The arrival of Apple Pay means the mobile payments war will now seriously heat up.

The heft of Apple Inc. (Nasdaq: AAPL) and the fact that it was able to bring so many major players on board, from the big banks to the credit card companies, has put a spotlight on mobile payments.

And deservedly so.

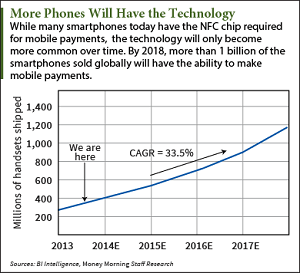

Mobile payment transactions in the U.S. alone totaled $1.8 billion last year. They will more than double in 2014 to $4.5 billion, according to research firm BI Intelligence. They'll more than double again in 2015 to $15.4 billion.

By 2018, BI Intelligence projects that U.S. consumers will make $189 billion in mobile payments.Numbers like that are attracting a lot of powerful companies to fight over the spoils. Big profits await the winners.

Big profits also await investors who spot the mobile payments winners now...

Earlier this week we told you about the losers in the mobile payments war. Today we're going to talk about the winners.

Apple Takes the Lead in the Mobile Payments War

Any discussion of the mobile payment war winners necessarily starts with Apple.

Despite Apple Pay's limited reach - it only works with the new iPhone 6 - the service is going into the hands of a very well-heeled demographic.

For example, a June comScore survey said the median income of a U.S. iPhone owner is $85,000. That's more than twice the median income for all U.S. full-time workers - $41,080, according to the U.S. Bureau of Labor Statistics.

That's a demographic retailers love.

It's what gave Apple the power to enlist the big banks like Bank of America Corp (NYSE: BAC) as well as Mastercard Inc. (NYSE: MA) and Visa Inc. (NYSE: V).

That high-profile demographic and Apple's focus on security give Apple Pay plenty of ammo to stay on the front lines of the mobile payments war. Apple will lose the market share battle, but that's okay. Apple has always been fine with skimming the best customers off the top.

And that brings us to how Apple makes money from mobile payments...

Apple Pay does bring in a little money itself in the form of a 0.15% fee the banks are paying in return for the added security.

But that's not where Apple will make money. Apple Pay is just one more tempting feature that adds value to the iPhone.

Just about everything Apple does these days is designed to make the iPhone a more compelling purchase. And rightly so - the iPhone rakes in more than half of the company's revenue and profits.

Apple Pay will sell more iPhones. It's that simple.

But despite its influence, Apple won't dominate mobile payments. Already some winners have begun to emerge.

Finding the Early Winners in the Mobile Payments War

Here's the early leaderboard in the mobile payments war:

Payment Startups: Apple actually wanted to buy credit card processor Square for $3 billion right before it announced Apple Pay. But Square said the offer was too low. Now Square is building a point of sale (POS) system that will take Apple Pay, credit cards, and even the digital currency Bitcoin. Keep an eye out for a Square IPO in the next year or so, if it doesn't get acquired.

Another startup winner is payment processor Stripe Inc. This company got a big win as the behind-the-scenes payments technology for Apple Pay. Stripe also has similar deals with Twitter Inc. (NYSE: TWTR) and Alibaba Group Holdings Ltd (NYSE: BABA) affiliate AliPay. As with Square, expect an IPO or acquisition within the next year.

The Credit Card Companies: For now, the credit card companies are in the loop, and their lucrative interchange fees remain secure. And just as Apple Pay partnered with Mastercard, Visa, and American Express Co. (NYSE: AXP), so will any Android-based mobile payments system.

Bitcoin: Bitcoin is ideal for mobile payments, but is a technology in its infancy. As Apple Pay and other mobile payment systems catch on, using Bitcoin won't seem so alien. And the spread of all-purpose POS devices (like Stripe is building) will make it easier to use Bitcoin.

PayPal: This eBay Inc. (Nasdaq: EBAY) subsidiary has struggled to make a dent in the mobile payments space, but the stars may be aligning at the right moment for the leader in online payments.

PayPal is a prime candidate to create the dominant Android mobile payments system. Remember, Android runs on over 50% of U.S. smartphones and about 85% of smartphones worldwide. It's a massive opportunity.

PayPal will probably need a hardware partner like Samsung to pull it off, but should have suitors lined up at the door. And given that eBay plans to spin PayPal off, an acquisition is also a possibility. In both scenarios, PayPal wins.

But what happens with Android depends on what Google does. Google Wallet remains a wild card.

The Google Wallet Factor

Because Google controls the Android software, it logically should control any Android-based mobile payments system.

And it has tried. Google's mobile payments system, Google Wallet, launched way back in 2012. But Google Wallet has not caught on.

Google seems to think it's a visibility issue. The company is planning a new marketing campaign in the wake of the Apple Pay launch.

But Google Wallet faces a bigger obstacle than customer awareness.

Whereas Apple Pay goes to great pains to avoid collecting any user data, Google Wallet makes it a point to do so. Customers apparently have not been eager to use a mobile payments service that tracks their shopping habits.

But that's Google's best option for monetizing mobile payments. Data collection is part of the company's DNA.

It's a dilemma that Google needs to solve if it hopes to be a serious contender in the mobile payments war. Otherwise, PayPal - and others - will seize the initiative.

The Losers: Whenever you have a disruptive new technology, there are both winners and losers. Yesterday we looked at the first wave of losers in the mobile payments war. Investors need to treat these companies with caution...

Follow me on Twitter @DavidGZeiler.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.