The Utica shale formation hasn't gotten as much attention as some of the others, but that may be about to change as drillers home in on a "sweet spot" in southeastern Ohio that is producing staggering amounts of natural gas.

That's big news for investors on the hunt for natural gas stocks, as the companies with prime holdings in the top shale gas and oil formations stand to profit the most from the shale gas and oil boom.

That's big news for investors on the hunt for natural gas stocks, as the companies with prime holdings in the top shale gas and oil formations stand to profit the most from the shale gas and oil boom.

Last year was a major turning point for the Utica.

Wells drilled in that "sweet spot" were the main reason Ohio natural gas production more than doubled from 89.4 billion cubic feet in 2012 to 203 billion cubic feet in 2013, according to the Ohio Oil and Gas Association.

One well alone has produced 1.25 billion cubic feet of gas in 90 days, Larry Wickstrom, the former chief geologist for the Ohio Department of Natural Resources and now in private business, told the Cleveland Plain Dealer.

"Some of these wells are monsters," Wickstrom said.

The sudden increase in Utica natural gas production has turned Ohio from a natural gas importer to a natural gas exporter, with more and more pipelines being reversed. The state is headed toward an export rate of 10 billion cubic feet of gas per day - an amazing reversal from the 10 billion cubic feet Ohio used to import.

It's also touched off a construction boom in natural gas processing plants. In the past few years, 10 new facilities have been built.

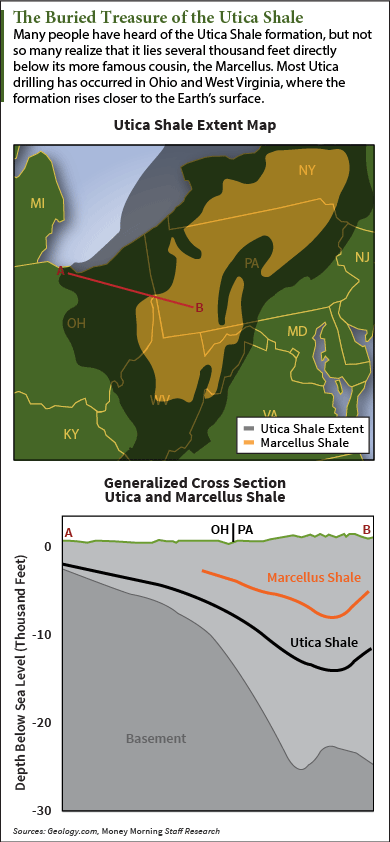

One reason it has taken longer for the Utica shale to take off is that most of it is more difficult to access than the Marcellus. That's because the Utica lies thousands of feet below the Marcellus formation (see graphic) in a geological layer about 80 million years older.

Only in the past year did the formation's full potential begin to become apparent.

One of several natural gas companies active in the region, Magnum Hunter Resources Corp. (NYSE: MHR) is calling the Utica "potentially the best shale play in the U.S."

And Gulfport Energy Corp. (Nasdaq: GPOR) recently said it expects "record production growth" in the Utica region.

And best of all, seismic tests are showing that the formation's potential has barely been touched.

"I think there will be quite a heyday once we can see these structures clearly," Wickstrom said.

It's no wonder that companies are seeking more and more drilling permits in the Utica; the number of permits issued is up more than 60% from the same time last year.

This burst of activity will pay off for several natural gas stocks as production in the Utica continues to ramp up...

Five Natural Gas Stocks That Will Profit from the Utica Shale

Here's a look at some natural gas stocks that should benefit from the Utica shale increase in production. These companies all have significant stakes in the Utica:

- Chesapeake Energy Corp. (NYSE: CHK): Chesapeake is by far the biggest player in the Utica; it owns 1 million acres and already has obtained 610 permits and drilled 249 wells. CHK saw production increase 91% in the third quarter of 2013. Chesapeake is also very active in the Marcellus. The stock closed Thursday at $29.22.

- Gulfport Energy Corp. (Nasdaq: GPOR): Gulfport is the second-most active oil and gas producer in Ohio. It holds 167,700 acres in the Utica and recently said it plans to spend $634 million this year on development in the formation. The company hopes to quadruple daily production this year. GPOR last closed at $75.16.

- Rex Energy Corp. (Nasdaq: REXX): Rex Energy is a smaller player, but is betting big on the Utica. Last year Rex added 1,200 acres and 21 drilling locations, to bring its total acreage to 21,200. The company plans to drill 11 more wells in 2014, frack 17 wells, and place 11 wells into production. REXX closed Thursday at $21.50.

- EV Energy Partners LP (Nasdaq: EVEP): EV Energy this month said it plans to drill 190 wells in the Utica as part of a joint venture with Chesapeake Energy and Total SA (NYSE ADR: TOT). The joint venture has already drilled 370 wells. In addition, EVEP has 158,000 acres in the Ohio portion of the Utica. EVEP closed at $36.68 Thursday.

- Hess Corp. (NYSE: HES): In January Hess said it planned to step up drilling in the Utica, where it owns 185,000 acres. The company said it would invest $550 million to drill 35 wells in the Utica in 2014, after spending $455 million last year. Hess is a good play on the U.S. shale gas and oil boom in general, as it is very active in the Bakken shale of North Dakota. HES closed at $88.31.

Have you invested in any oil or natural gas stocks to capitalize on the shale energy boom? Tell us about your favorite picks on Twitter @moneymorning or Facebook.

Drilling in the Marcellus may be a bit ahead of drilling in the Utica, but that doesn't mean there isn't a ton of money to be made there as well. Several studies now show the Marcellus will be the most productive shale gas play in the United States. And here are the natural gas stocks that will be first in line for the profits...

Related Articles:

- Cleveland Plain Dealer:

Utica Shale Play Smaller Than Thought but Production Is Staggering - Geology.com:

Utica Shale - The Natural Gas Giant Below the Marcellus - Columbia Business First:

Magnum Hunter's Utica Overview Calls It 'Potentially the Best Shale Play in the U.S.'

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.