In nine days, the final round of the French presidential election will take place between Emmanuel Macron and Marine Le Pen.

Now, the markets are clearly betting on a Macron win.

But no matter the outcome, this election could be huge for your portfolio...

And here are two ways to do just that...

Why France Matters to Your Portfolio

You might be wondering why the political developments in France should even matter to your portfolio, and the answer is simple: volatility.

In a nutshell, volatility reflects uncertainty in the markets about the change in value of a security (stocks, bonds, commodities, ETFs) and how fast or slow that change is taking place. When volatility is higher, it means the price of the security can move higher or lower pretty dramatically over a relatively short amount of time. On the flip side, when volatility is lower, it means the price of the security will remain pretty steady over a longer period of time, and any changes in price will be relatively small.

All the news surrounding the French election has already been affecting market volatility. For example, Goldman Sachs Group Inc. (NYSE: GS), Citigroup Inc. (NYSE: C), and Bank of America Corp. (NYSE: BAC), as well as other banks, jumped higher after the preliminary second-round results came in last Sunday.

We're also in the middle of second-quarter earnings season, with roughly 70% to 80% of S&P 500 companies still due to report over the next two weeks. Earnings already causes volatility to increase, so when you combine a large batch of earnings announcements with the French election results, you're looking at the potential for even more dramatic price moves within the next nine days.

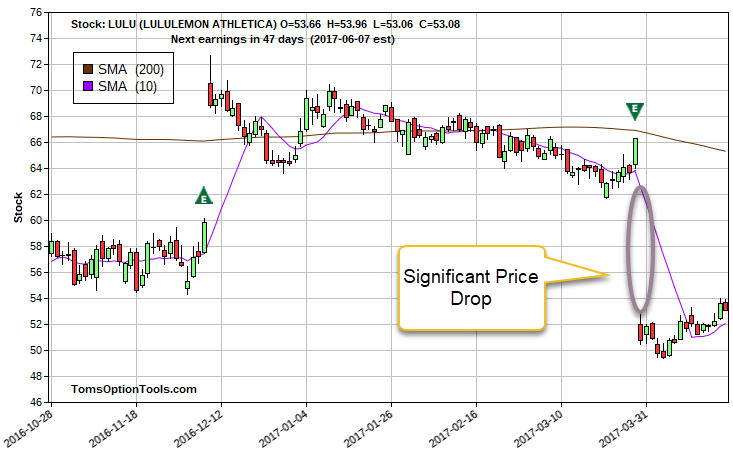

The other player in this mix is the retail sector. With what seems to be an endless stream of new store closures, retail stocks have been taking quite the beating. Just look at the price volatility heading into and out of earnings on just two of the bricks-and-mortar stores that have been struggling for some time...

Lululemon Athletic Inc. (NYSE: LULU):

Michael Kors Holdings Ltd. (NYSE: KORS):

In both cases above, volatility increased going into and immediately after earnings. Typically, volatility decreases for a short time after earnings announcements, but nothing in retail has given me reason to change my mind about the continued challenge retail stocks will have going forward.

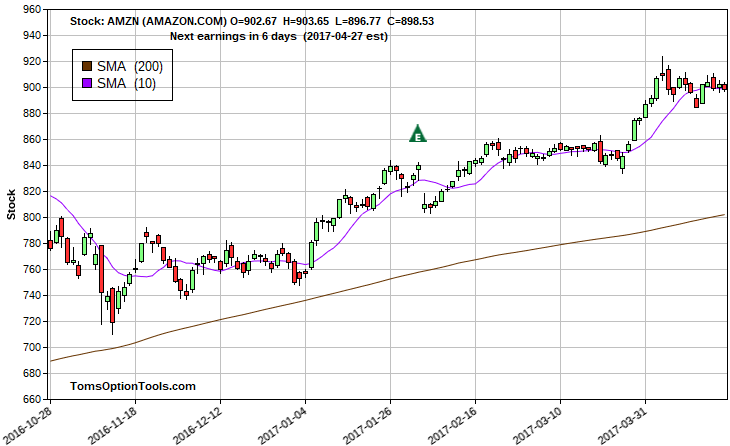

Of course, there is one retailer that isn't suffering: Amazon.com Inc. (Nasdaq: AMZN). This should come as no surprise to you, as this guy's pretty much a leading reason why the old bricks-and-mortar store is dying out. Right now, the stock is trading near all-time highs, with earnings coming out April 27.

Now, AMZN has climbed higher regardless of how good earnings are.

However, the same can't be said for many, many others. And the volatility we're sure to see after the French election could only make things worse for these stocks - and your portfolio.

But There Are Two Ways to Turn This Volatility into Cash...

1. Straddle

What it is: An options trading strategy where you buy an at-the-money (ATM) call and an ATM put with the same strike prices and expiration dates - at the same time, on the same order ticket

When to use: In high volatility and during earnings season

How to profit: When the stock (or other underlying security) moves either up or down

Maximum risk: The net debit paid (cost of both the call and put)

Maximum reward: Unlimited

Pre-earnings straddles: Exit before earnings come out

Post-earnings straddles: Exit within a few days after earnings come out

2. Strangle

What it is: A cheaper alternative to the straddle, where you buy an out-of-the-money (OTM) put at a lower strike price and an OTM call at a higher strike price with the same expiration dates - at the same time, on the same order ticket

When to use: In high volatility

How to profit: When the stock (or other underlying security) moves either up or down

Maximum risk: The net debit paid (cost of both the call and put)

Maximum reward: Unlimited

And in a couple days, I'll show you another major "event" coming that could help or hurt your portfolio just as much as the French election.

Until then...

Don't Miss: This investing strategy has delivered 217 double- and triple-digit peak-gain winners since 2011. And you can get access for just pennies a day. Learn more…

The post Two Ways You Can Profit from the French Election appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.