While many Americans were grumbling over lower-than-expected tax refunds this year, 60 corporate tax dodgers - all of whom turned a profit in 2018 - paid zero in taxes. But that's not the worst of it...

Most of the following companies actually received millions of dollars in rebates.

According to the Internal Revenue Service, the total amount of tax refunds to individual citizens this year was $4.4 billion lower than it was last year.

Meanwhile, according to an analysis by the Institute on Taxation and Economic Policy (ITEP), those 60 U.S. corporations collected tax rebates worth $4.3 billion - despite earning $79 billion in profits.

Does that sound unfair to you? How could this happen?

Act Now: Our new book could help you quadruple your monthly income, and we're ready to send it to you immediately, for free - but only 1,000 copies are available today. Read more...

It comes down to changes made in the 2017 Tax Cuts and Jobs Act. Several groups of individual taxpayers lost big deductions. Residents of high-tax states got hit with the new $10,000 cap on deductions for state and local taxes.

The 2017 tax reform law also suspended deductions for unreimbursed employee expenses, an important deduction for workers such as telecommuters, traveling salespeople, and construction workers.

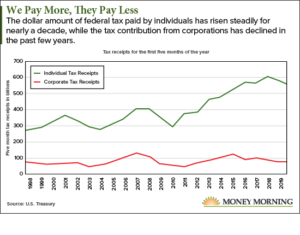

But tax breaks for corporations were mostly left untouched, while the corporate tax rate was chopped from 35% to 21%. That doubled the number of profit-making companies paying no taxes. And U.S. tax revenue from corporations plunged 31% from fiscal 2017 to fiscal 2018, a reduction of $92 billion to the U.S. Treasury.

But tax breaks for corporations were mostly left untouched, while the corporate tax rate was chopped from 35% to 21%. That doubled the number of profit-making companies paying no taxes. And U.S. tax revenue from corporations plunged 31% from fiscal 2017 to fiscal 2018, a reduction of $92 billion to the U.S. Treasury.

Individual taxpayers, however, paid $97 billion more in FY2018.

Here's how the corporations are getting away with this...

Corporate Tax Avoidance 101

Corporations have many tax breaks and loopholes at their disposal.

For example, Amazon.com Inc. (NASDAQ: AMZN) lopped $1 billion off its obligations by using a tax break for stock options. Hundreds of companies use this break every year.

Companies also use a variety of tax credits to lower their tax bill. Last year, Netflix Inc. (NASDAQ: NFLX) had $140 million worth of research and development credits. Video game company Activision Blizzard Inc. (NASDAQ: ATVI) claimed $46 million in R&D credits.

A change in the 2017 law allows companies to claim the full amount of a capital investment (typically equipment and facilities) in the same year in which it was made. Previously, companies claimed a tax break on capital expenditures by depreciating the item over a period of years.

Sectors with high levels of capex, such as energy companies and airlines, were only too happy to exploit this change in their 2018 taxes. Chevron Corp. (NYSE: CVX) reduced its taxes by $290 million with this trick, while Halliburton Co. (NYSE: HAL) saved $320 million. In all, ITEP reports, companies shaved $8 billion from their taxes using this break.

Then there are the corporate tax breaks targeted at particular sectors. Again, energy is a prime beneficiary. Thanks to the enhanced oil recovery credit, Occidental Petroleum Corp. (NYSE: OXY) trimmed $158 million off its 2018 tax bill.

Alternative energy credits are just as lucrative. Duke Energy Corp. (NYSE: DUK) snagged $128 million worth of renewable energy credits. DTE Energy Co. (NYSE: DTE) managed a tax reduction of $223 million with production credits.

With so many ways to thwart the tax man, it's no wonder almost every one of the companies on ITEP's list got millions of dollars back from the government.

About half of the companies on the list made billions in U.S. profits and still got hefty rebates. EOG Resources Inc. (NYSE: EOG) had income in excess of $4 billion and yet earned a rebate of $304 million.

Here's the full chart, with all 60 companies, how much U.S. profit they earned in 2018, and how much they got back from the government:

60 Corporate Tax Dodgers That Made the Government Pay

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

U.S. income and federal tax figures in millions of dollars.

| Company | Ticker | U.S.

profit |

Federal Tax | Effective Tax Rate | Industry |

| Activision Blizzard | ATVI | $447 | -$228 | -51% | Computers, office equip, software, data |

| AECOM Technology | ACM | $238 | -$122 | -51% | Engineering & construction |

| Alaska Air Group | ALK | $576 | -$5 | -1% | Transportation |

| Amazon.com | AMZN | $10,835 | -$129 | -1% | Retail & wholesale trade |

| Ameren | AEE | $1,035 | -$10 | -1% | Utilities, gas, and electric |

| American Electric Power | AEP | $1,943 | -$32 | -2% | Utilities, gas, and electric |

| Aramark | ARMK | $315 | -$48 | -15% | Miscellaneous services |

| Arrow Electronics | ARW | $167 | -$12 | -7% | Retail & wholesale trade |

| Arthur J. Gallagher | AJG | $322 | - | - | Financial |

| Atmos Energy | ATO | $600 | -$10 | -2% | Utilities, gas, and electric |

| Avis Budget Group | CAR | $78 | -$7 | -9% | Motor vehicles and parts |

| Celanese | CE | $480 | -$142 | -30% | Chemicals |

| Chevron | CVX | $4,547 | -$181 | -4% | Oil, gas, & pipelines |

| Cleveland-Cliffs | CLF | $565 | -$1 | 0% | Oil, gas, & pipelines |

| CMS Energy | CMS | $774 | -$67 | -9% | Utilities, gas, and electric |

| Deere | DE | $2,152 | -$268 | -12% | Industrial machinery |

| Delta Air Lines | DAL | $5,073 | -$187 | -4% | Transportation |

| Devon Energy | DVN | $1,297 | -$14 | -1% | Oil, gas, & pipelines |

| Dominion Energy | D | $3,021 | -$45 | -1% | Utilities, gas, and electric |

| DTE Energy | DTE | $1,215 | -$17 | -1% | Utilities, gas, and electric |

| Duke Energy | DUK | $3,029 | -$647 | -21% | Utilities, gas, and electric |

| Eli Lilly | LLY | $598 | -$54 | -9% | Pharmaceuticals & medical products |

| EOG Resources | EOG | $4,067 | -$304 | -7% | Oil, gas, & pipelines |

| FirstEnergy | FE | $1,495 | -$16 | -1% | Utilities, gas, and electric |

| Gannett | GCI | $7 | -$11 | -164% | Publishing, printing |

| General Motors | GM | $4,320 | -$104 | -2% | Motor vehicles and parts |

| Goodyear Tire & Rubber | GT | $440 | -$15 | -3% | Motor vehicles and parts |

| Halliburton | HAL | $1,082 | -$19 | -2% | Oil, gas, & pipelines |

| Honeywell International | HON | $2,830 | -$21 | -1% | Industrial machinery |

| International Business Machines | IBM | $500 | -$342 | -68% | Computers, office equip, software, data |

| JetBlue Airways | JBLU | $219 | -$60 | -27% | Transportation |

| Kinder Morgan | KMI | $1,784 | -$22 | -1% | Oil, gas, & pipelines |

| MDU Resources | MDU | $314 | -$16 | -5% | Oil, gas, & pipelines |

| MGM Resorts International | MGM | $648 | -$12 | -2% | Miscellaneous services |

| Molson Coors | TAP | $1,325 | -$23 | -2% | Food & beverages & tobacco |

| Netflix | NFLX | $856 | -$22 | -3% | Retail & wholesale trade |

| Occidental Petroleum | OXY | $3,379 | -$23 | -1% | Oil, gas, & pipelines |

| Owens-Corning | OC | $405 | -$10 | -2% | Miscellaneous manufacturing |

| Penske Automotive Group | PAG | $393 | -$16 | -4% | Motor vehicles and parts |

| Performance Food Group | PFGC | $192 | -$9 | -4% | Retail & wholesale trade |

| Pioneer Natural Resources | PXD | $1,249 | - | - | Oil, gas, & pipelines |

| Pitney Bowes | PBI | $125 | -$50 | -40% | Computers, office equip, software, data |

| PPL | PPL | $1,110 | -$19 | -2% | Utilities, gas, and electric |

| Principal Financial | PFG | $1,641 | -$49 | -3% | Financial |

| Prudential Financial | PRU | $1,440 | -$346 | -24% | Financial |

| Public Service Enterprise Group | PEG | $1,772 | -$97 | -5% | Utilities, gas, and electric |

| PulteGroup | PHM | $1,340 | -$44 | -3% | Miscellaneous manufacturing |

| Realogy | RLGY | $199 | -$13 | -7% | Miscellaneous services |

| Rockwell Collins | UTX | $719 | -$16 | -2% | (acquired by United Technologies Nov. 2018) |

| Ryder System | R | $350 | -$23 | -7% | Transportation |

| Salesforce.com | CRM | $800 | - | - | Computers, office equip, software, data |

| SpartanNash | SPTN | $40 | -$2 | -4% | Retail & wholesale trade |

| SPX | SPXC | $66 | -$5 | -8% | Industrial machinery |

| Tech Data | TECD | $203 | -$10 | -5% | Retail & wholesale trade |

| Trinity Industries | TRN | $138 | -$19 | -14% | Miscellaneous manufacturing |

| UGI | UGI | $550 | -$3 | 0% | Utilities, gas, and electric |

| United States Steel | X | $432 | -$40 | -9% | Metals & metal products |

| Whirlpool | WHR | $717 | -$70 | -10% | Electronics, electrical equipment |

| WEC Energy Group | WEC | $1,139 | -$218 | -19% | Utilities, gas, and electric |

| Xcel Energy | XEL | $1,434 | -$34 | -2% | Utilities, gas, and electric |

| TOTAL | $79,025 | -$4,300 | -5% |

Source: Institute on Taxation and Economic Policy analysis of SEC filings

5G Could Mint a New Wave of MILLIONAIRES!

It's the greatest tech shift in generations, and it can create untold wealth for investors.

If you ignored weed or crypto - DO NOT miss out again. This could be your LAST shot at early retirement.

Find out how you could capture a life-changing SIX-figure windfall from 5G right now.

Follow me on Twitter @DavidGZeiler and Money Morning on Twitter @moneymorning and Facebook.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.