It's the time of year when many of us like to rewatch "Rudolph the Red-Nosed Reindeer." Even if you've never seen it, you've probably heard of the Island of Misfit Toys - the destination for defective toys deemed unworthy for people's homes.

Now, this movie is the perfect trading and investing reminder to look for misfit stocks. Generally, these are the ones that aren't selling as well as they had in the past.

Maybe these companies' products or services have fallen out of favor, or maybe people in charge have made poor business decisions, or recent acquisitions haven't worked as anticipated. There are any number of reasons.

The best part is these stocks are easy to spot because they typically sit at or near their 52-week lows.

That means you're looking at the perfect opportunity to pinpoint the ones with the greatest turnaround - and profit - potential.

And it all boils down to this simple strategy...

Why the Best Time to Buy a Stock Might Be When It's at Its Worst

Do you believe that over the course of a year, a stock has turnaround potential to the tune of regaining 50% or more of its 52-week high price?

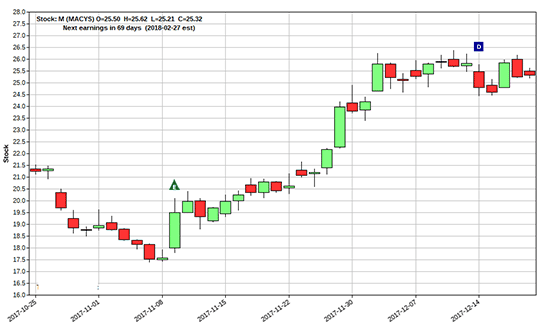

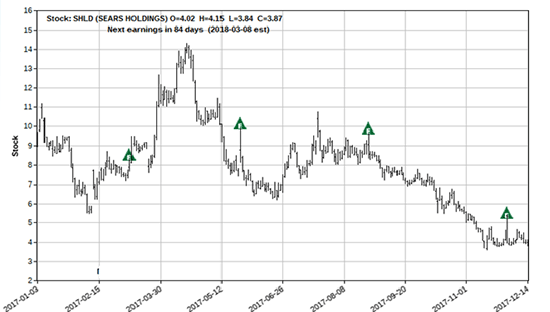

A few weeks ago, we talked about the dead cat bounce options strategy. In that update, I revealed Macy's Inc. (NYSE: M) and Sears Holdings Corp. (Nasdaq: SHLD) as two stocks with the potential for quick profits via long call options.

In the charts above and below for M and SHLD (respectively), we can see the stocks hit at or near what were 52-week lows. Each was able to turn around for a quick pop.

But this isn't just a "Dogs of the Dow" (DOTD) investment idea. I am looking at all stocks in the Dow, not just the top 30. And this isn't based upon company dividends, either.

However, what is similar between this turnaround strategy and DOTD investing is that I would consider a Long-Term Equity Anticipation Security (LEAPS) option on it.

Now, I'm not saying there won't be shorter-term trading opportunities throughout the year, but I'm not considering these as short-term trades at the start of the year. I see them with major long-term profit potential, so I'm not too inclined to concentrate on them for a quick pop right away.

If you do see a short-term technical pattern emerge on these stocks, I caution you to not worry about your LEAPS option on our turnaround strategy.

If you do, you might be tempted to close your LEAPS play when you close the shorter-term technical pattern. Although that might seem like the best idea, you actually risk leaving money on the table for that LEAPS option.

In most cases, the short-term pop isn't going to be the 52-week high for this turnaround stock. And the whole purpose of the LEAPS option was for a yearlong hold perspective.

Important Things to Look for in a Turnaround Stock

Here are important things to consider before deciding upon a LEAPS option target...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

- Is there a new management team in place? Or are the same folks who got the company into the mess still around?

- Is the company going to produce and introduce a new product, technology, or service? Do you expect it will lead to better sales growth?

- Are the people in charge making appropriate decisions on operations and overhead: cutting jobs, reducing costs, and streamlining operations?

- Finally, always pay attention to a company's debt. If the company's bonds are trading at a discount, it may be more trouble than it's worth. The company has to satisfy its debts to others before it can provide value to its shareholders.

While these aren't the only criteria, it's a great start. And if we can check off all of these bullet points for a compay, it may be a good target for our LEAPS option.

But if the answer to most or all of the aforementioned points is "no," it's probably a sign to stay away from the company and look for other opportunities.

Once you have researched these items, it's up to you and your financial team to decide to move on or consider a LEAPS call option.

Realize, though, that a beaten-down stock is still a beaten-down stock. It's not necessarily a good buy just because it's trading at $5 now and it used to be $30. We need to see that the company is capable of rectifying its existing problems before the stock actually has potential again.

A depreciated share price alone is not reason enough to consider a LEAPS call option trade. Consider the words of Warren Buffett, who said that "turnarounds seldom turn."

Do your research and be patient. When you feel you have found a company that's getting its mojo back, you may have just found a misfit toy that is worthy of a home in your portfolio.

Just make sure you bundle it in the form of a LEAPS call option.

If You Like Fast Cash, You Don't Want to Miss This

I love fast money. That's why I've been working on a new invention. It's a way to get rapid-fire profits in your hands week after week.

I'm talking about trades you can make from anywhere, even right on your phone, in four days or less.

The pattern behind these quick paydays appears every single week. And I'm the only one who knows how to find it.

I've used it to show my readers top gains like 100% on RTN in one day, 100% on BIDU in one day, 120.93% on MS in two days, and 124% on ABBV in one day.

If you hope to find yourself with a pile of extra cash in your pockets, click here to learn more...

The post How the "Market Misfits" Can Double Your Money in 2018 appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.