Gold prices will go up, and for the most basic of reasons: supply and demand.

Yet that isn't a factor you hear much about in the financial media. When most pundits talk about what moves gold prices, they usually focus on international turmoil, the direction of the global economy, and the bad habits of central banks.

So most of them have completely missed a trend that will push gold prices to $2,500 and beyond over the next few years.

In short, we're running out of gold.

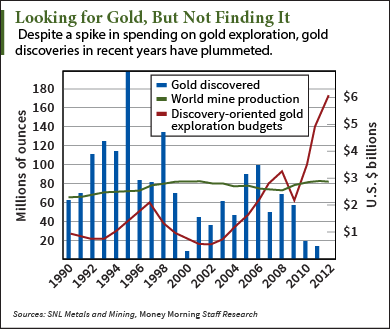

Take a look at this chart. It shows the amount of gold discovered each year (the bars), the price of gold, and worldwide gold mine production.

Take a look at this chart. It shows the amount of gold discovered each year (the bars), the price of gold, and worldwide gold mine production.

The blue bars show how the amount of gold discovered has fallen sharply since 2009, and it's not a one-year anomaly.

Nor is it for lack of trying. In fact, gold exploration budgets soared to record heights along with gold prices from 2009 to 2012. And still the gold miners made fewer and fewer discoveries. (Yet the mine production amount has remained steady - more on that later).

"A lot of the low-hanging fruit - deposits that are easier to find - have been picked," said Money Morning Resource Specialist Peter Krauth, a 20-year commodity guru and portfolio advisor. "Companies looking for gold have to go farther, drill even deeper, and look in places that are increasingly geopolitically challenged."

But it gets worse.

Lower Gold Prices Mean Less Money for Exploration

After gold prices fell in 2013, so did exploration budgets. The junior miners, which find the majority of new gold deposits, slashed exploration spending by 40% last year. Exploration spending for this year is expected to drop another 20%.

Even if gold discoveries returned to the historic average - which is extremely unlikely - it wouldn't make much difference.

Even if gold discoveries returned to the historic average - which is extremely unlikely - it wouldn't make much difference.

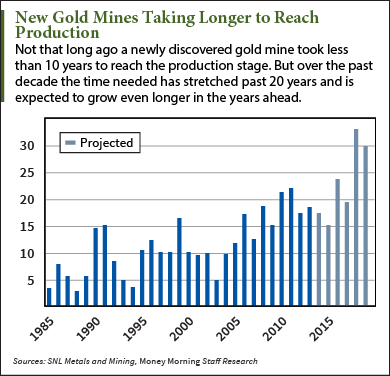

That's because the time to turn a gold deposit discovery into a productive mine keeps stretching - to as much as three times as long.

In 1995 it took about 10 years to go from discovery to production. By 2010, that had doubled to about 20 years. Some discoveries made later this decade could take as long as 30 years to get into production.

With discoveries on the wane and new mines taking longer to go into production, research firm SNL Metals and Mining estimates that global gold production will eventually be cut in half.

But what about that steady green line on the chart that shows consistent production?

That's actually part of the problem...

Gold Miners Borrow from Their Future

Over the past few years, gold miners have managed to maintain production levels despite the lack of new discoveries. In part, they're reaping benefits from investments made when gold prices were peaking.

But what they're doing isn't sustainable. It has to do with how they're processing what they mine.

"The gold miners are choosing to 'high-grade' their ore," Krauth explained. "That means they're digging up and processing the ore that contains the most gold per ton, rather than depleting the deposit more evenly."

By doing this, the miners can make a profit even as gold prices fall.

"Processing the same quantity of higher grade rock means lower costs and higher output," said Krauth. "But the piper will eventually have to be paid."

As the high-grade ore runs out, gold mining will get more expensive. That means miners that were still profitable with gold at $1,100 an ounce, or even $1,000, will soon need gold prices of at least $1,400. Otherwise, they'll be operating at a loss.

And the scarcity of new mines will add to the problem.

Welcome to the Era of Peak Gold

"What lies ahead, especially as deposits become increasingly depleted, and the lack of replacement discoveries worsens? Peak gold, that's what. We're quickly approaching that precarious state of peak production after which output will begin to decline," Krauth said.

That means supply will fall. Meanwhile, demand is likely to remain relatively steady.

Jewelry accounts for more than half of gold demand and has been on the rise long term. Central banks have made up 12% of demand and industrial uses account for about 10%.

Gold prices could well fall in the short term to the $1,000 level many predict, but in 2015 the trend will reverse. By 2016 gold prices will be in the $1,300 to $1,400 range.

And higher gold prices will beget even higher prices.

"For the miners, soaring gold prices will start to fatten the bottom line, and that will attract a lot of investors," Krauth said. "They will scramble to boost production, but that will only deplete reserves faster."

As the forces of supply and demand accelerate, gold prices will push relentlessly higher. By 2020 - if not sooner - gold prices will hit $2,500. And they could easily shoot past that target.

With lower gold prices expected in the short term, and much higher prices in the years ahead, investing in gold is the very definition of the classic mantra, "buy low, sell high."

How to Buy Gold: So you've decided you want to invest in gold. But where to start? There are a lot of options for investing in gold, from physical gold to stocks and ETFs. Here Peter Krauth goes over the pros and cons of all the options...

Follow me on Twitter @DavidGZeiler.

Related Articles:

- Mining.com: Fewer Discoveries, Slower Development Weigh on Gold Industry

- SNL Metals and Mining: Major Gold Discoveries Failing to Replace Production

- Mining.com: Gold's Fundamental Supply Picture

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.