Sometimes a big trend isn't little enough - what I mean by that is that a big trend may not be as focused as you'd like. To really refine your profit potential, you've got to hone in on a sub-trend.

We're going to talk about that today and, specifically, how recent trading conditions have created an opening that most people don't see in a restaurant sector sub-trend driving one of the most powerful of our Unstoppable Trends - Demographics.

That sounds like a tall order, but it's not too hard if you know what to look for.

The last time I brought one of these sub-trends to your attention, Total Wealth readers who followed along had the opportunity to capture returns of 120.40% in less than nine months.

The opportunity I want to share with you right now could do even better... and even faster.

The key is something called "fast-casual" dining.

This Sub-Trend Has Already Created Millionaires - It's Your Turn

Let me set the stage.

Team Yellen insists that there's a recovery underway, and the Fed highlights falling unemployment and steadily increasing economic growth as a declaration that they're doing their job.

You and I both know that's not true for reasons we've talked about many times.

Case in point, a tight labor market would be characterized by higher wages and rising prices. Yet, wages are flat to falling, median household wealth continues to decline, and the percentage of working-age Americans with jobs is still below pre-recession levels. The most damning data of all, underemployment - meaning people who want to work full time but who are forced to work part time - is still near record highs.

Not surprisingly, the Congressional Budget Office continues to lower growth projections, most recently dropping annual U.S. growth projections to just 2.0% in an August update to the Budget and Economic Outlook 2015 to 2025.

Not surprisingly, the Congressional Budget Office continues to lower growth projections, most recently dropping annual U.S. growth projections to just 2.0% in an August update to the Budget and Economic Outlook 2015 to 2025.

Now, here's where it gets interesting.

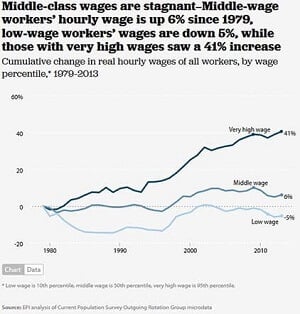

If you really pull apart the wage data, you see a very clear dividing line between high-wage, middle-wage, and low-wage jobs.

What this tells me is that the nature of spending has changed and will continue to change, especially when it comes to how Americans like to reward themselves, because that's where the bulk of discretionary spending occurs, especially when it comes to eating out.

It used to be that Americans went to fancy restaurants all the time. High-end joints were all the rage for birthdays, anniversaries, parties, and much more. But now with wages crimped, that's changed.

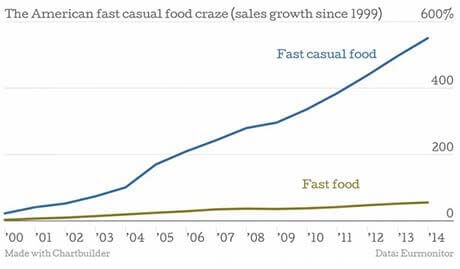

Americans still go out to eat, just not to white tablecloth restaurants like they used to. Instead, they've turned to something called "fast-casual" dining. Think Chipotle Inc. (NYSE: CMG), Panera Bread Co. (Nasdaq: PNRA), and even Shake Shack Inc. (NYSE: SHAK) here. Not Morton's.

They're still cheap, casual dining environments. But they're a step up from fast food, and the change has been so pronounced that it's left that industry in the dust.

It's a fundamental change in America's $709 billion restaurant sector, and I want you to be ready to capture the next leg up.

Analysts Have Given You Another Fabulous Entry Point

One of the most compelling - albeit highly speculative - plays right now in fast-casual dining is Dunkin' Brands Group Inc. (Nasdaq: DNKN).

I know that the company may seem like an odd choice given that it's being torn apart by the investing public right now in the media. But hear me out.

First, the stock got trashed last Thursday, falling more than 12% by the end of trading. The cause? Dunkin' Donuts saw its Q3 2015 same-store sales rise 1.1%, but traders punished it merely because analysts had expected 2.6%.

That alone screams opportunity. The headlines should have read, "Analysts Got It Wrong, Again."

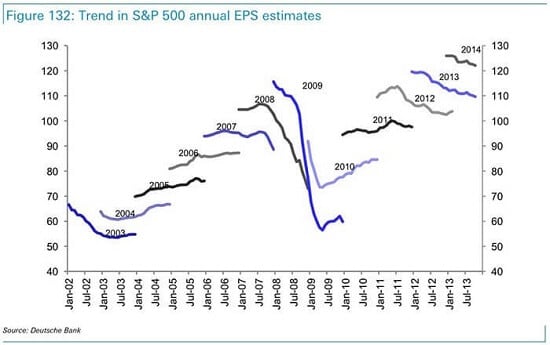

We've talked before about how nonsensical it is for investors to define success or failure by what analysts think. They're conflicted, they're frequently talking up their own book, and they're often totally unqualified to run a business, let alone analyze the sectors they're charged with.

Worse, traditional Wall Street analysts as a whole tend to underestimate earnings after sharp corrections but consistently overestimate earnings potential as markets mature. You can see that quite clearly in this chart from Deutsche Bank.

You'll recall that we saw a similar situation with Chipotle last April, when the stock tanked more than 7% after the company reported same-store sales growth of "only" 10.4%, in contrast to the 11.8% analysts were predicting.

The situation was so ludicrous to me I even devised a play for Total Wealth readers that was based on it, urging you to make analysts your secret weapon by acting on the entry point in Chipotle they unwittingly created.

Anyone who followed along had the opportunity to capture gains of 16.59% since April 29 - no small feat in today's markets. The S&P 500 has dropped by -7.75% in comparison.

After Thursday's sell-off, Dunkin' Donuts sports a price/earnings (PE) ratio of just 25, which is barely half of Chipotle's. That's important considering that the company is one of the largest coffee and baked goods operators worldwide, with more than 11,000 units in operation, according to National Restaurant News, and a planned 6,000 on the board.

I'm particularly excited about the company's view on China. Dunkin' opened its first restaurant in Shanghai in 2008, had about 50 locations by 2014, and now has plans for another 1,400 stores in China over the next 20 years.

The situation reminds me of how Dunkin' entered South Korea, which now accounts for 40% of the company's international sales and 900 locations.

Factor in DNKN's conscientious efforts to become more like Starbucks both in terms of the products and the ambiance it creates, and I believe management has a very clear understanding of what's needed to succeed when it comes to the fast-casual dining segment.

Factor in DNKN's conscientious efforts to become more like Starbucks both in terms of the products and the ambiance it creates, and I believe management has a very clear understanding of what's needed to succeed when it comes to the fast-casual dining segment.

By the way, the next time you're in South Korea, check out the newly introduced 1945 Legend White Creamy. And let me know how you like it.

Follow us on Twitter @moneymorning.

Editor's Note: Fast-casual stars like Chipotle have returned up to 2,000% over the last decade as they conquer this growing sub-trend - but Keith has found a company he believes will post these gains even sooner. This small-cap robotics company is making aggressive moves to corner the Human Augmentation Trend, and it's growing so fast Keith foresees exponential growth in store for the stock over the next few years. For a full and free report on Keith's calculations for the company that could dominate the Human Augmentation Trend, click here to sign up for Total Wealth - it's free!

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.