Just as I suggested in last week's update on the price of silver, the metal has decided to retreat from its five-month highs. It posted a 2.3% loss last week and is down another 2.1% so far this week.

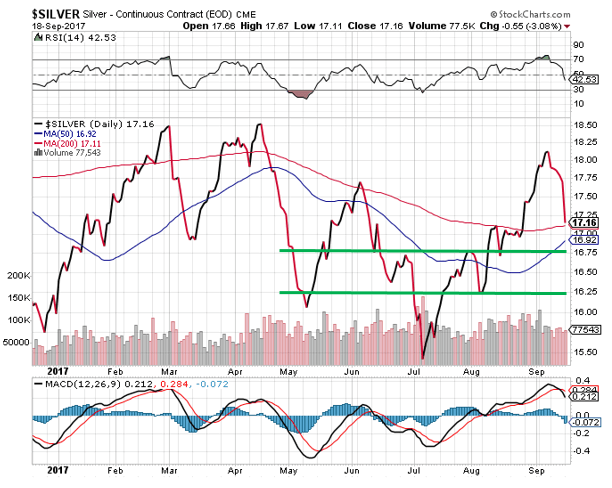

Since peaking recently at $18.12 on Sept. 12, the technical indicators for the silver price showed the metal was overbought and therefore due to dial back. That's what we've gotten over the last week, with silver falling 5.3% from that Sept. 12 high to close at $17.16 on Monday, Sept. 18.

So, has the silver price correction run its course yet?

While the technical indicators show it's no longer overbought, I think we may keep seeing a bit more weakness and at best a consolidation. But this is just a healthy short-term pullback, which will make way for silver to return to its bullish price action.

In fact, I think silver prices could rebound 27% from today's current level through the end of the year. And I'll show you why I'm so confident in my bold prediction.

First, let's explore silver's downturn over the last week...

Price of Silver Declines 2.3% Last Week (Sept. 8-15)

After settling at $18.12 on Friday, Sept. 8, silver kicked off the week with little excitement. The metal trended steadily throughout the day on Monday, Sept. 11, eventually ending the session at the previous closing price.

Tuesday was more of the same for the silver price, as the dollar remained steady throughout the session. The U.S. Dollar Index (DXY) - which measures the dollar against other currencies like the euro and yen - hovered mostly near 91.75 the entire day. This caused silver to close at $18.12 for the third consecutive session.

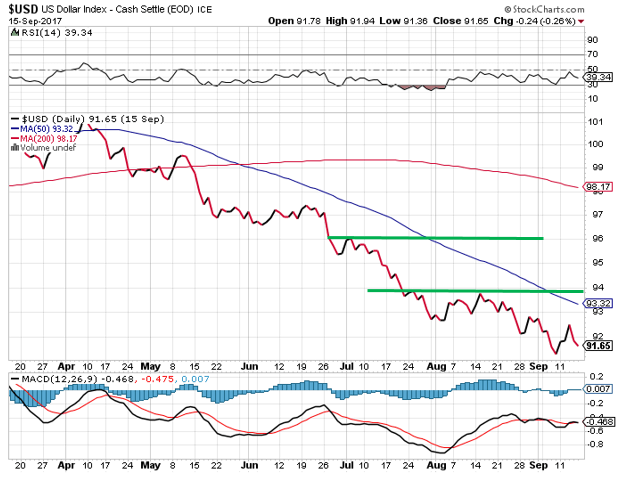

On Wednesday, Sept. 13, the DXY went ballistic, popping from 91.8 to 92.5 in a matter of just three hours. Since silver is priced in the dollar, any rise in the DXY makes the metal more expensive to users of other currencies. This reduces demand and thus drags prices lower.

The DXY's surge to 92.5 dragged the price of silver lower during the day, with the metal eventually closing at $17.87 for a 1.4% loss.

Here's a look at the DXY's performance last week...

The dollar steadily retreated toward the 92 level on Thursday, but it wasn't enough to boost silver prices. The metal declined another 0.4% that day to settle at $17.79.

Friday saw both the DXY and silver backtrack once again, with the former hitting a bottom near 91.60. Meanwhile, the price of silver fell to $17.70 by the close, marking a 0.5% loss on the day. With that, the metal posted a weekly loss of 2.3%.

Urgent: Executive Editor Bill Patalon just saw something on his precious metals charts he's only seen twice in 20 years. He calls it the "Halley's Comet of investing" - and it could lead to windfall profits. Read more...

The silver price began this week with a huge drop on Monday, Sept. 18. As the dollar regained the 92 level and the S&P 500 notched an all-time high, investors moved away from safe-haven metals like silver. The metal plunged 3.1% to close the session at $17.16 - the lowest finish since Aug. 25.

Yesterday (Tuesday, Sept. 19), silver prices recovered a bit, as the DXY fell back below 92 to close the day at 91.83. This lifted silver throughout the day to close 0.7% higher at $17.28.

And the silver price today continues yesterday's small rebound. Prices are up 0.3% and trading at $17.32.

As you can see, the dollar's strength has been largely responsible for silver's 4.4% drop since the Sept. 12 high. The DXY was expected to rebound from its 32-month low of 91.35 on Friday, Sept. 8, and that's exactly what it's done since then.

While this could keep happening in the short term, my long-term outlook is much more bullish. I see silver gaining 27% from here through the end of the year.

Here's why...

Why I See the Price of Silver Climbing 27% Through the End of the Year

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

My forecast shows silver rising to $22 per ounce by the end of Q4, which is up 27% from today's $17.32 price.

But my forecast also shows the current silver price weakness continuing in the interim, and there are two charts showing me this could happen...

First, I think the dollar is currently forming a higher low as it temporarily recovers some of its 10.3% year-to-date loss. As I've suggested recently, that could take the DXY back to the 94-96 level, marked by the green bars below...

If that happens, I expect silver to fall into the range marked by the green bars below...

It was already close to testing the $17 level on Monday, when it settled at $17.16. Since the DXY could reach as high as 96 from here, the silver price could see more pressure, perhaps retreating to the $16.25-16.75 range if it breaks below $17.

Nonetheless, I'd expect this correction to be short-lived, lasting possibly a few more weeks. After that, look for silver to bounce back and take out the 2017 high of $18.51 this fall. Beyond that, expect $22 silver by the end of the year.

Up Next: Rare Gold Anomaly

Money Morning Executive Editor Bill Patalon just caught something on his gold charts that he's only seen twice in the past 20 years. A $13 billion gold anomaly he calls the "Halley's Comet of investing."

It's very rare, and fleeting, and Bill sees things lining up perfectly to bring some very sizeable precious metal profits to well-positioned investors.

Click here to check out his research...

Follow Money Morning on Twitter @moneymorning, Facebook, and LinkedIn.