Precious metals haven't grabbed dramatic headlines like oil and gas have.

But their story is no less exciting. And the metals remain a fundamentally critical part of the global economic and strategic landscape.

Indeed, gold and silver took roller coaster-like rides throughout the year, both screeching towards their respective price lows before bouncing, albeit cautiously, ahead.

With the benefit of hindsight and the value of foresight, it's time to look at how gold and silver acted in 2014, and what we can do to profit in 2015.

Let's start with the yellow metal...

Gold Will Bounce Back Quickly

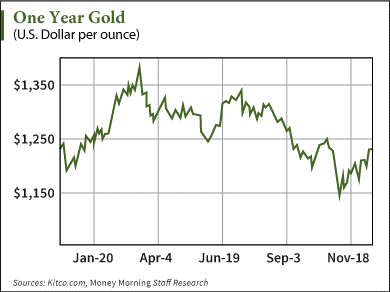

As you follow along with the graph, note that gold started out with a bang, bottoming around $1,195 December 19, 2013, then surging upward 12% to $1,390 by mid-March. It then headed back to the $1,300 level, and meandered sideways between $1,250 and $1,350 until mid-year.

As you follow along with the graph, note that gold started out with a bang, bottoming around $1,195 December 19, 2013, then surging upward 12% to $1,390 by mid-March. It then headed back to the $1,300 level, and meandered sideways between $1,250 and $1,350 until mid-year.

The U.S. dollar began a strong climb from July onwards, likely in anticipation of the Fed ending its asset purchase program in October, as it ultimately did.

By November the SPDR Gold Trust ETF (NYSE Arca: GLD), the largest gold ETF, saw its gold holdings at six-year lows. Gold had become almost universally hated, which may well have marked the bottom.

And then it embarked on a new rise...

One of the biggest positives is how gold held up over the recent months: as oil prices plunged 27% from early November into mid-December, gold climbed by 7%.

Not even news of the defeat of the Swiss Gold referendum held it back.

Then India, battling for top gold consumer spot with China, relaxed some of its import restrictions on gold, making it more attractive during the traditional wedding season, and helping to push its price higher.

Chinese gold demand remains robust as well, and is expected to grow substantially again in 2015.

Will 2014 eventually prove to define the bottom in gold?

The odds of that are improving. Even if the U.S. dollar continues to show relative strength, I believe the fundamentals are in place for gold to reach back into the $1,400 to $1,500 range by this time next year.

Silver Will Take Longer - but It Will Be Worth the Wait

Silver's had it rougher than gold which, thanks to its nature, is to be expected.

While gold is off about 1% so far this year, silver's given up about 12% - way more than it typically would.

But not everyone is selling...

Looking at iShares Silver Trust ETF (NYSE Arca: SLV), the largest U.S. silver ETF, it enjoyed a very stable level of outstanding shares, despite weakening silver prices. That means investors held on, despite falling unit prices.

Last year the U.S. Mint set a new sales record for its American Eagle silver bullion coins, with sales of 42.68 million coins.

By December 9, 2014, that level was bested with sales already reaching 43.05 million.

And physical demand has been strong, with physical bar & coin consumption reaching a whopping 46% of industrial consumption levels, which by last year had undergone a five-fold increase in just 6 years.

With a wide and growing array of uses, industrial consumption is set to grow in 2015.

Meanwhile, production is likely to be somewhat limited. Silver's often a by-product of producing the two base metals, lead and zinc. With their prices relatively weak, that's likely to lead to somewhat softer supply levels.

All things considered, I think we could see silver turn in a positive 2015, likely to regain $20 and trade in the $20 to $25 range by end 2015.