I see a lot of stuff every week.

From fresh research to private placements, to the hottest new opportunities you can imagine in a wide variety of sectors and subsectors, there's always a way to make money.

But nothing gets me more excited than the possibility of doubling your money quickly and efficiently.

Today, I want to show you a carefully guarded day-trading technique used by pros to regularly harvest gains from weekly options.

There's a lot to like...

First, this technique limits risk, which means you're never on the hook for more than you counted on. Unlike many options trading techniques commonly taught out there, this means you don't get in over your head (or your wallet).

Second, the technique uses weekly options, which means you're never going to run out of opportunity. They're a far cry from the monthlies I "grew up" with when I started, and they're considerably more flexible too.

And third, you can make a killing without being chained to your computer all day. The trade I'm going to describe to you can easily be managed using limit orders, trailing stops, and profit targets.

... Interested?

I thought you might be.

I call this trade the "Weekly WhizBang," and it's a great Total Wealth Tactic for those of you who enjoy quick action and potentially even quicker profits.

You can use it to trade both bullish AND bearish expectations. Which means it's flexible and easily adaptable to current market conditions.

What's more, the "Weekly WhizBang" is great for big, liquid stocks like Apple Inc. (Nasdaq: AAPL).

In fact, let's start there.

How the Weekly WhizBang Works

Apple stock is under huge pressure at the moment.

[SPECIAL] Billions could be recovered for hard-working Americans like you…

Legions of analysts are falling all over themselves to downgrade and reprice the stock. Robert Cihra of Guggenheim, for example, downgraded the stock from "buy" to "neutral" (which is Wall Street speak for "sell," even though they will never tell you that); UBS cut its 12-month forecast from $240 to $225, while lowering their iPhone quarterly sales estimates; Goldman Sachs cited that they are "concerned that the end demand for new iPhone models is deteriorating," and have lowered their 12-month forecast from $222 to $209. Other similar commentary will undoubtedly follow.

I think $150 a share isn't out of question before the latest downturn runs its course.

The problem, of course, is that the move won't be in a straight line. So simply shorting the stock or buying put options, like most people will do, is going to be a rocky ride filled with false rebounds, dead cat bounces, and a head fake or two the pros will set up to separate you from your money, just for good measure.

Instead, we're going to use a technique called the "horizontal spread."

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

A horizontal spread – some folks also call this a calendar spread – involves simultaneously buying and selling two options at the same strike price but with different expiration dates.

In this case, a week apart.

Horizontal spreads can be created with calls if you're bullish or with puts if you're bearish. In fact, that's one of the great things about this trading technique... there is no wrong way to do it!

Last Wednesday morning, Nov. 14, Apple came out of the gate at $193.90 a share. My expectations were bearish, given Apple's chart and the related headlines.

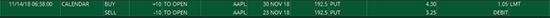

So, I created the following Weekly WhizBang trade example eight minutes after the markets opened at 6:38 p.m. PST, for a total cost of $1.05 ($1,050), excluding commissions for simplicity.

(Click to enlarge)

Approximately four hours later, Apple fell $7.51 to $186.39 a share.

The same trade was now worth $1.20, which means you would have made a cool $150 if you were following along (also excluding commissions, which vary from broker to broker).

Then, to show you how easy this can be, I "closed" it with the following order.

(Click to enlarge)

Not too shabby, eh?

A trade like this makes money like McDonald's makes value meals – but by combining options instead of French fries and burgers.

In this case, that's $0.15. ($1.20 you get when you sell it, less the $1.05 you pay to open or initiate the trade). You multiply that by 100 because every standardized option contract represents 100 shares and, again, by 10 because my example was for 10 contracts in each leg of the spread.)

Put another way, that's a quick 14.28% on your money in four hours – which doesn't sound like much until you annualize your return. Then you've got a very appealing 5,847.66% on your money!

Unstoppable: While the markets were in a tailspin last month, the Night Trader managed to pull off a perfect track record in closed trades – all with the help of his new Infrared Index. Strike now if you want in...

Are there caveats?

Absolutely.

A trade like this one can lose money if Apple closes at or below $192.50 per share, plus the premium you would have received ($1.05) when you put the trade on. The breakeven, in other words, would be $193.55 at expiration on Nov. 23 – a week from today.

However, you are also long the further dated at-the-money put option (the one that expires Nov. 30). And that's usually going to increase in value as time decay shifts and as volatility changes, so you should have a smaller gain building, even though Apple's price could go against you with the near-dated option (the one that expires Nov. 23).

Second, you can alter this trade to suit your individual risk tolerance and appetite.

For example, you can choose a horizontal spread like I did for purposes of our discussion, or vary that by going "at-the-money" -1, -2, or even -3 strikes. In this instance, that would have meant picking a $190, $187.5, or $185 strike put.

Trading a bullish expectation simply means reversing the instructions and using a horizontal spread with calls instead of the puts I've highlighted in today's column. I'll put an example like that in place when Apple reverses.

Third, risk management is straightforward.

Exit the trade when one of the following conditions occurs:

- You double your money or you've hit your daily profit target (that's the $150 in today's example – because I wanted to write about it and cut the trade short to prove my point);

- You arrive at the near-term expiration date and the trade is still running; or,

- You "give back" 50% of your initial debit (the cost you incur putting the trade on to begin with when you open it).

As always, this is a speculative trade.

I suggest limiting the total amount of capital to any single Weekly WhizBang to 2% of your total investable portfolio. That way you can completely biff the trade without the risk of blowing up your nest egg – yet still build your fortune rapidly.

Every trade's got limited risk and potentially unlimited profits.

Week by week.

The Chance for at Least 50 Triple-Digit Winners – No Matter What the Markets Are Doing

It’s time to leave the markets behind, and never again concern yourself with the ups and downs of the S&P 500, Dow Jones, Nasdaq, or any other market index.

Take a look at the S&P 500 since the beginning of this month:

Back down 39 points… up 18… sinks 21… jumps 45 more…

Put $2,000 in this market, and in the end, all you made was a measly $3 on your money.

This has a lot of people freaked out. It’s time to get off the ride.

Starting right now, you no longer have to care about how the markets are doing.

They could be climbing to record highs, or falling through a bottomless pit…

The chance at gains like these keep coming in all conditions.

Take a look:

When the markets are losing money… $3,000 cash on Micron Technology while the S&P 500 would’ve lost you $102.60.

When the markets are making money… $8,000 cash on Biogen Inc. while the S&P 500 returned just $54.60.

Even while the markets are barely moving at all…$4,000 cash on Ferrari NV while the S&P 500 would’ve returned just $12.60.

That’s just a tiny sampling of what’s possible – and there are even more opportunities ahead.

So if you’re tired of trusting your hard-earned money to the whims of the market… here’s your chance to kiss them goodbye… and start profiting in any and all market conditions – to the tune of 50 triple-digit winners over the next year.

Click here for the full details.

The post Double Your Money with a New Total Wealth Tactic - The Weekly WhizBang appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.