The seemingly impenetrable Apple Inc. (Nasdaq: APPL) was hacked through the app store in late September. Dozens of apps infected iPhone and iPad users with malware.

WeChat, one of the affected apps, has 600 million users who could have been exposed to the breach.

It is massive hacks like this that are why Money Morning Chief Investment Strategist Keith Fitz-Gerald just re-recommended this cybersecurity ETF to readers...

PureFunds ISE Cyber Security ETF (NYSE: HACK) is an exchange-traded fund. The fund tracks the performance of companies across the globe that are direct service providers for cybersecurity.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

While Apple's breach provides momentum to increase the performance of this ETF in the short term, the cybersecurity sector is looking at years of growth right now...

The research firm Cybersecurity Ventures projects the cybersecurity industry will grow from $77 billion in 2015 to $170 billion by 2020. That's a 54% increase over the next five years.

Money Morning Tech & Defense Specialist Michael A. Robinson highlighted a specific growing source for cybersecurity demand.

"Cybersecurity will remain a growth field for years to come. According to a report from Market Research Media, the federal government will spend $65.5 billion on cybersecurity between 2015 and 2020," Robinson wrote last month.

The government demand is important. But it's not the only reason to consider adding HACK to your portfolio. There are three reasons to buy into this cybersecurity ETF now...

HACK Cybersecurity ETF Cashes In on Rising Breaches

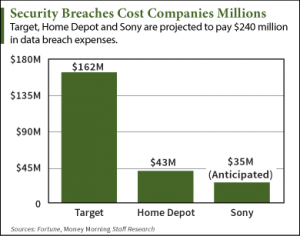

The first reason to consider this specialty ETF is the rise in data breaches and the cost to the global economy.

The first reason to consider this specialty ETF is the rise in data breaches and the cost to the global economy.

A report by software company McAfee in June 2014 projected that cybercrime costs the world $400 billion. A maximum estimate is even scarier: $575 billion.

Data breaches were up 23% from 2013 to 2014, according to the Identity Theft Resource Center. The demand for cybersecurity isn't limited to the government: countries, companies, and individuals all have a need for protection.

Cybersecurity is now a necessity. It is no longer a niche industry.

HACK ETF Offers Safer Exposure to Cybersecurity Investments

Investing in any single company will always have its risks. Cybersecurity companies can be even riskier.

It's a younger sector where newer companies utilizing emerging technology have yet to provide investors with a history of successful performances.

But this cybersecurity ETF isn't just an investment into one company...

Fitz-Gerald stated, "HACK is made of 32 cybersecurity companies chosen because they represent companies fighting breaches representing 92% of all data breaches."

This diversification limits the risk of investing in just one company. You increase your exposure to revenue growth from the major players in the industry. You're also limiting yourself to the ups and downs of one particular company.

There's also a sneaky multibillion dollar play in the cybersecurity sector that can help the HACK ETF skyrocket...

Buyouts Offer Cybersecurity ETF Investors an Added Bonus

Cybersecurity companies offer an established infrastructure for technology giants not looking to start developing systems from scratch.

Cybersecurity companies can be used directly by a company for its own cybersecurity operations, or the cybersecurity technology can be sold as a product of its own.

Instead of building a competitive system, Intel Corp. (Nasdaq: INTC) bought the antivirus company McAfee for $7.6 billion in 2010. In July 2015, Microsoft Corp. (Nasdaq: MSFT) completed a buyout of cloud security provider Adallom for $320 million.

Share prices tend to shoot up when a company is acquired. In recent takeover news, a site pretending to be Bloomberg posted that Twitter was acquired for $31 billion in July. The report was fake, but Twitter's stock price rose by 8% immediately following the news.

Analysts have identified Palo Alto Networks Inc. (Nyse: PANW), FireEye Inc. (Nasdaq: FEYE), and Fortinet Inc. (Nasdaq: FTNT) as potential candidates for buyouts. PANW and FTNT are part of HACK's top 10 holdings.

Cybersecurity ETF: By the Numbers

The rest of HACK's top 10 holdings include:

- Imperva Inc. (NYSE: IMPV)

- Trend Micro Inc. (OCTMKTS: TMICF)

- Proofpoint Inc. (Nasdaq: PFPT)

- Science Applications International Corp. (NYSE: SAIC)

- Check Point Software Technologies Ltd. (Nasdaq: CHKP)

- Juniper Networks Inc. (NYSE: JNPR)

- Cisco Systems Inc. (Nasdaq: CSCO)

- Intralinks Holdings Inc. (NYSE: IL)

The HACK ETF has provided returns of 4.04% to investors since its creation in 2014.

Yahoo! Finance reports HACK's net assets are $1.16 billion as of Aug. 31. The ETF reports a P/E ratio of 27.

Follow us on Twitter @MoneyMorning and on Facebook.