One of the most challenging aspects of options trading is timing.

Whenever you turn on the TV, you see a different expert telling you that it's impossible to time the market. Or you see another giving you THE fail-proof strategy for timing the market perfectly.

This leaves retail investors and traders scrambling to buy their stocks at the absolute lowest prices (the bottom) or sell their stocks at the absolute highest prices (the top).

And they usually fail.

Now, I'm not saying that you can't buy stock at the lowest price or sell it at the highest price...

But if anyone tells you they caught the absolute top or bottom in a stock, that person is lying to you.

So how do you know when to jump in and out of your trades?

Today's lesson will show you exactly when to jump in or jump out of the market... when a stock is going to turn from its current high or current low point... and how to profit handsomely.

This is the best way to time your trades...

To make money trading options, you need to know when a stock's price is going to turn, or pivot, and you need to understand stochastics.

This may sound challenging, but I'm going to tell you everything you need to know.

Let's get started.

The Pivot Point Tells You Which Direction a Stock Will Turn

The pivot point is used for determining the overall trend of the market over different time frames. In itself, a pivot point is the average of the high, low, and closing prices from the previous trading day.

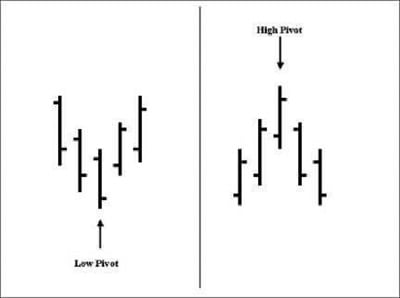

A pivot point on a chart is formed by three bars or candlesticks (for those who prefer this type of chart). A pivot high occurs when a middle bar is sandwiched between two bars that have lower highs than that of the middle bar.

A pivot low occurs when a middle bar is sandwiched between two bars that have higher lows than that of the middle bar.

You can see what a pivot high and pivot low look like in the chart below.

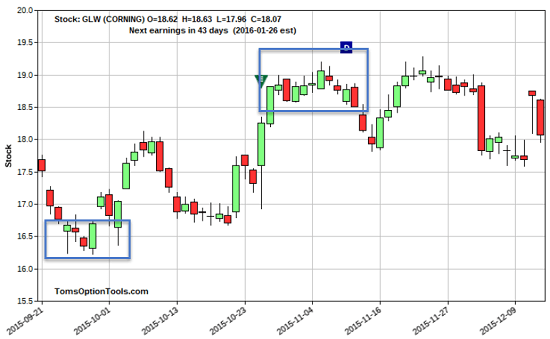

Now let's talk about what it looks like when a pivot high or pivot low starts reversing. This is called a pivot high reversal or a pivot low reversal.

For a pivot high reversal to occur, the most recent bar (or candlestick) should have a lower low and a lower closing low from its previous trading day (middle bar).

For a pivot low reversal to occur, the most recent bar (or candlestick) should have a higher high and a higher closing high from its previous day (middle bar).

Trading above the pivot point indicates a bullish market sentiment, while trading below the pivot point indicates a bearish market sentiment.

Stochastics Will Tell You When the Tables Are Turning

Now that you know how to tell which direction a stock is turning, let's talk about when the stock will turn.

This is when stochastics comes into play.

Stochastics is a momentum indicator used to measure a stock's closing price compared to its price range over a specific period of time.

It's based on the observation that as the closing price of a stock increases, the daily closes tend to be closer to the upper end of the recent price range. Conversely, as the stock price decreases, the daily closes tend to be closer to the lower end of the recent price range.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

When a stock is trending up, it tends to close within the higher part of its bar range. When a stock is trending down, it tends to close within the lower part of its range.

You can tell a reversal is forming during an uptrend when the stock starts to close (or actually closes) in the lower part of its range. During a downtrend, a reversal may be forming when the stock starts to close (or actually closes) in the higher part of its range.

Simply put, the stochastic oscillator values simply represent the position of the stock on a percentile basis versus its range over the previous number of trading days. The percentile scale ranges from the bottom, 0, to the top, 100.

Calculate Stochastics Yourself with This Simple Formula

Stochastics is formed by calculating two numbers:

- The following formula: %K = 100[C - L of N / H of N - L of N]

This may look confusing, but don't worry, I've broken down the formula for you below:

%K: (a stock's current closing price - its lowest low) ÷ (a stock's highest high - its lowest low) x 100

N: the stock

C: the most recent closing price of the stock's previous trading sessions

L of N: the lowest price of the stock's previous trading sessions

H of N: the highest price of the stock's previous trading sessions

A trading session could be a week, a day, or an hour, but the default number of trading sessions is 14.

- %D: a 3-session moving average of %K

Both of these numbers are represented by a line (similar to a MACD line), and they are plotted on the pivot point chart.

The calculations above find the range between the stock's high and low price over a specific amount of time. The price is then shown as a percentage of this range over that specified time frame.

As I mentioned above, percentile scale ranges from 0 to 100. Zero represents the bottom (or low) and 100 represents the high (or top) of this range over the specified time frame.

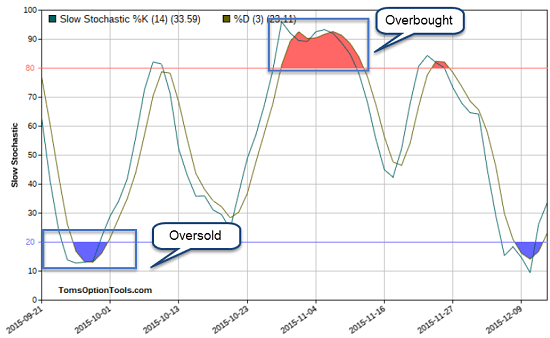

A set of lines that are sloping upward above 20 show a potential bullish momentum in price. A set of lines that are sloping downward below 80 show a potential bearish momentum in price.

A Word of Caution

When the stochastic lines are found in the 20 to 0 range, the stock is deemed oversold. When a stock is deemed oversold, this means that there is an anticipation that the markets believe the stock is at a better value than it was at a higher price. Therefore, the selling should stop, which allows buyers to enter at the lowered price.

Beware that stocks can remain oversold. Stock prices could go even lower in an oversold environment for longer than you may expect.

When the stochastic lines are found in the 80 to 100 range, the stock is deemed overbought. When a stock is deemed overbought, traders think the stock price has been pushed too high (or to a price where the buying will eventually stop). As a result, the stock should start declining in price because sellers will sell to at least lock in some of their profits.

Beware that stocks can remain overbought. Stock prices could go even higher in an overbought environment for longer than you may expect.

The charts below show you what happens in both an oversold and overbought environment.

While it's almost impossible to buy at the absolute lows and sell at the absolute highs, you can learn how to tell which direction a stock is going to turn and when and how to time your options trades. And it's as easy as these two things:

- Use the pivot point to tell which direction a stock is turning.

- Use stochastics to tell when a stock is turning.

Next week, I'm going to show you how to use what I've told you today to enter and exit your options perfectly.

Follow us on Twitter @moneymorning or like us on Facebook.

10 Tips for Tax Season: It's the end of the year, which means tax season is upon us - and it's time to make sure you preserve your hard-earned money. As you start thinking about your tax plan, consider these 10 tips for protecting your capital from Uncle Sam...

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.