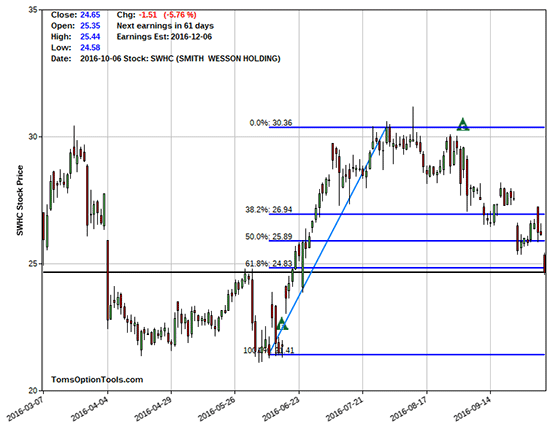

When looking at the Fibonacci retracements over this past month, all of the selling activity has brought it down to a level of 61.8%. As you saw two weeks ago, these levels act as support and resistance (in this case, we are looking for this to be a support area).

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

But even though SWHC took a small hit (5.20% loss) on Thursday after Wunderlich Securities Inc. downgraded the stock from a "Buy" to a "Hold," Smith & Wesson is still one of the largest gun manufacturers in the world and a more than well-established household name.

So I'm going to show you a trade idea that gives the stock time to regain its footing from the downgrade and move high enough to reap the pre- and post-election benefits from gun sales.

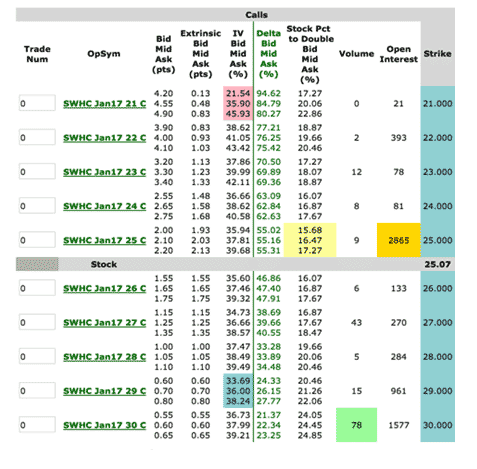

And the way I see it, call options with January 2017 expirations are the best way to take advantage of the surging gun sales we've already seen - and can expect to see after a new president has been elected.

Now, near-the-money options offer a decent spread... But if you really want to eliminate time risk, I suggest going for in-the-money (ITM) call options.

ITM options have a much wider spread because the options are further out in time and deeper in the money. So as time goes by, and as more trading activity ensures, the bid and ask spread should tighten up. Right now, the prices shown above are deemed the mid-prices of the current bid and ask spread.

Remember, you're eliminating time risk but adding price risk as you go deeper in the money with an option. I feel that ITM options have more real value and move more like the stock does.

Aside from the election, SWHC also posts earnings on Dec. 1. So you can anticipate the stock's implied volatility really spiking then. So this could further increase your potential for triple-digit gains.

This Is the Best "Retirement Stock" of 2016... And the good news is, it's trading for "pennies." But it won't be for long... its revenue is set to surge 4,709%. Learn the details of this $5 stock today while it's still "on sale." Read more...

Follow Money Morning on Facebook and Twitter.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.