If you're not worried about the stability or solvency of a lot of American banks, you should be.

New data from the FDIC (Federal Deposit Insurance Corporation) shows that while things may have stabilized since the March banking panic, they are not getting better; they are actually getting worse. FDIC Chairman, Martin Gruenberg, starts off his opening comments on the deposit insurer's second quarter 2023 Quarterly Banking Profile saying, "Despite the period of stress earlier this year, the banking industry continues to be resilient."

However, just two sentences later, he concludes his opening remarks with, "But banks reported tightening net interest margins and funding pressures for a second consecutive quarter."

As is typical for any capital markets or banking regulatory body, or in the case of the FDIC, the organization that is supposed to "insure" or backstop trillions of dollars of customers' bank deposits, the mixed results apparent in the Q2 Profile were sugarcoated wherever possible with upbeat assessments about improving metrics. But there's just not enough lipstick in the FDIC's boudoir to make the ugly banking metrics look pretty.

Of course, that's why I'm here: to tell you how ugly some glossed-over metrics really are, why depositors and investors should be worried, and what to do about it.

The problem isn't "transitory;" it's structural.

Remember when Fed Chairman Jerome Powell, from Q1 through Q3 2021, termed the inflation spike the country was experiencing as "transitory?" It didn't take long - by the end of Q4 2021, in fact - for Chairman Powell to acknowledge that "transitory" was not likely the trajectory of inflation. The same is true for what ails America's banks. If inflation was in fact transitory, the Fed wouldn't have had to raise the fed funds rate from zero to a high, so far, of 5.5%, and banks would be in great shape.

They're not. Because inflation appears to be more structural, i.e., embedded in the economy, to continue to combat inflation, the Fed is going to have to keep raising rates or, at a minimum, keep them "higher for longer." That's worrisome because higher rates embed hard-to-overcome, sometimes impossible, structural issues into banks after years of artificially manipulated low rates.

When interest rates were low, having been manipulated lower for a prolonged period, and finally brushing up against the "zero-bound" in the U.S. - while they were actually negative in Europe and other areas due to the plague of Covid-19 - banks were flush with deposits from customers and corporations who had no use for their money for a considerable time.

Banks turned those trillions of dollars of "liabilities" (deposits are liabilities because they can leave) into "assets" by buying lower and lower-yielding U.S. Treasury securities and mortgage-backed securities. And because the yields, or interest offered, on instruments like Treasuries were so low, banks opted for extra yield by leveraging their holdings and buying longer-dated bonds with incrementally more yield.

With "transitory" inflation turning structural and rates getting raised relentlessly, banks now face a frightening new profile. The low-yielding bonds and mortgage-backed residential and commercial securities they bought using a lot of leverage are all underwater now. "Underwater" means they are sitting on losses on all the assets, including loans they made, that have yields lower than what equivalent maturity fixed-income assets or loans offer today.

And as if that's not bad enough, the trillions of dollars of deposits, those liabilities banks used to buy all those low-yielding assets, are living up to their name and moving to higher-yielding venues, like money market funds and other banks' high-yielding CDs (Certificates of Deposit).

To compensate for the departing deposits, banks are acquiring deposits in the "brokered deposits" marketplace, which I've written about extensively, and are borrowing or obtaining and paying for "advances" from their regional Federal Home Loan Banks.

Some of the sugarcoating in the FDIC's Q2 Profile sounds like this: "For community banks, second quarter net income increased from the prior quarter as higher noninterest income and lower losses on the sale of securities more than offset lower net interest income and higher noninterest expense."

But reading between the lines, you'll catch on to the real reason net income increased: from "lower losses on the sale of securities." That's because they weren't selling securities at a loss after what happened in the first quarter; they are simply sitting on the losses and not "realizing" them, and are reassigning securities in their available-for-sale portfolios into their held-to-maturity portfolios to bury them deeper in their balance sheets.

The hard facts are there too. The report states, "The industry's net interest margin declined for the second straight quarter, though by a lower amount than last quarter. Although the interest rates earned on loans increased more than the rates paid on deposits, the interest rates banks paid on non-deposit liabilities, such as Federal Home Loan Bank advances and borrowings from the Federal Reserve's Bank Term Funding Program, increased by a larger amount, pushing up the overall cost of funds for the industry."

Regarding smaller banks, the report notes, "Community banks reported the same increase in deposit costs as the industry but reported a lower increase in loan yields, which contributed to a greater decline in the net interest margin than for the industry."

Chair Gruenberg noted in his remarks on the Profile, "As I indicated earlier, the reason for the decline in the industry's net interest margin is that the cost of non-deposit liabilities, such as Federal Home Loan Bank advances and borrowings from the Bank Term Funding Program, increased significantly in the second quarter. The cost of non-deposit liabilities rose by 87 basis points to 4.0 percent, driving the industry's cost of funds to exceed the yield on earning assets."

Starting to get it?

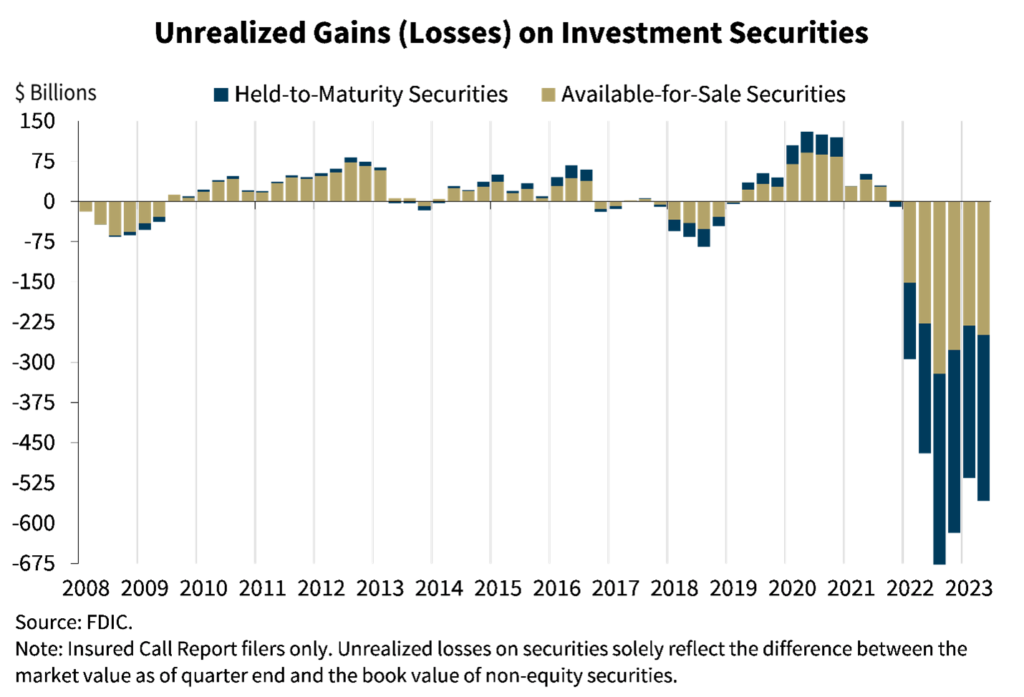

Total deposits for the quarter declined, marking 5 consecutive quarters of decline. Net income for the banking industry actually fell 12.5% in the second quarter. And unrealized losses on available-for-sale and held-to-maturity assets amounted to $558.4 billion.

If the chart below doesn't worry you, you must be made of kryptonite.

America's banks are in trouble, and their problems are structural, not transitory. The only way banks come out of this hole is if interest rates immediately and precipitously decline. As a friend of mine likes to say, "good luck with that."

There are many individual banks that have seen their stock prices rebound, as if the rate-hiking regime and banks' troubles are transitory, but are about to plummet back down to earth. We're planning to play them to the downside in my subscription services - you can get my full briefing on that here.

For those of you looking to profit from the next downturn in banks, the S&P Regional Banking ETF (KRE) is a good place to explore for potentially very profitable put option spreads. I say, go for it.

The post We're Headed for a Second Banking Crisis - Here's What to Do appeared first on Total Wealth.

About the Author

Shah Gilani boasts a financial pedigree unlike any other. He ran his first hedge fund in 1982 from his seat on the floor of the Chicago Board of Options Exchange. When options on the Standard & Poor's 100 began trading on March 11, 1983, Shah worked in "the pit" as a market maker.

The work he did laid the foundation for what would later become the VIX - to this day one of the most widely used indicators worldwide. After leaving Chicago to run the futures and options division of the British banking giant Lloyd's TSB, Shah moved up to Roosevelt & Cross Inc., an old-line New York boutique firm. There he originated and ran a packaged fixed-income trading desk, and established that company's "listed" and OTC trading desks.

Shah founded a second hedge fund in 1999, which he ran until 2003.

Shah's vast network of contacts includes the biggest players on Wall Street and in international finance. These contacts give him the real story - when others only get what the investment banks want them to see.

Today, as editor of Hyperdrive Portfolio, Shah presents his legion of subscribers with massive profit opportunities that result from paradigm shifts in the way we work, play, and live.

Shah is a frequent guest on CNBC, Forbes, and MarketWatch, and you can catch him every week on Fox Business's Varney & Co.