Entrepreneurs are always looking for an edge - anything that can make them smarter, nimbler... and better.

In Silicon Valley, hardware manufacturers for decades have sought that "edge" in a high-tech axiom known as Moore's law.

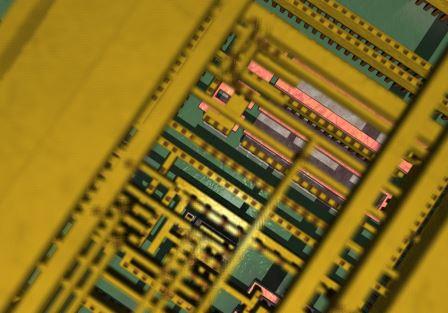

This rule of thumb, proposed way back in the 1960s by Intel Corp. cofounder Gordon E. Moore, tells us that computing power doubles every two years or so. The reason is simple: As technical know-how and production methods get better and better, the number of transistors on integrated circuits doubles during that same two-year time frame.

That "law" puts one particular group of companies - semiconductor-equipment firms - in a very powerful position. And one specific company - Applied Materials Inc. (Nasdaq: AMAT) - just last week divulged an invention that's only going to add to its marketplace muscle.

This company is already a market leader, making it one of the best stocks to buy in the sector - and you won't find a better time to invest than now...

A Semiconductor Industry Surge

The semiconductor-equipment sector is very much a boom-and-bust cycle business.

And right now, it's booming.

The Semiconductor Industry Association (SIA) said worldwide sales of semiconductors reached $78.47 billion during the first quarter of 2014 - the highest ever total for the first three months of a year.

The Semiconductor Industry Association (SIA) said worldwide sales of semiconductors reached $78.47 billion during the first quarter of 2014 - the highest ever total for the first three months of a year.

There's a reason for that. Chips are literally all around us. You'll find them in LEDs, smartphones, Wi-Fi routers, tablets, gaming consoles, digital camcorders, and new cars and trucks.

And when chip sales zoom, chip-making companies start investing in new equipment.

In fact, that's already happening.

SEMI, the trade group representing the producers of chip-manufacturing gear, says equipment makers signed $1.28 billion in orders in March, for a book-to-bill ratio of 1.06. That represents a year-over-year increase of 16.1%.

And it's not just the increases in volume that have chip-making firms boosting their spending.

Remember, chips just keep getting smaller, too.

And that means the production methods get more and more complex.

Consider, for instance, the tiny copper wires that connect all the transistors housed atop a microchip: As components get smaller and smaller - as projected by Moore's law - those copper-wire connections become increasingly problematic.

Last week, Applied Materials Inc. - one of the leading designers and manufacturers of chip-making gear - unveiled a new way to make these connections. It's the first industry improvement in this part of the production process in 15 years. And it means companies using AMAT's chip-making equipment will get a sought-after "edge."

And that will bolster Applied's marketplace muscle.

Plus, AMAT has a big announcement coming up in June - which is why it's on our "stocks to buy now" list... Here's what's ahead.

Profit from Applied Materials' (Nasdaq: AMAT) Bold Moves

With 45 years of experience in the field, the Santa Clara, Calif.-based Applied has risen through the industry's booms and busts - and endured a few of its own making, too.

In fact, the company has been surprisingly slow to benefit from the semiconductor boom over the last couple of years.

But that's quickly changing - a fact that should serve as a timely catalyst for investors moving into the stock now.

Besides getting a boost from the escalating demand for semiconductor sales in general, Applied is benefiting from a huge increase in customer interest for its chip-making equipment.

And some of this new customer interest is being driven by the company's renewed commitment to innovation. One example is the solution to the copper-wire problem I mentioned a moment ago - an innovation the company has dubbed the Applied Endura Volta CVD Cobalt system.

The company recently made two decisive moves aimed at capitalizing on the big surge in semi sales. The first occurred last August when the firm named Gary E. Dickerson as chief executive officer (CEO). Dickerson previously served as CEO of Varian Semiconductor Equipment Associates Inc., which Applied picked up in 2011.

Dickerson has a deep background in tech, including 30 years in semiconductors. Before joining Varian in 2004, he spent 18 years at KLA-Tencor Corp. (Nasdaq: KLAC), which performs quality inspections for chip firms. He started at the Delco Electronics Division at General Motors Co. (NYSE: GM) and also served at AT&T Inc. (NYSE: T).

Dickerson wasted no time setting Applied Materials up for a major expansion drive. Last September, he announced one of the largest semiconductor equipment mergers ever: Applied Materials agreed to buy industry rival Tokyo Electron Ltd. (OTCMKTS: TOELY) in a stock transaction worth $9.39 billion.

I see this as a critical marriage that will be of enormous benefit to Applied Materials.

The linkup removes a competitor. And it gives AMAT more negotiating power with clients, a process that should help improve profit margins. Both companies said the deal will result in positive cash flow in the first full fiscal year the two are combined.

Beyond the obvious fit on paper, there is another aspect that bodes well for the success of this merger. Because Dickerson has been friends with Tokyo Electron CEO Tetsuro Higashi for 30 years, the rough spots that often afflict post-deal transitions should be lessened.

Applied Materials also announced it will buy back roughly $3 billion in stock within a year of the merger's completion. We should get a good idea of when that will occur on June 23, when AMAT is scheduled to hold a special shareholders' meeting to finalize the deal.

In fact, we expect to find out a lot more about Applied's growth strategies as a result of that meeting. So, we're recommending that you make your move beforehand.

In the meantime, the company is benefitting from the bolstered demand for its products being created by such new markets as flat-panel displays and solar power. It doesn't break out those sales, but both are long-term growth sectors that will bring in additional revenue.

Its renewed commitment to growth is resulting in surging sales and profits. Applied reported blowout numbers when it announced its results for the fiscal second quarter ended April 27.

Net sales came in at $2.35 billion, up 19% from the year-ago period, as operating income soared 69% to $482 million. Non-GAAP earnings per share came in at $0.28 - a jump of 75% on a year-over-year basis.

Trading at roughly $20 a share, AMAT has a premerger market cap of roughly $24 billion. It trades at roughly 15 times forward earnings, about a 20% discount from the Nasdaq 100's forward price/earnings (P/E) ratio.

Clearly, what we have here is a storied leader that has been slumbering. But with new management, the Tokyo Electron merger, and the renewed commitment to innovation as demonstrated by the cobalt technology announcement, Applied Materials represents a unique "special-situation" profit play.

If the company can maintain just one-third of its recent profit-growth rate of 75%, earnings would double in less than three years.

And the stock price would advance at about the same rate.

This is an aggressive forecast, but one that can be achieved. AMAT is benefiting from a global semiconductor boom as it announces new technologies and lowers overhead as a result of the Tokyo Electron merger.

And for this company on our "stocks to buy" list, it means our recommendation couldn't be better timed.

More from Michael Robinson: Many investors believe that with our presence in Iraq largely gone, defense tech firms will offer mediocre returns at best. But they couldn't be more wrong. This defense tech play is scorching the market...

About the Author

Michael A. Robinson is a 36-year Silicon Valley veteran and one of the top tech and biotech financial analysts working today. That's because, as a consultant, senior adviser, and board member for Silicon Valley venture capital firms, Michael enjoys privileged access to pioneering CEOs, scientists, and high-profile players. And he brings this entire world of Silicon Valley "insiders" right to you...

- He was one of five people involved in early meetings for the $160 billion "cloud" computing phenomenon.

- He was there as Lee Iacocca and Roger Smith, the CEOs of Chrysler and GM, led the robotics revolution that saved the U.S. automotive industry.

- As cyber-security was becoming a focus of national security, Michael was with Dave DeWalt, the CEO of McAfee, right before Intel acquired his company for $7.8 billion.

This all means the entire world is constantly seeking Michael's insight.

In addition to being a regular guest and panelist on CNBC and Fox Business, he is also a Pulitzer Prize-nominated writer and reporter. His first book Overdrawn: The Bailout of American Savings warned people about the coming financial collapse - years before the word "bailout" became a household word.

Silicon Valley defense publications vie for his analysis. He's worked for Defense Media Network and Signal Magazine, as well as The New York Times, American Enterprise, and The Wall Street Journal.

And even with decades of experience, Michael believes there has never been a moment in time quite like this.

Right now, medical breakthroughs that once took years to develop are moving at a record speed. And that means we are going to see highly lucrative biotech investment opportunities come in fast and furious.

To help you navigate the historic opportunity in biotech, Michael launched the Bio-Tech Profit Alliance.

His other publications include: Strategic Tech Investor, The Nova-X Report, Bio-Technology Profit Alliance and Nexus-9 Network.