The Alibaba IPO is the biggest name on the 2014 IPO market, because it will easily raise the most money of any initial public offering this year.

The second-largest IPO - Synchrony Financial (NYSE: SYF), hitting the market this week - is expected to raise $3.1 billion. Alibaba could raise more than $20 billion.

The second-largest IPO - Synchrony Financial (NYSE: SYF), hitting the market this week - is expected to raise $3.1 billion. Alibaba could raise more than $20 billion.

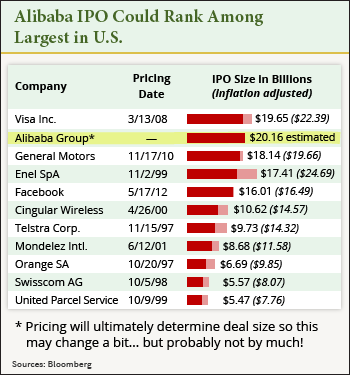

With a price tag that high, Alibaba will be more than just the "IPO of the year." The Alibaba IPO could be the biggest initial public offering in U.S. history.

While we don't have an exact date yet for the IPO, we do know Alibaba stock will begin trading within the next several months. In preparation, we've answered the most frequently asked questions from investors regarding this massive IPO.

Alibaba IPO Frequently Asked Questions

No. 1: When is the Alibaba IPO date? No specific date has been set, but according to reports, Alibaba will be waiting until after Sept. 1 to hold its IPO. Sources cited by The Wall Street Journal claimed Alibaba views September as a busier month for IPOs instead of August. Initially, rumors had placed the Alibaba IPO for some time in early August, but delays are common when it comes to IPOs of this size.

No. 2: How big will the Alibaba IPO be? While estimates are varied on the final IPO price for Alibaba, many analysts expect the Chinese e-commerce giant to raise more than $20 billion. That would make it the largest U.S. IPO ever, surpassing the $19.65 billion Visa Inc. (NYSE: V) raised in 2008. Even the more conservative projections expect Alibaba to raise more than the $16 billion raised by Facebook Inc. (Nasdaq: FB) in 2012, making it the largest Internet IPO in history.

No. 3: How much is Alibaba worth? Estimates of Alibaba's value have fluctuated, but a recent survey of five analysts from Bloomberg has Alibaba pegged as a $154 billion company at the time of its IPO. That would make Alibaba No. 27 of more 1,800 companies on the NYSE in terms of market cap.

While that $154 billion valuation is one estimate, other projections have ranged much higher. An April poll by Bloomberg had that figure at $168 billion. Piper Jaffray analyst Gene Munster has projected that the Chinese e-commerce giant could be worth $221 billion, including cash. Financial research company Sanford C. Bernstein has set the bar the highest with a $230 billion estimate.

Money Morning members, continue reading for the answers to seven more frequently asked questions:

No. 4: Who are the underwriters on the deal? The underwriters on the Alibaba IPO are Citigroup Inc. (NYSE: C), Credit Suisse (NYSE ADR: CS), Deutsche Bank AG (NYSE: DB), Goldman Sachs Group Inc. (NYSE: GS), JPMorgan Chase & Co. (NYSE: JPM), and Morgan Stanley (NYSE: MS).

No. 5: Where can I buy shares of Alibaba? In order to buy shares of Alibaba before the IPO, you'll need to be a client of one of the underwriting companies that will be selling shares. However, this can be a difficult proposition, as Money Morning's Defense and Tech Specialist Michael Robinson has said.

"As I often tell people, because Wall Street tends to reserve the hottest issues for its 'best' customers - folks I often describe as the 'ultimate insiders' of the U.S. financial markets - IPO deals can be tough for retail investors to get into," Robinson said.

Therefore, many retail investors will have to wait until after shares are issued to buy Alibaba stock...

No. 6: Where will Alibaba stock trade? In late June, Alibaba officials announced that its shares will trade on the New York Stock Exchange under the ticker "BABA." Both the Nasdaq and the NYSE had competed for the mega-IPO, but eventually the NYSE won out.

No. 7: Do any ETFs own Alibaba stock? Since Alibaba shares are not public yet, no ETFs or funds currently own a position in Alibaba. But there is an ETF that is poised to buy a position in Alibaba, the Kraneshares Trust (Nasdaq: KWEB).

KraneShares has 30 Chinese Internet companies in its portfolio. These companies deal with everything from social media and gaming, to e-commerce, to real estate Internet portals. KWEB owns numerous companies similar to Alibaba, like Tencent Holdings (OTCMKTS ADR: TCEHY), Baidu Inc. (Nasdaq ADR: BIDU>), and NetEase Inc. (Nasdaq ADR: NTES).

No. 8: Who is getting rich from the Alibaba IPO? Those who have been following the deal know that Yahoo Inc. (Nasdaq: YHOO) owns a minority stake in Alibaba. Through the IPO, Yahoo will be selling 140 million shares. According to The Wall Street Journal, analysts have been expecting Yahoo to receive approximately $10 billion from selling its shares in Alibaba.

Additionally, each of the underwriters of the deal will be getting a solid payday. The six firms will be splitting approximately $400 million in underwriting fees, giving each company a sum of about $66 million.

Finally, Chairman Jack Ma, who owns about 8.9% of Alibaba, and Executive Vice-Chairman Joseph Tsai, who owns 3.6% of the company, are in line to become billionaires.

But that's not all; here's how Alibaba employees will be cashing in on the deal as well...

No. 9: Who is Jack Ma? He's the founder and current chairman of China's largest e-commerce firm, but he had humble beginnings. Formerly a teacher, Ma had no computing or e-commerce experience. But the lack of experience didn't hold him back

"Innovation in many industries has been triggered by outsiders," Ma wrote in a June 2013 article in the Communist party's official newspaper the People's Daily. "The finance industry needs a disrupter, it needs an outsider to come in and carry out a transformation."

Find out more about the man who is the public face of Alibaba.

No. 10: Is there a way to profit from the Alibaba IPO today? Yes, you can profit now. The best news about this looming IPO is that it has created a major profit opportunity that most investors haven't yet noticed... It's happening now, months before Alibaba hits the market...

In fact, this could be your one and only chance to make the kind of gains normally reserved for the high-net-worth investors and bankers. And there are three ways to play. You can learn more about this Alibaba profit opportunity here.

Join the conversation on Twitter @moneymorning and @KyleAndersonMM using #Alibaba