You know me.

I'm not prone to hype, nor do I say things I don't mean. My job as Chief Investment Strategist is to help you make a fortune by telling you what you need to know. Sometimes that's stuff the Street hasn't thought about yet, or simply doesn't want to consider (but should in the name of profits).

So today, I'm just going to say what I gotta say:

The Dow Jones Industrial Average will hit 60,000 within the next 10 years.

Here's how I know (and what you need to know to profit).

The Dow Could Triple Within the Next 10 Years

Before I go any further, though, understand this.

What I want to share with you today may be the single most important market driver in the history of modern finance.

It trumps earnings, fundamentals, the Fed, the world's central banks, terrorism, geopolitical hijinks, and more. It renders the question about whether or not stocks are expensive moot. And it makes conventional thinking with regard to traditional diversification a dangerous relic of the past.

Make no mistake about it.

If you and your family have ever wanted to be fabulously wealthy, this is your chance.

The markets could double or triple within the next 10 years.

That means the Dow Jones Industrial Average hits 60,000.

That the S&P 500 tops 7,200.

That the Nasdaq exceeds 18,900.

I know this is a lot to take in.

But hang with me.

Your financial future depends on...

Liquidity.

It's a nebulous term you've heard hundreds perhaps even thousands of times since the financial crisis began. So much so, in fact, that most investors take it for granted - meaning they think they know what it means so they dismiss its importance.

In reality, very few people actually have a clue. Even hardened professionals have trouble processing the concept I'm going to share with you today.

Technically speaking, liquidity is a function of monetary policy, electronification, and engagement. It's made of up of four discrete but related dimensions: immediacy, tightness, market breadth, and activity - all of which determine the amount of money that can or will be put to work in the financial markets as a function of risk.

The plain English explanation is far simpler - the more money that's sloshing around, the higher stocks will go.

It really is that simple.

I understand if you're skeptical.

Many investors are. They fear a recession, political hijinks, terrorism, war, and "expensive" stock prices. Throw in the prospect of a massive market correction and the end of the financial universe as we know it, and most want to hide in the basement.

Logically they're hesitant to invest.

The problem is that's based on a mistaken belief that the markets are a closed system.

That might sound strange to you, but today's central banks do not operate like your checkbook.

The liquidity I am talking about is created out of thin air.

There is no limit to how much money they have or do not have. Nor are there boundaries with regard to spending.

But, but, but...

Trust me when I tell you that the markets do not work the way you've been led to believe. There is no checking account that central bankers access, nor is there some sort of slush fund. Just fancy accounting.

Here's how they do it - create money out of thin air, that is - and why every dollar they create winds up in the stock markets sooner or later.

Take the Fed, for Example

Like other central banks around the world with their own debt, Team Yellen has to buy and sell billions of dollars in U.S. Treasuries each day from the big banks and trading houses, yet doesn't have to pay a dime when it does.

Instead, what happens is the Fed issues a credit to the seller on their Federal Reserve Statement which, for all intents and purposes, is like your bank account statement. At that point, the seller can either use that money or keep it "on deposit."

Most "use" it to buy other bonds and financial instruments on the open markets because doing so is at the very core of what makes them profitable. At this point those very same credits issued by the Fed get transmogrified and - voila - become "cash money."

Interestingly, I get asked a lot about why the big banks and trading houses don't just stop trading or at least slow down when the going gets tough, like any rational investor would.

They can't.

What most folks are missing and why there's such a disconnect is that big banks cannot sit on their hands and do nothing even when market conditions suck, when stocks are too expensive, or trouble looms. They have to keep the money they use moving at all times because their existence depends on it.

So, the sellers start making loans, issuing insurance, trading in derivatives and - ta da - buying stocks - all the while using money that was literally created from nothing.

Here's where the rubber meets the proverbial road and why I am so certain that the gains we have seen so far are but a fraction of what's ahead.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

What central banks and their cronies are doing effectively puts a "floor" on prices. Not only does this almost completely eliminate the possibility of a major financial flameout, but it also provides upward buying pressure at a time when global terrorism, economic shenanigans, and political discord would otherwise tank markets.

This is why markets continue to shake off damn near everything that hits 'em and why they will continue to climb over time as more money is created from thin air and force fed into the global financial system.

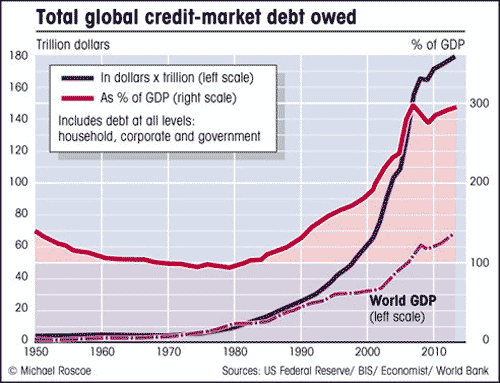

You can see the relationship quite clearly in the following chart.

Over time this will become even more pronounced.

To be fair, what I am telling you will be hotly denied in Washington, deemed impossible by most "experts," and regarded as pure fantasy by most investors who cannot separate short-term market movements from long-term growth.

Which is why I want to leave you with an example that makes my point using nothing more sophisticated than high school economics.

Back to the Basics: ECON 101

ECON 101 dictates that if you have 1,000 eggs in the store and only 10 buyers, the price of eggs will drop precipitously. However, if there are 1,000 buyers and only 10 eggs, the reverse is true and the price will shoot higher as competing buyers bid it up.

Now imagine there's somebody out there giving every one of those same 1,000 people more money and telling them they have to spend it - and here's the catch - even if it dramatically exceeds the amount of money all the eggs are actually worth.

This is what's happening all over the world and why stocks continue to defy all odds.

It's also why the perma-bears have been as wrong as the day is long since 2009, despite scary news flashes and loads of doom and gloom.

As long as what I am describing remains true, valuations no longer matter like they once did. Conventional analysis won't work as it has in the past.

Any investor who refuses to acknowledge the argument I've just laid out will get left so far behind that their head will spin around like one of those dolls in an old "Exorcist" flick.

You can argue about whether stocks are expensive till the cows come home. You can debate whether or not this much debt is good until hell freezes over. You may or may not be right.

Or, you can get on board and be profitable.

My preference is clearly the latter and I'm guessing you agree, by virtue of the fact that you're here.

Again, I understand if you're skeptical. I get thousands of emails every week from investors who share your very valid concerns.

The Way I See It, You've Got Two Options

You can stop reading right now, walk away from your computer, and ignore everything I've just shared with you. But do so knowing that the odds are firmly stacked against you.

How do I know?

Because politicians around the world want to be reelected, and the economists who advise them cannot admit they've been wrong for decades. Playing the growth card by using currency created out of thin air is the only option they've got left.

It's the ultimate Unstoppable Trend.

In closing, you've probably got a few questions, like whether all this debt is a good thing or not, whether there will be a crash along the way, and how to pick the best companies in light of what I'm describing.

I'll answer those very shortly in an upcoming webinar that you will not want to miss.

Every one of those things is a risk management issue you can deal with using trailing stops, inverse funds, position sizing, and half a dozen other Total Wealth Tactics we've discussed over the years to capture profits when it hits.

Longer term, the world is awash in liquidity, and that's really what you need to understand today.

Never forget that profits are tied to growth no matter how it is created...

...and paid for.

An $80 Billion Cover-Up? Under the watchful eye of Congress, the government will soon be implementing a controversial plan that threatens the retirement of millions of Americans. And they;re using an obscure loophole buried in Title 29 of the U.S. Labor Code to do it. If you have a 401(k), IRA, or any type of retirement account, this could cause you to miss out on $68,870 or more. Learn more…

The post Dow 60K... Here's Why appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.