"Beating the stock market" is a thriving cottage industry. There are thousands of books out there – some New York Times best-sellers – that promise to reveal that one method that just magically delivers market-crushing returns, each and every time.

The problem is… there is no "one way" to beat the stock market. Maybe if the entire market was one investor somehow moving one stock in one direction for one reason, there might be.

Besides, even if you had some luck following that "one" tactic or system, it makes no sense to use a static approach to a dynamic problem. You actually stand to lose money that way.

So forget those hundreds of "only ways" you’ve seen to beat the markets.

Instead, I’ll show you exactly what to look at to determine the direction a stock is heading, how much money you can make, and how long you have to capture those profits.

It’s a solid approach no matter how experienced you are – and one that works in any market environment.

Now let’s get to it…

Why It Can Cost You to Be a "One-Trick" Trader

One of the most commonly touted strategies in the types of books I’ve mentioned is price action trading.

Price action trading is when you basically rely on a stock’s charted price movements. It’s a trading technique that’s become especially popular among beginner traders and stock investors because it has only one ingredient: price.

As a price action trader, your focus is on where the stock is and what it may be doing in the near future. Price action traders may use technical analysis to measure where a stock is in regard to its support and resistance areas, and they may even look at technical oscillators, such as candlestick patterns. But they look at virtually nothing except price.

Price action traders tend to keep their blinders on to everything but what’s happening to a stock’s price and neglect important upcoming events and announcements, like earnings.

As we’ve seen… neglecting events like these absolutely destroys trades.

Now, price movements are even more important to options traders than stock investors due to the volatility sensitivity of the underlying stock. But when options traders only look at price action, they end up buying options that are too expensive or holding them up until expiration when time decay (also called theta) accelerates the most.

Ultimately, price action traders stand to lose the most money because they’ve locked themselves into that single-method approach to beating the markets, like being in a crashing plane with no parachute.

So don’t be that trader. Look at these three things to determine the right approach.

Price, Time Value, and Implied Volatility Are Everything

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

One of the risks a trader faces (that an investor might not) is losing your money because you’ve neglected to consider all of the factors that will make or break your trade.

That’s exactly why those "beat the markets with this single simple trick" books can set you up for short- and long-term failure. These one-size-fits-all methods fail to incorporate all of the various components that can influence, and move, the markets – especially major, shocking events, like the Brexit vote. Instead, to maximize the number and frequency of your winning trades, you’ll want to evaluate and adjust your trading strategy as necessary – the furthest you can get from the "one simple method."

Price is more important to options traders due to volatility sensitivity of the underlying stock. But it’s by no means the only thing you should pay attention to…

If you’re not aware of time value and implied volatility, you may find yourself in a situation where the stock isn’t moving in your favor, and time value as well as implied volatility are preventing your options trade from increasing in value as much as you’d like – if at all.

In order to talk about time value, we need to touch on intrinsic value first. Both go hand in hand with price.

Intrinsic value is how "in the money" a stock is compared to the option’s strike price. It indicates the value of the option if there was no time remaining to expiration and the stock was still at that price.

Time value (also called "theta"), however, is what’s left after you remove the intrinsic value from the option’s premium price. You can determine the time value of your trades by subtracting the intrinsic value from the premium. The more time until expiration, the greater the time value component of the option.

The reason time value is so important is that an option loses one-third of its time value during the first half of its life and the rest of its value as it gets closer and closer to expiration.

In its simplest form, options traders who don’t pay attention to time value don’t recognize the potential depreciation of that time value as the option gets closer to expiration.

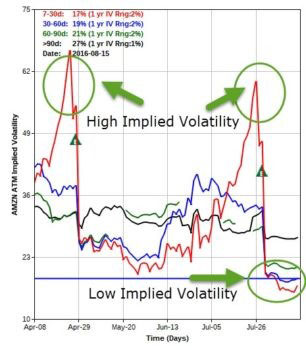

Implied volatility is the anticipated volatility of a stock (or other security). Generally speaking, it increases in bearish markets and decreases in bullish markets.

Options buyers want low implied volatility when they open their positions with the anticipation of it increasing over time. And when it does, it increases the option’s premium faster and by a larger amount so that the trade can be closed for a nice profit.

When you don’t follow implied volatility closely, you run the risk of buying-to-open an option in which the implied volatility is already too high, making it challenging for that premium to increase. And that means it’s harder for you to cash in on the trade.

Take a look at the chart below and see where the implied volatility is the highest, prior to earnings…

If you buy-to-open your option and it goes through an earnings (either good or bad) report, the implied volatility typically drops by a huge amount. This often causes a "volatility crush" that can severely reduce the value of your trade.

So you want the assessment of the stock to be one that will increase in price quickly and substantially enough to offset the decay of time and volatility.

Now there’s a formula that can calculate the percentage the stock needs to make (that’s favorable to your trade) in order for your trade to double in value, called "percent to double." My proprietary tools have this capability, and your broker may have the same. So I would suggest contacting your broker to see if they have it or if their online trading platforms have that capability.

Follow Money Morning on Facebook and Twitter.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.