Our Apple stock forecast for 2015 anticipates another good year for Apple Inc. (Nasdaq: AAPL).

Our Apple stock forecast for 2015 anticipates another good year for Apple Inc. (Nasdaq: AAPL).

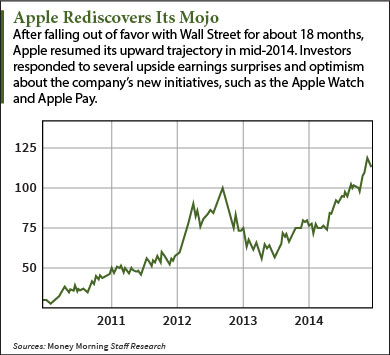

The Cupertino, Calif.-based tech giant has been on a major roll of late. AAPL stock has risen more than 40% in 2014. Its market cap of nearly $657 billion is the largest by far of any company in the world.

Now Apple is set up for record profits in 2015. Sales of the iPhone 6 show no signs of letting up, and the company has a completely new product category on the horizon in the Apple Watch.

It also has enough cash - $155 billion as of Sept. 30 - to finance its visionary strategy for years to come.

Here's the breakdown of what's fueling this bullish Apple stock forecast for 2015...

Apple Stock Forecast 2015: An iPhone Company Now More than Ever

The iPhone is by far Apple's most important product. It accounts for more than half of Apple's profits. The latest models, the iPhone 6 and iPhone 6 Plus, continue to sell almost as fast as Apple can make them.

Demand is so crazy that BMO Capital analyst Keith Bachman suspects Apple is hoarding the latest models for sale in its own retail stores. A check of third-party sellers found limited supplies of the low-end 16GB models and none of the pricier 64GB and 128GB models.

This means Apple will deliver great news to investors on Jan. 27 when the company reports Q1 2015 earnings. Sales of the iPhone could surpass 70 million units in the current quarter, which would be a 37% year-over-year increase. Depending on how well Apple's other units perform, numbers like that could increase profits by more than 20%.

Such popularity bodes well for the whole first half of 2015. Higher-than-expected sales of the iPhone 5 models helped AAPL deliver upside surprises in the March and June quarters. Look for the iPhone 6 to do the same.

And by the mid-year, Apple stock will have this new catalyst...

Apple Stock Forecast 2015: Keep an Eye on the Watch

The Apple Watch will be almost as important as the iPhone for Apple stock in 2015 for the simple reason that it's a totally new product. All the revenue and profit the Watch generates will be additive.

We know what the Apple Watch, which Cook unveiled back in September, looks like. What we don't know is exactly when it will go on sale. The earlier Apple starts selling it, the more profit it will generate in 2015.

We know what the Apple Watch, which Cook unveiled back in September, looks like. What we don't know is exactly when it will go on sale. The earlier Apple starts selling it, the more profit it will generate in 2015.

While some rumors out of Asia have the Apple Watch hitting store shelves as early as February, most signs point to spring 2015. It could arrive in April, but no later than Apple's annual Worldwide Developers Conference (WWDC) show in early June.

Apple Watch sales estimates vary widely. Piper Jaffray forecasts 10 million units sold in calendar 2015. Stifel Nicolaus is calling for 19.6 million; UBS 24 million. Morgan Stanley thinks Apple will sell at least 30 million.

Prices will start at $349, but given the three models and wide range of bands Apple plans to sell, expect a much higher average selling price (ASP). Most analysts are pegging the ASP at about $430, although it could end up significantly higher.

That makes it tough to estimate how much juice the Apple Watch will deliver, but AAPL should see at least $4.5 billion in new revenue. And with projected margins at about 40%, we're talking about a minimum of $0.30 more in earnings per share (EPS).

Given AAPL's track record, don't be surprised if the Apple Watch adds $0.50 or more to the company's earnings in 2015. And that should translate to $5 to $10 added to the AAPL stock price.

Apple Stock Forecast 2015: Don't Bury the iPad Just Yet

While weakening iPad sales have been the biggest negative for Apple this year, there's a big reason for that trend to reverse in 2015.

Apple has a deal with International Business Machines Corp. (NYSE: IBM) to make iPads more attractive to business customers. The companies announced the news in July, and results of the deal just started to arrive this week.

Apple has never had much of a footprint in the enterprise, but the partnership with IBM figures to change that in 2015. It's a bold move for AAPL, and should be enough to get iPad sales growing again.

The goal of the partnership is to combine IBM's expertise in Big Data and analytics with Apple's mobile platform, primarily the iPad.

The partnership unveiled its first 10 apps yesterday (Wednesday). One app, Incident Aware, is an aid to law enforcement. It provides real-time access to maps and video feeds.

Two airline-focused apps help pilots improve fuel efficiency and provide data to crew members on baggage, re-booking services, and special in-flight offers.

With more of these apps, IBM and Apple plan to make the iPad and iPhone into a versatile tool of mobile computing. The companies have targeted the retail, healthcare, banking, travel, and insurance industries, among others.

A rumored "iPad Pro," which would sport a bigger screen - 12.2 inches versus the 9.7-inch of the current iPad Air - could also debut in 2015. Such a model would come with premium pricing and high margins, and be aimed squarely at business customers.

The iPad is Apple's dark horse for 2015. Keep an eye on it.

Apple Stock Forecast 2015: Building Up the Ecosystem

Virtually everything Apple announced in 2014 serves one higher purpose: To strengthen the Apple ecosystem.

As Apple's ecosystem grows and improves, it makes the company's hardware - which generates most of the profits - that much more desirable.

Here's how Apple's 2014's developments will benefit the ecosystem in 2015:

- One thing to expect early in the year is a streaming music service based on Apple's $3 billion purchase of Beats Electronics. The revenue from a streaming service - even if Apple lowers the price to $5 a month - would help offset slumping iTunes music sales.

- Apple Pay, launched this fall, is already thriving. The mobile payments service will only become more entrenched in 2015. Apple Pay not only gives people another reason to buy an iPhone, but eventually could generate a $500 million revenue stream.

- Once the Apple Watch debuts, we'll see more of what Apple's HealthKit software can do. Remember, one of the key selling points of the Watch is its ability to monitor your health and make sense of the data.

- In October, Apple finalized its HomeKit platform, which allows third parties to build home automation products that will interact with the iPhone, iPad, and Apple TV. Expect this platform to develop much further in 2015.

- Apple is also likely to further integrate the Mac operating system with the iOS software that runs its mobile devices. This year's "Yosemite" update to Mac OS X added several integration features. Apple's goal is to let customers move totally seamlessly between its Macs, iPhones, and iPads.

What you won't see is any major developments with Apple TV. Here Apple is waiting for a more thorough disruption of the old model before it jumps in.

Apple Stock Forecast 2015: Wild Cards

One of Apple's challenges in 2015 will be managing its sales outside the United States.

For example, Apple has tapped only a tiny part of the potential of the Chinese market. So far the iPhone 6, with its larger screen, seems to be doing well. But Apple wannabe Xiaomi Inc., which sells low-cost, high-quality smartphones represents a real threat. Xiaomi already has crushed Samsung Electronics (OTCMKTS: SSNLF) sales in China.

Meanwhile, the troubled economies of the Eurozone, as well as Japan, could dampen Apple's global business.

At the same time, Apple needs to build on its momentum in India, the world's next major smartphone market. AAPL's revenue there has more than doubled since 2012. And smartphones still make up only 15% of all mobile phones, opening a big door for the iPhone.

Apple also could make another major acquisition in 2015. Tim Cook showed a willingness to pull the trigger on larger deals when he bought Beats this year. And Apple still has the biggest piggy bank in Silicon Valley.

So the Apple stock forecast for 2015 is for historic highs.

Money Morning Defense & Tech Specialist Michael Robinson has a $142.85 target on AAPL stock, the equivalent of $1,000 a share before the 7-for-1 split that took place earlier this year.

At Wednesday's close of $111.99, Robinson considers Apple stock a buy.

"I definitely would not be sitting on the sidelines watching AAPL continue to go up," he said.

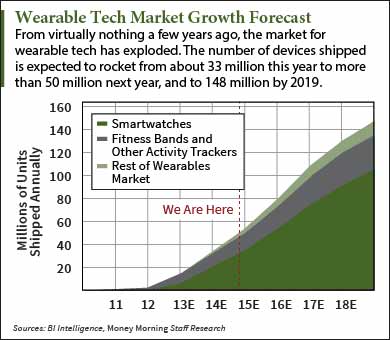

Wearable Tech Forecast: Sales of wearable tech devices will rise from about 33 million units shipped this year to over 50 million in 2015. From there, the wearable tech market will nearly triple by 2019. But getting there will come in fits and starts. Companies will spend 2015 trying to figure out what customers are willing to wear - and buy. Here's the outlook for the top contenders...

Follow me on Twitter @DavidGZeiler.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.