Our new list of best stocks to buy now includes smart plays on cryptocurrencies and blockchain technology, precious metals, and banks. Each company is tapped into major growth trends that we see as the best for making money this year.

Here's a preview of what we're giving you this week:

- Mining Bitcoin has become out of reach for most of us, but that doesn't mean we can't profit from the hardware that miners use. We'll show you how.

- We zero in on a company that's actually using blockchain technology to generate profits, not just hype.

- Multiple indicators are pointing to a bull market for silver, and we've picked one of the best mining companies to profit from it.

- Tax cuts and higher interest rates combine to deliver big opportunities for one of the most dependable regional banks in the country.

- You'll need to act quickly to take advantage of a major biotech firm raising its dividend by 35% this quarter - and that's just the first reason we like it.

Now, for our five latest best stocks to buy now...

Best Stocks to Buy Now, No. 1: This Hardware Manufacturer Is the Perfect "Pick-and-Shovel" Play on the Bitcoin Craze

It was only a few years ago that mining Bitcoin was easy enough to do on your computer at home as long as you had a high-end graphics card installed.

A lot of us are kicking ourselves for missing that opportunity. Bitcoin's protocol was designed to mimic natural resources like gold and silver, meaning mining would become more resource-intensive as more and more Bitcoin was "unearthed."

Due to the cryptocurrency boom of the last several years, mining Bitcoin today is now incredibly complicated - and far beyond most people's reach.

But for anyone who can't afford the setup to mine Bitcoin, you can still buy stock in one of the top suppliers to the mining community.

That would be Xilinx Inc. (Nasdaq: XLNX).

Xilinx manufactures the highly sophisticated field programmable gate arrays (FGPAs) that have become must-have hardware for Bitcoin miners.

In addition to the cryptocurrency market, about half of Xilinx's sales come from aerospace and defense, and another big chunk comes from the communications and data center sector. It's also a major leader in the development of machine learning - the ability of robots to master tasks without needing humans to program them.

In other words, for its $75 share price, Xilinx lets you benefit from Bitcoin, while also not exposing you to the risk of getting wiped out if the crypto boom turns into a bust. Xilinx has a diversified portfolio in several of the most surefire growth sectors in the tech industry.

XLNX's earnings per share (EPS) in the most recent quarter was up 30.8% from a year earlier, and that figure is projected to grow 57.7% over the next two years.

"Xilinx is sweating it to be sure it plays a major role in as many emerging technologies as possible," says Money Morning Director of Technology & Venture Capital Research Michael Robinson. "And all of them will lead to a steadily higher share price for you."

Best Stocks to Buy Now, No. 2: Blockchain Is More Than Just a Buzzword for This Company - It's a Life-Saving and Productivity-Boosting Technology

By now, pretty much everyone has heard of blockchain technology. But not many people know what it is - other than that it has something to do with cryptocurrencies.

That has led to all kinds of companies using and abusing the word "blockchain" in order to stir up hype. Eastman Kodak Co. (NYSE: KODK) and Starbucks Corp. (Nasdaq: SBUX) both recently announced they'd be incorporating blockchain technology into their businesses, while offering little substance in terms of its actual applications.

But even that's not as brazen as Long Island Iced Tea Corp., or rather, Long Blockchain Corp. (Nasdaq: LBCC), as it's now known. That company announced in December that it would be changing its focus from beverages to blockchain technology and changed its name accordingly.

The stock surged 200% in one day - though it had lost most of those gains by the end of January.

Critical: A tiny company's revolutionary device has just been approved by the FCC - and even a small stake could reward you with astronomical gains. Find out how to take advantage of this ground-floor profit opportunity...

It's tough to separate the wheat from the chaff in a saturated market. But it's worth the effort in this case, because blockchain is, in fact, big business.

According to research firm Gartner, blockchain technology created $4 billion in business value in 2017, and that number is expected to hit $3.1 trillion by 2030.

When we look for businesses in the blockchain game, we want to target those that are using the technology to create value in a specific business application.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Enter JD.com Inc. (Nasdaq ADR: JD). This Chinese company isn't as well-known as Alibaba Group Holding Ltd. (NYSE: BABA) or Tencent Holdings Ltd. (OTCMKTS: TCEHY), but it's actually the fourth-largest Internet company in the world by revenue.

In addition to selling a wide variety of products online, JD has recently launched a fresh food delivery service. And it's using blockchain's decentralized digital ledger to substantially improve food quality and safety.

The technology will help track beef imports from Australia - which in China amounted to $737 million in 2016 - including information such as where the livestock was bred and raised, where the meat was processed, and how it was transported.

This is an extremely tedious, and therefore expensive, process. But with blockchain, JD has been able to simplify it considerably.

Thanks to its role in the Blockchain Food Safety Alliance, which includes several top American companies as well as researchers at Tsinghua University, JD will be bringing this technology to more and more fresh food categories in the years to come.

"So with JD.com, we have a company that's using blockchain to streamline the supply chain," says Michael Robinson, "making JD a superior blockchain play."

Best Stocks to Buy Now, No. 3: The Next Silver Boom Is on the Way - Here's Your Best Profit Play

From the technology that powers Bitcoin, we move to a more old-fashioned commodity: silver.

Silver's performance has been weak over the last couple years, thanks in large part to the strength of the stock market and the popularity of cryptocurrencies.

But in the last few months, we've seen Bitcoin lose half its value and the stock market show signs of instability.

Whether or not these are truly causes for alarm, the fact that people are starting to worry about the safety of stocks and cryptocurrencies is a positive sign for silver, which, along with gold, is historically seen as a safe haven.

Unlike gold, silver is also extensively used in manufacturing. Its high conductivity makes it ideal for electronics. Plus, it's a necessary component in solar panels, so growth in that industry is a strong driver of silver demand.

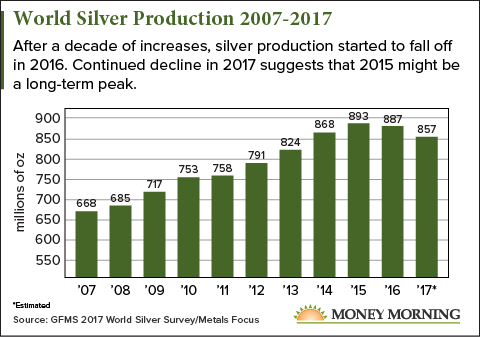

As demand for silver is rising, however, supply is falling. After 10 years of growth, global silver production fell in 2016. And even though silver prices rose in that time, production didn't pick up - it fell again in 2017.

Increasing demand plus limited supply means a silver bull is likely on the way.

If you want to buy silver coins directly, we don't discourage it. But as Money Morning Resource Specialist Peter Krauth says, "the most outstanding returns are going to come from junior silver companies, potentially handing you thousands-of-percent gains."

One of Peter's favorite junior miners is Fortuna Silver Mines Inc. (NYSE: FSM), a company that mines silver and gold primarily in Mexico and Peru, and more recently in Argentina.

Fortuna compounds the already favorable market factors for silver by bringing its all-in sustaining costs from $25.50 per silver equivalent ounce in 2012 to just $11.90 today.

In that same time, Fortuna has doubled its silver output, from 8.1 million silver equivalent ounces in 2012 to an estimated 16.6 million in 2018.

In other words, while the rest of the industry struggles to keep up with demand, Fortuna is churning out the white metal more than ever, and at a lower price. That gives it a major competitive edge that could lead to big gains as we enter a highly favorable market for silver.

"By all accounts," Peter says, "this is a solid bet on higher silver prices."

Best Stocks to Buy Now, No. 4: Follow the Smart Money into One of the Most Venerable Banks in the Country

A big key to making money in the stock market is finding out where the smart money is and getting there before everybody else catches on.

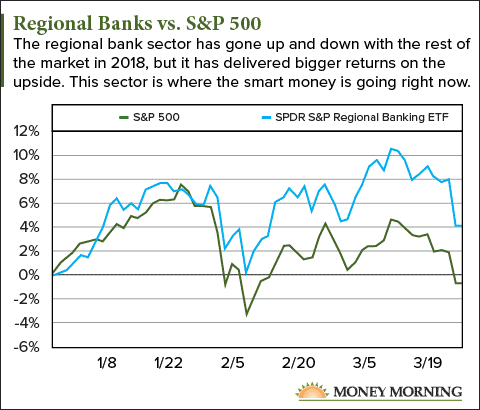

And right now, the smart money is pouring into U.S. regional banks.

You can see from the chart below that regional banks are outperforming the rest of the market in 2018 by a wide margin, even including recent market declines.

That's because the tax overhaul from Congress has simultaneously slowed loan demand from big conglomerates - they're busy repatriating their money from overseas - and spurred loan demand from small- and medium-sized businesses. That, combined with rising interest rates, has significantly raised income opportunities for regional banks.

Our favorite way to capitalize on this trend is First Horizon National Corp. (NYSE: FHN).

Weekly Windfalls: This exciting way to make money has the potential to deliver fast-cash paydays Monday to Friday every week - kicking out $1,000, $1,500, and even $2,000 in four days or less. Learn how to get in on this...

Based in Tennessee, FHN is the fourth-largest bank in the southeastern United States, holding about $41 billion in assets. In 2017, American Banker named it on of the top 10 most reputable banks in the country.

Earnings for 2017 were triple what they were in 2015. And according to FactSet, analysts project earnings to grow another 70% in the next two years, in part due to FHN's December acquisition of Capital Bank Financial.

First Horizon made about $20 billion in loans last year, with 60% going to business development and 25% going to home mortgages. When you buy a regional bank stock like this one, you're helping to grow the local economy and increase home ownership. And you're reaping the profits when that economy takes off.

Best of all, says Money Morning Chief Investment Strategist Keith Fitz-Gerald, First Horizon was founded in 1864, "which means management understands stability and longevity."

Having faced six financial panics in its first 50 years - before weathering the Great Depression - FHN is as trustworthy as it gets in the banking world.

On top of that, FHN delivers a 2.4% dividend, which can add some solid income to your portfolio.

Best Stocks to Buy Now, No. 5: You Only Have Until April 13 to Take Advantage of This Biotech Giant's Big Dividend Boost

Speaking of dividend stocks, they are among your best defenses against market volatility. Those regular income payments can greatly ease the pain of the occasional 5% and 10% dips in market value.

So when one of the top pharmaceutical companies in the world announces it's boosting its dividend by 35%, it's a good time to move.

In fact, you have until April 13 to get in on the first $3.84-per-share dividend that AbbVie Inc. (NYSE: ABBV) will pay out to shareholders in May.

Of course, we wouldn't recommend a stock only for its dividend payment. There's every reason to believe AbbVie will be a great value over the long haul.

AbbVie's arthritis treatment, Humira, is currently the world's top-selling drug, and according to FiercePharma, it should continue to hold that title through at least 2020.

But the company is not resting on its laurels. It recently announced a major collaboration with Voyager Therapeutics Inc. (Nasdaq: VYGR) to develop new immunotherapy treatments.

The immunotherapy sector includes treatments designed to activate the body's own immune system to battle cancer cells. Transparency Market Research projects this sector to more than triple, to $124.9 billion, by 2024.

In spite of a hefty $180 billion market cap, AbbVie has managed to grow its sales by an average of 12% per year, putting it on pace to double in six years.

But Michael Robinson anticipates that the company's EPS will grow by an average 20% over the next three years - a conservative estimate given the 37% projections for this year. At that pace, if you invest today, your shares would likely double in value in a little more than three and a half years.

The stock price fell earlier in this year along with the rest of the market. But between its solid financials, its leadership in major growth sectors, and, of course, that rising dividend, now is an ideal time to buy into this industry giant.

"Here we've got one of the top life sciences stocks to own," Michael says, "one of the top stocks to own - period."

D.R. Barton Has Made a 922% Profit in 20 Days - and He's Not Slowing Down

You have the ability to turn $500 into $1,000,000 or more in as little as 11 weeks.

Sure, that might sound crazy at first glance.

But in truth, all you need to understand is the simple concept of money-doubling.

When you think about it, you only have to double $500 11 times to accumulate $1,000,000 or more in wealth.

And there's a "trick" to successful, consistent money-doubling...

Boiled down, you need to know which stocks to invest in, when to buy, and when to sell.

And D.R. has developed a system to make that easy.

In fact, his strategy has already shown readers over 50 chances to double or triple their money. Even better, all it takes is 10 minutes a day to see these gains.

Learn how to get started using this system here.

Follow Money Morning on Twitter @moneymorning, Facebook, and LinkedIn.

About the Author

Stephen Mack has been writing about economics and finance since 2011. He contributed material for the best-selling books Aftershock and The Aftershock Investor. He lives in Baltimore, Maryland.