It's just what investors need: A Bitcoin value chart that can detect when the cryptocurrency is in bubble territory.

One the most vexing things about investing in Bitcoin is that unlike stocks, it has no fundamentals you can analyze to determine a fair market price.

And with the price of Bitcoin ranging from less than $1,000 to nearly $20,000 just in 2017, there's never been a greater need for a tool that can ballpark whether the Bitcoin price is too high, too low, or fairly valued.

That's one of the reasons Willy Woo, an independent cryptocurrency investment researcher, created something he calls the NVT ratio (Network Value to Transactions ratio).

Here's how it works...

How the NVT Ratio Determines the Fair Bitcoin Value

Woo was seeking a Bitcoin equivalent to the price/earnings (P/E) ratio used to value stocks.

The issue with cryptocurrencies, of course, is that while they all have a price, they have no earnings. After doing some research, Woo came up with a substitute for earnings.

"Since Bitcoin at its essence is a payments and store of value network, we can look to the money flowing through its network as a proxy to 'company earnings,'" Woo wrote in an article published on Forbes.

Learn How to Turn $500 into $1 Million: This Sunday School teacher's "retirement career" made him a millionaire. This book will teach you how you can do it too. Claim your FREE copy...

This number is called the daily transaction value, and the Blockchain.info website calculates an estimate every day in U.S. dollars.

To get the NVT Ratio, Woo divides Bitcoin's market cap (the value of all Bitcoin ever created times the current price) by the daily transaction value.

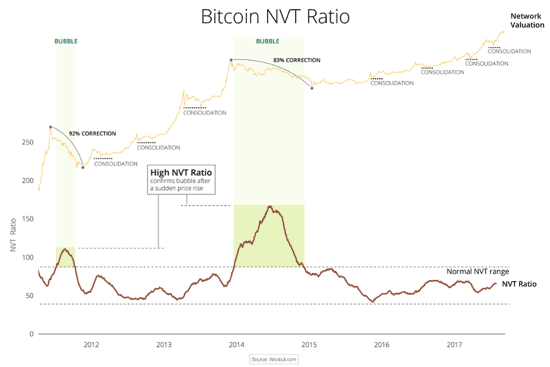

The normal range for the NVT ratio is between 30 and 95, according to Woo. Only when it breaks out above that range do we have a bubble.

Woo's long-term NVT ratio chart, which goes back to Bitcoin's launch, shows the cryptocurrency has had only two real bubbles in its history.

The first was in 2011-12, when the Bitcoin price plummeted 92%. Bitcoin soared from $1 to nearly $32 in two months, but over the next six months plunged all the way back down to $2. The second bubble took place in 2014-15, when the Bitcoin price declined 83%.

Following the second bubble, the NVT ratio soared far beyond the normal range, eventually hitting 187.

"If the ratio climbs above the normal range, it's a sign that the transactional activity is not sustaining the new valuation, and we can expect a lengthy price correction," Woo said.

The other seven major pullbacks were all episodes of consolidation. In each case, the Bitcoin value stayed within the normal range, kept in check by the rise in daily transaction value.

While these pullbacks were often quite steep - the one in early 2013 was 83% - they were short-lived compared to the two bubbles.

All of which brings us to several key questions: Where is the NVT ratio now? And was the most recent run-up in the Bitcoin price (from $8,000 to nearly $20,000 in less than a month) a bubble or not?

Let's see what the numbers tell us...

Is the Bitcoin Price in Bubble Territory Now?

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Woo points out he can't be sure whether any given pullback is a bubble or a consolidation while the Bitcoin price is still rising.

"A price explosion does not necessarily mean the asset is in a bubble. We can only determine this after the peak when the market reassesses the new valuation and we see if the price consolidates or crashes," Woo said.

The greatest rise in the NVT ratio comes in the weeks and months following a bubble's peak.

Despite the huge gains throughout 2017 - 1,800% at the peak - the NVT ratio has stayed in the normal range for all but a couple of days in early October, when it nudged up to 101.

Woo uses a 28-day moving average (14 days on either side of the current day) to calculate his "official" NVT ratio because the daily scores vary widely. The most recent official score, from Dec. 19, is 70.345 - still in the middle of the normal range.

That covers the most recent all-time high, which according to the CoinDesk Bitcoin Price index was $19,783.21 on Dec. 17. The NVT ratio on that day was 71.20 - comfortably within the normal range.

Since then, the price of Bitcoin has declined, while the NVT ratio over the past two weeks has averaged 74.58. So far, it looks we're in another period of consolidation following December's all-time high.

So, not a bubble - at least according to the NVT ratio.

If the current trend follows the pattern of the four previous consolidations, Bitcoin will revisit its all-time high within three to six months.

It could happen even sooner if the U.S. Securities and Exchange Commission (SEC) approves a Bitcoin-related exchange-traded fund. Although mid-year is more likely, it's possible the SEC could approve a Bitcoin ETF as early as the first quarter of 2018.

The arrival of an easy way for retail investors to invest in Bitcoin without buying or holding the cryptocurrency will cause the Bitcoin price to skyrocket well past the previous all-time high to at least $25,000.

Can a Single Book Make You a Millionaire? It contains the mathematical secret for turning $500 into $1,000,000 in a short amount of time! Every day, thousands of people are proving the success of this little book. Today, you can get it free. See how here...

Follow me on Twitter @DavidGZeiler and Money Morning on Twitter @moneymorning, Facebook, or LinkedIn.

Related Articles:

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.