Full disclosure...

The information I am about to share with you will make you absolutely livid.

What I'm going to explain to you today has already cost taxpayers in excess of $1 trillion over the past decade, according to the Center for Retirement Research at Boston College.

Now, that figure could double again...

... because of guaranteed pensions.

This is one of Wall Street's dirtiest, best-guarded secrets... but nobody ever talks about it outside the mahogany-lined hallways of their innermost sanctums.

They're the real reason why your local school district is cutting its budget, why there's never enough money to maintain our country's infrastructure, why healthcare costs so much, and why you're hit with one levy after another, year after year, to cover government "shortfalls."

The pension crisis is also the single BIGGEST risk to the world's stock markets today and, yes, to your wealth.

Rolling Stone calls this... a scam of almost unmatchable cruelty.

Forbes says it's a... "national crisis" of unprecedented proportions.

Bloomberg says... the writing appears to be on the wall.

I know I'm going out on a limb.

Things appear good. The economy is stronger than it's been in decades. Unemployment is near 50-year lows. Wages are expanding. Spending is up. Earnings are excellent.

What I have to say will be hard to believe.

But, here it goes...

U.S. pension assets were $25.17 trillion at the end of 2017.

That's a huge number.

So large, in fact, that many people can't wrap their heads around it.

But let's try anyway. That's double the shadow-banking system that brought this country to its knees in 2008, when securitized sub-prime mortgages blew up. And that's 9x the amount of capital that cratered Lehman Brothers.

Most folks are surprised to learn, however, that this is a double-edged sword...

... America's pensions owe retirees $6 trillion more than they can pay.

Put plainly, they don't have enough money.

So they're breaking promises they made to retirees by cutting their income substantially. In some cases, by 90% or more.

The pension industry is sitting on a massive, $6 trillion lie... and Congress won’t own up to the truth. Now, that lie has become a silent killer for the retirement dreams of millions of Americans. Here's what you need to know...

Adam Milton is a 75-year-old retired dockworker, for example. He was counting on a $2,300 monthly pension check and Social Security to keep him and his wife secure for the rest of his life. That's been cut 66.96% to $760 a month.

Ed Herman made ends meet with a monthly $2,422 pension check that's now been cut 62.76% to $902.

Sadly, neither of these men are exceptions.

More than 31 million Americans drawing a pension are directly at risk of default. Another 200 million investors are, too, even though they don't have a pension and never will.

Again, to put this in perspective, $6 trillion is 50% more than the amount of money Congress blows through in a year. It's 9x Washington's fiscal 2017 deficit of $666 billion.

The Pension Benefit Guaranty Corporation – the agency Washington's political apparatchiks created to deal with a situation like this – can't help. The PBGC is already "broke"... and $80+ billion in the red.

How It Got This Way

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Sadly, the pension crisis is not new.

It's been building for decades, and there's not a damn thing you can do to stop it.

You can, however, use it to your advantage now that you know it's coming... ahead of time.

In fact, you can use the American pension crisis to become fabulously wealthy, and I'll come back to that in a moment.

First though, let's talk about why this crisis could explode by Halloween, only 75 days from now.

Chances are you know all about "alternative investments." That's what Wall Street's Armani Army calls any investment that does not fit into their traditional stock- and bond-based investing models.

Individual investors typically use 'em to minimize risk on the theory that spreading investments around is a way to decrease risk (which is terribly flawed thinking I'll explain another time).

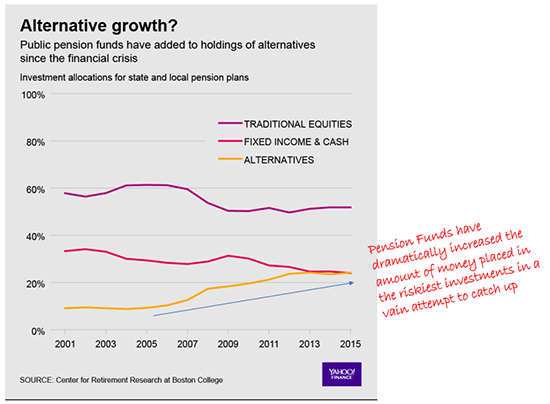

Institutions, however, use alternative investments to boost performance because they are trying to make up for the $6 trillion in underfunded liabilities I've just told you about.

The sales pitch is deceptively simple and akin to financial catnip for beleaguered fund managers desperate to kick the can before this blows up on their watch. In fact, I used to see it all the time at Wilshire Associates back in the day. Investment managers would tromp through our conference rooms daily, trumpeting how alternative investments would boost returns by investing in all sorts of exotic hedge funds, partnerships, real estate, music royalties, derivatives... you name it.

More often than not, performance never materialized and the fees... well, let's just say "high" was an understatement.

Pension plans are already defaulting left and right, and now, promises made to retirees are being shattered. But it’s not too late to tap into this financial defense strategy - as long as you arm yourself soon.

A rational person would ask "why?" and stop investing until the situation changed for the better. But guaranteed pension plans can't do that because they have to provide a certain amount of retiree income every year.

Like a drug addict craving his next high or a gambler who must bet larger and larger amounts of capital using a "Martingale" strategy to make up for a small initial loss, they're hooked.

So, these funds constantly take on more and more risk via increasingly speculative investments in a feeble attempt to make up the "gap" between the amount of money their funds can invest and the amount of money they have to return to retirees every year.

You can see that quite clearly in the following chart from the Center for Retirement Research, which reports that allocations went from only 9% of total assets in 2005 to 24% in 2015 – an increase of 2.6x.

And remember the part about being addicted?

A 2017 study by Coller Capital found that 23% of plan administrators expect – unbelievably – to add to alternative investment allocations in the next year and to private equity deals specifically, as reported by the Financial Times. Only they won't find the high returns they crave.

Returns will actually go down because all that money will compress returns as greedy funds pay more for the same investments at a time when the markets are trading at or near all-time highs. And that makes the problem worse.

Fund managers will have to cannibalize the very investment funds they're counting on to deliver the pension benefits they have to pay. It's like a snake swallowing its own tail.

The pile of investments at their disposal, in turn, dwindles, which means they'll have less to invest. So, they'll try to make "up" the gap by taking on even more risk in pursuit of still higher yields.

My fear is that the situation is already so bad that they start actively selling stock and bond investments to raise the cash they need to meet already reduced payouts to retirees. That means income drops because they're "robbing Peter to pay Paul," as the old saying goes.

It's the kind of nightmare that could make the crash of 2008 – when the S&P 500, the Dow Jones Industrial Average, and the Nasdaq tumbled by about 50% in only a year and a half – look like a cakewalk.

A single major pension fund default could set the entire thing off... and there are a whopping 11 ready to fail, as I noted this past April.

That's enough about that, though. I have no interest in ruining your day.

Actually, the reverse is true.

Here's the Good News

Massive market crashes can make the few people who know about the crash ahead of time fabulously wealthy because they know how to protect their money and which moves to make for maximum profits before the dust settles.

Back in April, we talked about how pension funds don't have the cash on hand needed to pay this month's checks, let alone those 25 years down the line. Now, you understand one of the primary reasons why.

The next part is, admittedly, my favorite.

What you can do about it.

Look, I'm a money guy, and crises like the one we're talking about today are damn scary because the shock waves they create will last for years. However, massive market drops are also one of the single biggest profit-generating, wealth-creating opportunities you will ever see in your life.

Contrary to what many investors think, there's plenty you can do to protect your money AND capture the huge profits that the vast majority of investors will miss (again) – just like they did in 2000 when Internet stocks blew up, or again in 2008 when the Global Financial Crisis exploded.

I've laid it all out in five guides that will take you through the specific steps you can take to sidestep the entire mess to build real, independent financial security. That way, you can laugh all the way to the bank when the you know what hits the fan only 75 days from now.

In the meantime, start double-checking the trailing stops on every investment you have.

We're going to use those to harvest profits and buy the very specific recommendations with huge profit potential that most investors will miss simply because they won't believe what's happening.

... again.

As always, I will be with you EVERY step of the way.

How to Safely Guide Your Money Through the Worst of This Market Disaster

Did you know some of the world’s biggest fortunes have been built during some of the most appalling market conditions?

It sounds contradictory…

But all you need are the right tools – and the uncensored truth the mainstream media doesn’t want you to know.

See, the incompetent and corrupt people who run some of America’s largest financial institutions are only a few weeks away from bringing the U.S. economy crumbling down.

And they don’t want you to know the truth until it’s too late.

But by arming yourself with the right knowledge today, not only will you and your money be shielded from this market storm – you could also start seeing explosive profits.

And if you make the right moves now, you could make more money in less time than you ever thought possible.

But you don’t have much time left to take action.

And once this wave of destruction hits, you’ll wish you had seen the signs while there was still time to do something about it.

The post Halloween May Be More "Trick" Than "Treat" This Year appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.