Money Morning's "unloved" pick of the week is defense contractor Kratos Defense & Security Solutions Inc. (Nasdaq: KTOS).

An unloved investment is one that's been beaten down - but is actually a great value. Investors then get an amazing entry point into a good long-term investment.

We've liked Kratos for a long time. Money Morning Defense & Tech Specialist Michael A. Robinson first recommended Kratos stock in June 2013. More recently, Money Morning Chief Investment Strategist Keith Fitz-Gerald named KTOS as one of his favorite picks for 2015.

Kratos Defense & Security Solutions (Nasdaq: KTOS): About the Company

Kratos Defense & Security Solutions traces its roots to a company called Wireless Facilities Inc. WFI was founded in San Diego in 1994 as a telecommunications firm. After a series of acquisitions from 2004 to 2009, the company changed its name to Kratos Defense & Security Solutions. Kratos merged with Integral Systems in 2011. Today Kratos provides services in the areas of communications, combat systems, and surveillance. Among its specialties are drone warfare and cybersecurity. The firm has a market cap of about $294 million. Kratos employs about 3,900 people.

Kratos Defense & Security Solutions traces its roots to a company called Wireless Facilities Inc. WFI was founded in San Diego in 1994 as a telecommunications firm. After a series of acquisitions from 2004 to 2009, the company changed its name to Kratos Defense & Security Solutions. Kratos merged with Integral Systems in 2011. Today Kratos provides services in the areas of communications, combat systems, and surveillance. Among its specialties are drone warfare and cybersecurity. The firm has a market cap of about $294 million. Kratos employs about 3,900 people.

Kratos (Nasdaq: KTOS) Stock: Why It's Unloved

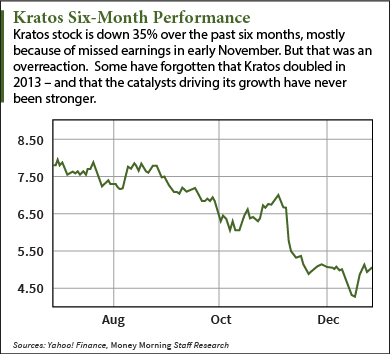

After a big run-up in 2013, KTOS stock had leveled off this year -- until recently. On Nov. 3 Kratos reported a loss of $0.19 a share. Excluding one-time costs, Kratos still missed expectations of $0.13 by reporting EPS of $0.10. Revenue also missed, coming in at $217.1 million versus a forecast for $244.4 million. Then, when the overall market dipped in December, it took Kratos stock to a 52-week low of $4.21. That was a more than 53% drop from the June 9 peak of $9.08. Even with a recent bounce to $5.12, KTOS is down more than 43% from its peak.

After a big run-up in 2013, KTOS stock had leveled off this year -- until recently. On Nov. 3 Kratos reported a loss of $0.19 a share. Excluding one-time costs, Kratos still missed expectations of $0.13 by reporting EPS of $0.10. Revenue also missed, coming in at $217.1 million versus a forecast for $244.4 million. Then, when the overall market dipped in December, it took Kratos stock to a 52-week low of $4.21. That was a more than 53% drop from the June 9 peak of $9.08. Even with a recent bounce to $5.12, KTOS is down more than 43% from its peak.

But here's why Fitz-Gerald thinks KTOS will be sitting at $10 this time next year...

Kratos (Nasdaq: KTOS) Stock: Why It's a Buy

Fitz-Gerald sees a lot to like with Kratos stock. He said the earnings miss was "totally not their fault" and has left KTOS seriously underpriced. "These guys are really in tune with how wars are being fought today," he said. "They're remote access, they're standoff support - and this company specializes in that sort of systems provision." Fitz-Gerald also likes how Kratos procures new business. Instead of a handful of mega-contracts that can spell disaster when they end, KTOS wins a lot of smaller contracts. Most of its deals with the government fall in the $1.4 million to $15 million range. And as of the most recent quarter, Kratos has a contract backlog of $1 billion. That's the equivalent of a full year of revenue.

Better still, Kratos focuses on areas in which it is the dominant provider, such as drone and targeting systems, avionics, and satellite communications and control. "I like that. It means management has a clear vision of what they do and where they want to take the company," Fitz-Gerald said. "I'm also particularly keen on the fact that management goes to great lengths to diversify its business mix and wants to compete only where they have a distinct advantage." The low-dollar contracts means Kratos projects are less likely to get chopped in a Washington budget fight. That most are also "critical needs" projects adds another layer of insurance. Better still, Kratos has diversified its customer base beyond the Department of Defense. That reduces risk and increases opportunities for growth. Finally, Kratos is a prime takeover target.

Investing in Kratos Stock (Nasdaq: KTOS)

The recent rebound in KTOS created the hook pattern that typically means a stock has bottomed. Unless the overall market sinks, Kratos stock is unlikely to see another prolonged pullback. In fact, it will probably pop in January as fund managers start hunting for bargains. So Fitz-Gerald advises investors to "buy KTOS at market and set a 25% trailing stop to protect your capital and harvest gains along the way." The consensus one-year price target is $9.10, but Fitz-Gerald thinks it will reach $10. That's almost double the current price.

Last Week's "Unloved" Pick: The plunge in oil prices has dragged down a lot of quality energy companies. Apache Corp. (NYSE: APA) is a solid company that deserves better treatment from Wall Street. This is why Apache has plenty of upside...

Follow me on Twitter @DavidGZeiler.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.