Last week, I showed you the two sectors that have made consistent, positive gains between Jan. 1 and Jan. 19.

While that's good to know, it's not everything...

And that's exactly why I'm going to reveal the two companies that could hand you the most lucrative opportunities this month. Now let's get started...

How the Straddle and Strangle Strategies Can Lead to Profits This Season

Since the start of the 20th century, data suggests that small-cap stocks are more prone to a "January Effect" than mid or large caps. I also found that this shift usually happened around the middle of the month.

If we're looking for a bullish pattern to play around the so-called "January Effect," it's definitely not during the first five trading days of the year - or even during the first 10.

There's something else going on...

As I mentioned, the Healthcare Select Sector SPDR ETF (NYSE Arca: XLV) and the Materials Select Sector SPDR ETF (NYSE Arca: XLB) are the only two ETFs in the S&P 500 that are providing majority bullish returns on investment (ROI). But that's not the full story. We need to know which companies to play in each of these ETFs.

We want to look for the stock in each fund that carries the most "weight," the company with the most gravity. After all, it's usually the case that as the biggest stock goes, so too does the entire ETF.

So, in that case, we're looking at Johnson & Johnson (NYSE: JNJ) in XLV and DowDuPont Inc. (NYSE: DWDP) in XLB.

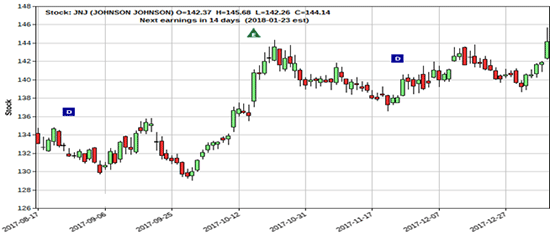

Currently, Johnson & Johnson is trading at or near its all-time highs (see chart below).

And, not to be outdone, DowDuPont is also trading at its highs (see chart below).

Although there is data to support the January Effect pattern theory in a general sense, I don't think this is it.

Not only are both companies large caps, the data also show that they continue their upward momentum long after the first five trading days of January. So there's another correlation going on here - another "effect" that we need to keep an eye on.

Beginning Jan. 15 and lasting until the end of February, there are about 50 S&P 500 companies releasing their fourth-quarter 2017 earnings results every single week. And two companies reporting right in between that range are - you guessed it - Johnson & Johnson and DowDuPont...

This is the real "effect" in January that we need to pay attention to because it will lead to major profits. This is what's called the "Earnings Effect."

The Night Trader's Secret: A former Wall Street insider just revealed a new strategy for executing night trades that could set you up for potential $850, $2,250, or $6,775 paydays – overnight. Click here.

As companies begin to report their numbers from the last quarter of 2017, the results will dictate whether these current sky-high market prices and valuations are justified. We're falling right into the old investing adage of "buying the rumor and selling the news." And the data have shown that the Earnings Effect has definitely been coming into play in January for the last 10 years.

How these companies report will speak volumes about the current valuations.

But that also speaks to the risk in trading options through earnings season. A company could get great press leading into its earnings report (the rumor), but then report worse earnings than expected (the news), which generally causes a stock to tank.

Or a company could get horrible press leading up to its report, then wind up beating expectations.

So far this season, financial news networks have expressed confidence that, in general, companies will beat their earnings expectations by a larger margin than usual.

Johnson & Johnson and DowDuPont are no different. Historically, their value should increase this month. And analysts' expectations are positive. But that's still no guarantee, so we need to be smart about how we play the market at this time.

And the best way to do that this earnings season is with the straddle and strangle...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

1. The Straddle

- What it is: An options trading strategy that dictates buying an at-the-money (ATM) call and an ATM put with the same strike prices and expiration dates - at the same time, on the same order ticket

- When to use: During high market volatility and during earnings season

- How we profit: When the stock (or other underlying security) moves either up or down

- Maximum risk: The cost of both options - call and put

- Maximum reward: Unlimited

- Pre-report straddle strategy: Exit before the earnings report comes out

- Post-report straddle strategy: Exit within a few days after the report comes out

2. The Strangle

- What it is: This is similar to a straddle, but there's less upfront cost; you buy an out-of-the-money (OTM) put at a lower strike price than the OTM call that you buy, but with the same expiration dates - at the same time, on the same order ticket

- When to use: During high market volatility

- How we profit: When the stock (or other underlying security) moves either up or down

- Maximum risk: The cost of both options - put and call

- Maximum reward: Unlimited

With these strategies, we're able to "buy and sell" both the news and the rumors on the companies that will be reporting their 2017 fourth-quarter earnings results within the next few weeks. As I mentioned, Johnson & Johnson and DowDuPont seem like the best cases, as they've led their respective sectors in positive gains every year for 10 years during this period. And with the straddle and strangle methods, you get to nearly maximize your profits while significantly lowering your risk.

As we get closer into the thick of earnings season next week, the market should remain bullish as continued optimism pushes valuations and equity prices higher.

For now, I'm going to be more bullish than bearish for the remainder of January as both the Earnings Effect and my Money Calendar support the outlook.

And with the straddle and strangle strategies, we're able to protect ourselves on both sides of any options trades.

If You Like Fast Cash, You Don't Want to Miss This

I love fast money. That's why I've been working on a new invention. It's a way to get rapid-fire profits in your hands week after week.

I'm talking about trades you can make from anywhere, even right on your phone, in four days or less.

The pattern behind these quick paydays appears every single week. And I'm the only one who knows how to find it.

I've used it to show my readers top gains like 100% on RTN in one day, 100% on BIDU in one day, 120.93% on MS in two days, and 124% on ABBV in one day.

If you hope to find yourself with a pile of extra cash in your pockets, click here to learn more...

Tom Gentile is America's No. 1 Pattern Trader, and for good reason. Since 2009, he's taught over 300,000 traders his option trading secrets, including how to find low-risk, high-reward opportunities. Now he's sharing that insight with you. To get started, just click here – you'll get Tom's twice-weekly Power Profit Trades delivered directly to your inbox, free of charge.

The post These Are the Top Two Stocks to Play in the S&P's Two Most Profitable Sectors appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.