I don’t think it’s the only cause of the volatility we’re seeing now, but the global markets are clearly worried about the escalating war of words raging between the United States and North Korea.

It’s getting ugly, it’s got investors worried, and I don’t expect it to subside anytime soon. When the media gets their hooks into a story like this… well, we’re not likely to catch a break in the pace of ‘round-the-clock news.

Unfortunately for most investors, making significant (read: expensive) investing and trading decisions based on emotion and news cycles is one of the fastest, most surefire ways I know of to lose money.

So this makes for a great “Trading 101” lesson, and even better, it’s the perfect opportunity to put on some protective profit plays on a collection of solid buy-and-hold stocks.

Get Protection and Profit Potential with LEAPS

Before the latest threats from Kim Jong Un came in, and in response to North Korea’s ongoing intercontinental ballistic missile (ICBM) testing and violations of United Nations (UN) resolutions, the UN Security Council unanimously passed a resolution imposing new sanctions on North Korea.

They’re intended to put a serious squeeze on North Korea’s coffers. These are the strongest sanctions ever imposed, targeting what few legitimate exports North Korea has and prohibiting countries from hiring any additional North Korean workers.

As you saw, North Korea's immediate response was, "the U.S. mainland will sink into an unimaginable sea of fire," and there are reports now claiming that it has the capacity to launch a miniature nuclear warhead inside of a missile.

Now, in spite of heated exchanges between U.S. President Donald Trump and the North Koreans, the fact of the matter is that people in the U.S. government and military are doing everything possible to de-escalate and protect.

That means defense companies are going to be seeing a continued increase in their sales and revenue.

So they’re definitely the place to park some money, both to hedge against a volatile market in which plenty of other stocks could sink, and to make some real money while defense stocks buck sentiment to soar.

And according to my Money Calendar, these are the top eight defense stocks trading at or near their 52-week highs…

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Now, like I said, this situation is unlikely to just go away; it is likely to continue for some time.

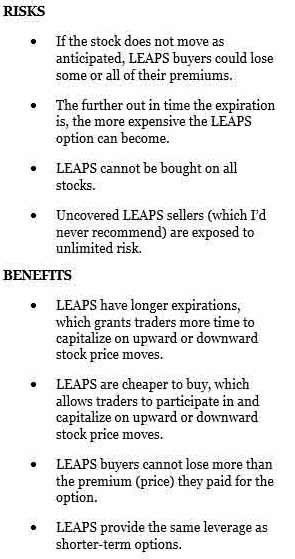

That’s why a short-term strategy won’t do much good. This is a time to take the long view, with Long-Term Anticipation Securities (LEAPS) options.

Here's how they work…

Now, if you don’t have your options-trading clearance from your brokerage yet, or if you’re up for a little “excess return” to juice your gains, a really great, though non-optionable, exchange-traded fund (ETF) to play is the iShares U.S. Aerospace and Defense ETF (NYSE Arca: ITA).

This is easily the largest defense-focused ETF by assets and, although it’s currently close to all-time highs, you can reasonably expect it to tack on even more gains as the United States and North Korea face off. The best part is, it holds all eight of the stocks I listed above.

As always, don’t trade on emotion or news cycles, and talk to a certified financial professional about what’s best for your specific needs and risk tolerances.

Up Next: This Is the Fastest Way to Make Money I've Ever Seen

I love showing readers how they can quickly double their money. And now I want to show you a way to cash in on triple-digit winners week after week.

You see, I've uncovered a pattern even Wall Street traders can't see. This unusually lucrative pattern only appears in the top 2% of stocks. And its unprecedented moneymaking power gives you the chance to double your money in four days or less.

I've been using it to find gains like 100% on RTN in one day, 100% on BIDU in one day, 120.93% on MS in two days, and 124% on ABBV in one day.

Even better, you'll never need more than $500 to get in on these plays.

This is the fastest way to make money I've ever seen. So if you want a shot at extra cash this week (and every week), click here now to learn more…

The post The Best Eight Stocks to Own Amid North Korea Fears appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.