Wall Street would love for you believe that rising interest rates are terrible for stocks and that there's nothing you can do to defend your money against higher rates... let alone profit.

That's simply not true.

Higher interest rates by themselves are not bad. In fact, they can be quite good for markets... it's the speed of the rise that's critical.

Today I want to talk about why this is an important nuance and how to identify the best companies - meaning those that can defend your money against higher rates and grow it, too!

Are Rising Rates Really Bad for Stocks?

Wall Street would have you believe that simply because it's in their interest to have you thinking that way. You'll be uncertain, caught off guard, and probably going to trade more frequently as a result (which generates hundreds of millions in commissions).

The mainstream media doesn't help matters much. This past Sunday, for example, White House budget chief Mick Mulvaney said that rising federal deficits could force interest rates to "spike." And that got a lot of coverage simply because the word "spike" is so dramatic.

At the same time, stronger than average jobs numbers have renewed concerns that the Fed may reduce monetary stimulus and boost rates more aggressively to compensate for growing economic strength. It's a meme being played out across the Internet and on news channels around the world.

Yet, rising rates are not the worry that you're being led to believe they are.

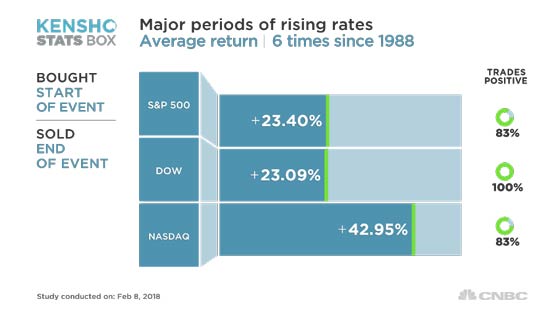

History shows that there have been six major periods of rising rates over the past 30 years. Five out of six times the markets rose significantly, according to Kensho, a hedge fund analytics engine, and CNBC.

And, as you can see, not just by a small amount either. All three of the major indices tacked on significant returns that varied between 23.09% and 42.95%, with positive trades occurring 83% of the time for the S&P 500 and the Nasdaq, and 100% of the time for the Dow.

My research - which we've talked about many times in the past - says the same thing. But don't take my word for it.

A 2013 research report from Rob Brown of United Capital Financial Advisors found that stocks declined in only three out of 16 periods of rising interest rates since 1920 and that the average return for the S&P 500 when rates climbed the most was 16.2% - much higher than the 12% return for all periods.

Urgent: An $80 billion cover-up? Feds use obscure loophole to threaten retirees… Read more…

Since 1971, there have been seven periods when the Fed raised rates during which the markets actually gained an average of 19.21% the following year.

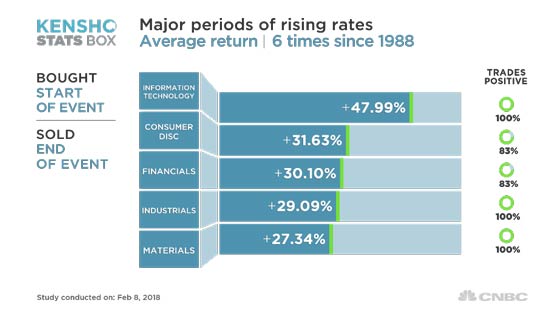

There's a good argument to be made for capital acceleration, especially when it comes to IT, consumer discretionary stocks, financials, industrials, and materials stocks.

Not surprisingly, the Kensho data agrees.

To be fair, there are six very dangerous words in play: "It could be different this time."

That's true... it could be... but probably won't be.

At least for us.

Where to Position Your Money to Profit

The key is to buy the "must-have" companies that I'm always talking about - all of which are aligned with our Unstoppable Trends - because they have the ability to protect margins.

Let me explain.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Generally speaking, rising rates crater companies that can't raise the price of their products even though the costs of producing those same goods and services are going up. Examples include consumer staples and anybody producing "nice-to-have" widgets like phones or washing machines, for example.

But shift your attention to companies like American Water Works Co. (NYSE: AWK), Becton, Dickinson and Co. (NYSE: BDX), and Raytheon Co. (NYSE: RTN), for example, and the game changes immediately.

Each one of the companies I've just mentioned has the ability to raise the price of their products quickly with no negative consumer backlash to compensate for rising rates. Plus, they have comparatively low labor costs and everything they make is "must-have," which means, simply put, you can't live without 'em.

In other words, they can respond positively to the increasing cost of money.

Other examples include electric utilities, certain technology plays, and even so-called "sin" stocks making booze, tobacco, and guns. Obviously, each of these stocks comes with a unique set of risks, but when rates are rising there's no better way to protect your money and grow it than with companies hellbent on doing the same thing.

Speaking of which, I've got a long list of similar choices in The Money Map Report and will be adding to 'em with fresh recommendations throughout the year. If you're interested, please consider a subscription! Just click here for more information.

Past performance, as the old saying goes, does not predict the future. But that doesn't mean we can't still learn a thing or two!

Especially when it comes to how you make money as rates rise.

I'll be with you every step of the way.

The post How to Identify Companies That Can Defend Your Money from Rising Rates appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.