The pharmaceutical industry saw record-setting M&A activity in the first quarter of 2015.

According to PricewaterhouseCoopers, the "life sciences" field had 35 deals in Q1 2015. The life sciences industry is made up of pharmaceuticals, medical devices, biotech, diagnostics, and contract-research organizations.

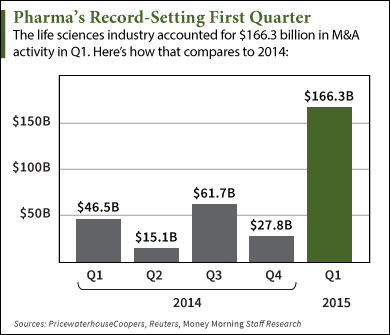

Those deals totaled $166.3 billion. That's more money than was spent during all of 2014, which saw M&A activity total $150.1 billion. In Q1 2014, just $46.5 billion was spent.

Those deals totaled $166.3 billion. That's more money than was spent during all of 2014, which saw M&A activity total $150.1 billion. In Q1 2014, just $46.5 billion was spent.

Some major deals have contributed to that record-breaking total. In March, AbbVie Inc. (NYSE: ABBV) announced the purchase of Pharmacyclics Inc. (Nasdaq: PCYC) for $21 billion. Shire Plc. (Nasdaq: SHPG) purchased NPS Pharmaceuticals Inc. (Nasdaq: NPSP) for $5.1 billion.

And the pharmaceutical industry's big spending will continue...

Top pharma companies go on the hunt for smaller firms when their older patents are about to expire. Instead of developing their own drugs - which can take up to 10 years and $1 billion - they buy other companies with new drugs.

Plus, the pharma industry is rich.

"Big pharmaceutical companies are sitting on phenomenal piles of cash," Barclays' Head of European Healthcare Investment Banking Will Thompson told Bloomberg in April. "They will be forced to look at M&A amid the current biotech exuberance."

Money Morning's Defense and Tech Specialist Michael Robinson has been recommending a way to profit from the M&A boom throughout 2015.

He told readers in February the pharmaceutical industry M&A market would continue to soar. Wall Street pundits claimed the market was dead - but Robinson knew that wasn't the case.

His pick to profit from this trend has already climbed 12% in 2015, compared to just 2% for the Dow Jones. Here's why it will continue bringing profits in 2015...

Our Pharmaceutical Industry Profit Play

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]Robinson recommends the SPDR S&P Pharmaceuticals (NYSE: XPH) ETF. It's composed of big pharmaceutical companies and several aggressive small caps.

"XPH is not an M&A fund - but it's a great way to take advantage of the trend," Robinson said. "This ETF focuses on the industry's bread and butter: high earnings."

The ETF has 39 holdings, and the average market cap is $37 billion. Major holdings include:

- Actavis Plc. (NYSE: ACT) - a global specialty drug firm that makes generic and branded compounds. It has more than 1,000 products, including both prescription and over-the-counter drugs. In November, it purchased the Botox-maker Allergan Inc. (NYSE: AGN) for $66 billion.

- Jazz Pharmaceuticals Plc. (Nasdaq: JAZZ) - an international biopharma company that's best known for Xyrem, a drug that treats sleeping disorders. JAZZ has either licensed or acquired outright six major drugs in 11 years.

- Eli Lilly and Co. (NYSE: LLY) is one of the best-known firms in pharmaceuticals. It made the move into animal pharmaceuticals after 2014's $5.4 billion acquisition of the animal health division from Novartis AG (NYSE ADR: NVS).

"XPH is more than just a great way to cash in on the steady stream of biotechnology and pharmaceutical M&A activity," Robinson continued. "This is an ETF that, at its heart, is focused on biopharma firms' ongoing high earnings growth."

In the last 12 months, XHP has climbed nearly 29%. That's more than three times the returns of the Dow Jones, which has climbed 9.5% in that time. In the last five year, XPH has gained 202%.

"The beauty of a play like this one is that rather than try to pick a single winner, we get the benefit of the entire sector's operations," Robinson said. "That makes XPH an excellent foundational investment to pave your road to wealth."

Follow me on Twitter: @KyleAndersonMM

Make a 100% Gain on the World's Most Valuable Company: Money Morning's Tom Gentile has found one small move that can help you make a 100% profit on a popular stock, all within the next 27 days. Here's how you can find out the step-by-step process to doubling your money...